Monthly Economy & Travel Industry Summary: August 2024

Federal Reserve Gives Clear Signal Rate Cuts Are Coming

The Federal Reserve’s two primary responsibilities guide its actions: maintaining stable prices and ensuring full employment. The Fed has prioritized the stable prices component of its mandate since 2022, when inflation soared to the highest rate in decades. The Fed’s primary tool for slowing inflation is constraining economic activity by raising interest rates.

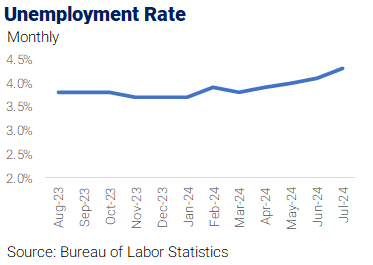

However, easing inflation and growing concerns about the labor market have prompted central bank leaders to shift their focus to full employment risks. Consistent with Oxford Economics’s outlook for the past few months, the Federal Reserve has all but guaranteed a cycle of monetary easing will begin in September.

“The time has come for policy to adjust.” With those words during the Federal Reserve’s annual gathering in Jackson Hole, Wyoming, Fed Chairman Jerome Powell provided a clear signal that the Fed would cut rates in September, with the real debate not whether to cut rates but by how much. Oxford Economics continues to forecast a 25bp rate cut in September, but an unexpectedly weak August employment report could prompt the Fed to cut by 50bps.

In the Fed’s eyes, more aggressive initial easing could help stabilize the labor market and reduce the risks that the recent softening doesn’t turn into something worse, particularly as the central bank doesn’t see the labor market as a threat to inflation. Therefore, we view the risks to our forecast for only two 25bp rate cuts this year weighted toward three rate cuts.

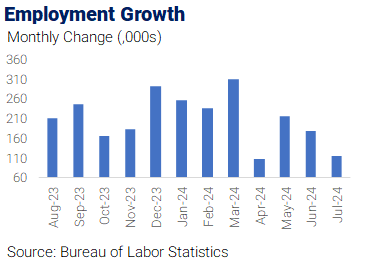

If the labor market cools more than expected, the Federal Reserve could take a more aggressive approach. Still, current labor market conditions argue for a measured pace of lowering rates. What might prompt us to change our forecast for the Fed? Further increases in the unemployment rate are driven by the rise in layoffs, in contrast to recent increases, which have been a function of growth in the labor force.

Initial jobless claims rose modestly in the week ended August 17 but remained at a level consistent with a small decline in the unemployment rate in August. Initial claims are leveling off on a trend basis, consistent with our view that, while the labor market is softening, it isn’t weak enough to warrant more than a 25bps rate cut at the Fed’s September meeting.

Continued jobless claims edged higher in mid-August, but trends in continued claims tend to follow initial claims with a lag. If initial claims stabilize, we expect continued claims will also level off in the weeks ahead.

Additionally, the layoffs and discharges rate declined from 1.1% in May to 0.9% in June, and every month this year has been below the 2018-2019 average of 1.2%. All this suggests labor demand, while softer than a few years ago, is still resilient.

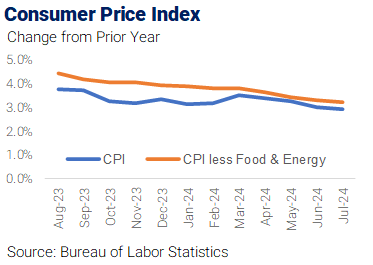

Inflation continued to ease in July. Growth in the Consumer Price Index eased to 2.9% from 3.1% at the start of the year and 3.3% one year ago. Rents are responsible for the bulk of excess inflation, or the difference between current inflation and the Fed’s target. We expect rental growth to move lower from here, but because of how the CPI source data are calculated, that will play out over the coming year, not the next month or two. Encouragingly for the Fed, core services, excluding housing prices, are rising more moderately than earlier in the year and suggest weaker price pressures across domestic-focused services.

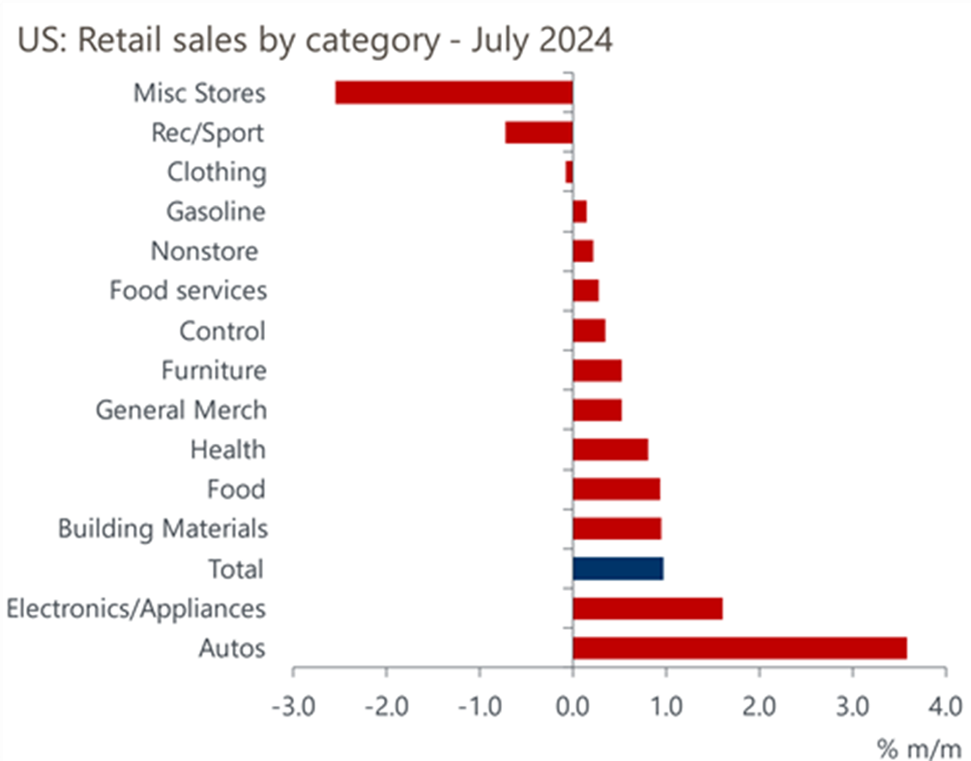

The deceleration in inflation will support growth in real disposable income, which matters for consumer spending. The 1% jump in July retail sales blew the consensus estimate of a 0.3% increase out of the water. As anticipated, the strength primarily reflected a rebound in auto sales in July, reversing the weakness seen in June due to a widespread cyberattack on the software used by most dealerships.

US Retail sales by category (July 2024); Source: Oxford Economics, Haver Analytics

Employment Growth (Source: Bureau of Labor Statistics)

Unemployment Rate (Source: Bureau of Labor Statistics)

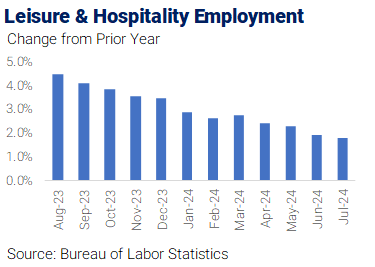

Leisure & Hospitality Employment (Source: Bureau of Labor Statistics)

Consumer Price Index (Source: Bureau of Labor Statistics)

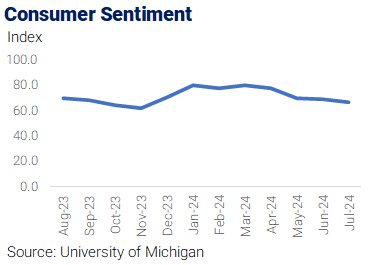

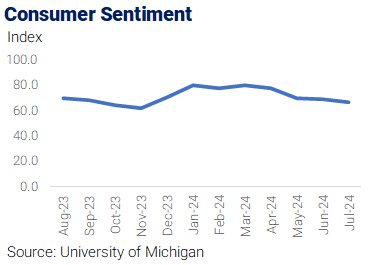

Consumer Sentiment (Source: University of Michigan)

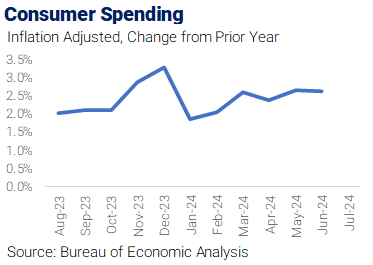

Consumer Spending (Source: Bureau of Economic Analysis)

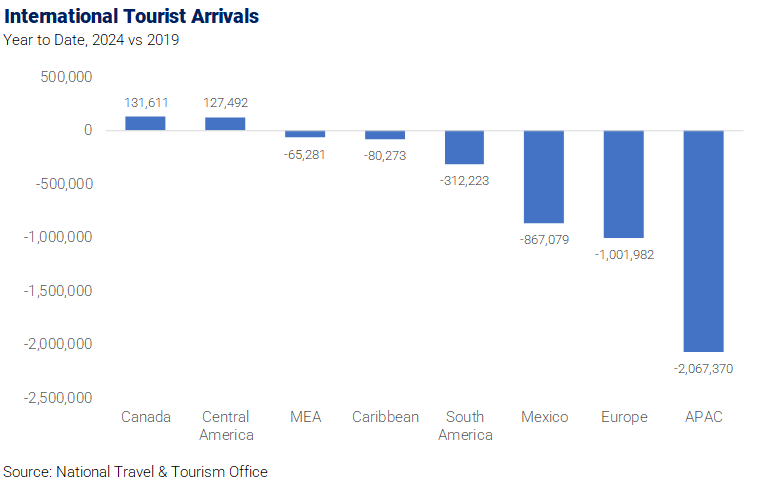

International Tourist Arrivals (Source: National Travel & Tourism Office)

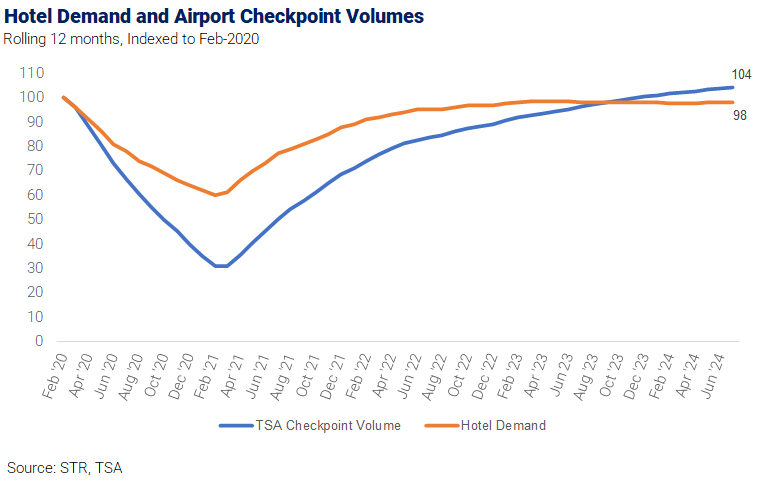

Hotel Demand and Airport Checkpoint Volumes (Source: STR, TSA)

International Touris Arrivals (Source: National Travel & Tourism Office)

Intent to Travel in Next 6 Months (Source: Longwoods International)

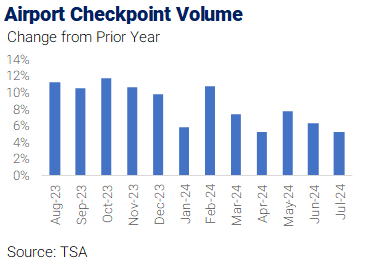

Airport Checkpoint Volume (Source TSA)

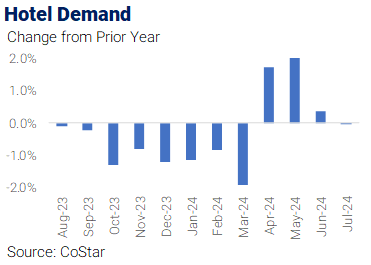

Hotel Demand (Source: CoStar)

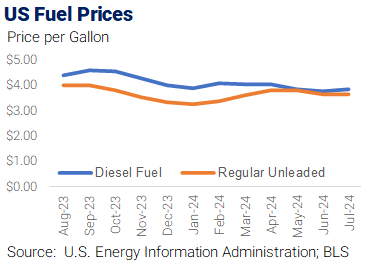

US Fuel Prices (Source: US Energy Information Administration; BLS)

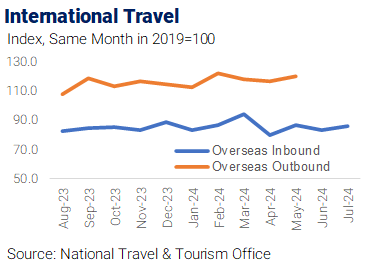

International Travel (Source: National Travel & Tourism Office)

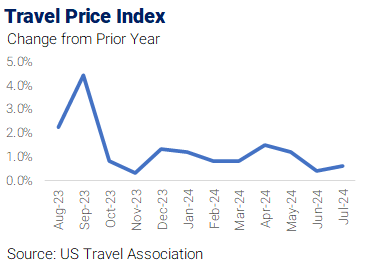

Travel Price Index (Source: US Travel Association)

Hotel Demand Not Keeping Pace with Record Airport Volume

The number of travelers passing through TSA airport security checkpoints set an all-time high in July 2024. Additionally, more than 3 million travelers passed airport security checkpoints on Sunday, July 7, the highest daily volume ever.

On an annualized basis, checkpoint volume for the twelve months ending in July totaled nearly 892 million travelers, the highest 12-month volume ever and 4% above the pre-pandemic peak.

Busy airports should mean busy hotels, which is valid to an extent. However, airport checkpoint volume surpassed its pre-pandemic peak in August 2023 and has continued to rise. Meanwhile, hotel demand has plateaued about 2% below pre-pandemic levels.

A significant reason hotel demand has not recovered as fast as airline travel has been the robust growth in US residents traveling to destinations outside the country. More Americans than ever are taking international trips, but international tourist arrivals have yet to reach pre-pandemic levels. As a result, hotel demand lost to the increase in US residents going outside the country has not been fully offset by growth in international visitors entering the country, creating a void in hotel demand.

International trips by US residents are 11% above last year and 8% higher than in 2019. Conversely, international arrivals to the US are about 10% below 2019 despite growing 11% year-over-year.

Canada and Central America are the only origins that have surpassed 2019 volumes. At the other end of the spectrum, arrivals from the Asia-Pacific region were more than 2 million (26%) less than the same period in 2019.

Robust growth in cruise passenger volume has also contributed to the slow recovery in hotel demand. Passenger volume for southern US ports of embarkations, including Port Canaveral and Port of Miami, the two busiest cruise ports in the world, is up 16% in 2024 and at an all-time high.

The launch of mega vessels, many since COVID, is changing the landscape in southern U.S.-based ports. For example, Royal Caribbean’s Icon of the Seas, the world’s largest cruise ship, set sail from the Port of Miami on its maiden voyage in January. Royal Caribbean launched the Utopia of the Seas from Port Canaveral in July.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.

Read the latest in the ABA News Center

- Busbud Announces 2026 Travelers’ Best Awards

- Courtesy Isn’t Optional: A Reminder About Service, Perspective, and Grace

- USDOT Launches New Partnership in Celebration of America’s 250th Birthday

- Derek Barrs: What Constructive Engagement Looks Like with Motorcoach Operators

- Prevost Network Expands at Goodlettsville Location