Monthly Economy and Travel Industry Summary: January 2025

The new year begins with uncertainty due to a flurry of executive office actions.

Trump’s Second Term Began with a Flurry of Executive Orders and Plenty of Uncertainty

It was a dizzying start to Donald Trump’s second term in office as he signed more executive orders in his first few days than any president since World War II.

Although many of the President’s executive actions were in line with our baseline assumptions, the only certainty with the president is uncertainty. Therefore, future adjustments to our economic forecasts will depend on how things unfold in Washington DC. Here are some of the guideposts we will follow as we consider whether to make policy-related changes to our baseline economic forecasts:

Trade: President Trump issued a memorandum directing federal agencies to investigate U.S. trade policy by April 1, setting the stage for future tariff increases. The memo is in line with our baseline assumptions that any tariff hikes will take time to occur and will only target certain countries and select products, with China bearing the brunt of the next wave of US trade protectionism.

Yet, in remarks, Trump suggested the US may impose tariffs as soon as February 1, including a 25% tariff on imports from Canada and Mexico and an additional 10% tariff on imports from China.

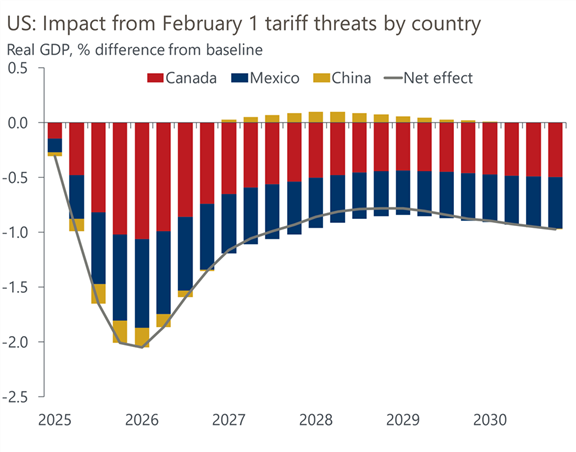

We modeled the economic impact of these tariffs by the US, plus the likely retaliatory tariffs by these major trading partners, and concluded that economic growth would slow dramatically in 2025 but the U.S. economy would not fall into a recession.

Specifically, higher tariffs on Canada, Mexico, and China would lower annual U.S. GDP growth by 1.2 ppts this year. The Canada and Mexico tariffs do significantly more damage than the China tariffs, largely because the U.S. trades much more with the rest of North America than it does with China.

Weaker growth would also translate into softer labor market conditions. Under the February 1 tariff threats, the unemployment rate would average 4.5% in 2025, up 0.3ppts relative to the baseline.

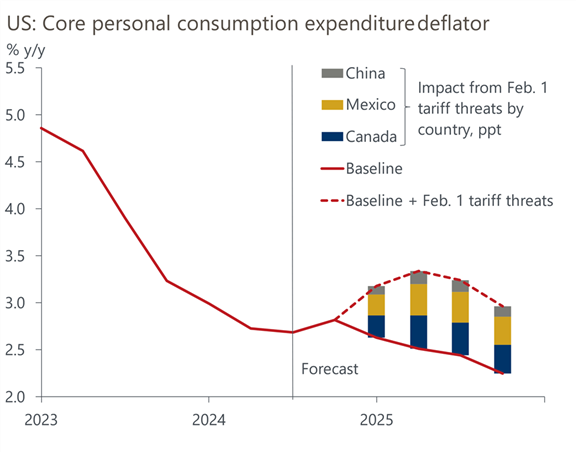

Core inflation would come in stronger this year, pushing the Federal Reserve’s preferred measure above 3%, whereas our baseline foresees it slowing to 2.2% by Q4 2025. Again, the Canada and Mexico tariffs account for the bulk of this inflationary boost.

The potential for such sizable economic impacts ought to be enough of a deterrent that Trump will not follow through with these higher tariffs. If he does, key import categories from Mexico and Canada are likely to be excluded to limit the fallout on growth and inflation.

Even if Trump implements 25% tariffs on a narrower set of imports from Canada and Mexico, we think they would be short-lived and used as bargaining chips in upcoming discussions on issues including the renegotiation of the US-Mexico-Canada trade agreement.

Immigration: On his first day in office, Trump pressed pause on refugee resettlements, all but shutting down entry for migrants applying for asylum at official ports of entry and paving the way for stepped-up deportations. We anticipated these immigration restrictions and our baseline calls for net migration to fall to 800,000 per annum during the latter half of Trump’s second term, down from 1.1mn as assumed in our pre-election forecast.

Travel sector businesses, such as hotels, restaurants, and other service-oriented companies, tend to employ greater than average shares of immigrants and stand to be disproportionately impacted by reduced immigration. Almost one-third (31.1%) of employees at hotels and other accommodations are immigrants, based on Census Bureau estimates for 2023. Of these employees, about half are naturalized US citizens (15.6% of total employees), and half are non-US citizens (15.5%). This 15.5% non-US citizen share is lower than in sectors such as landscaping, agriculture, and construction, but is higher than the US average of 8.5%. The non-US citizen category includes those working with documentation (e.g., green card holders, temporary work visas), as well as undocumented workers.

Travel sector employers face already-tight labor conditions. In a situation in which policies further restrict immigration, they are likely to experience greater difficulty maintaining staffing and higher wage costs.

Energy: President Trump moved quickly to encourage more oil and gas production. However, market forces, not presidential actions, are what will matter most for domestic energy production. With West Texas Intermediate oil prices not much higher than the average break-even price to profitably drill, the incentive to drill a new well is as not as strong as in recent times past.

The baseline forecast assumes that some, but not all, of the Inflation Reduction Act’s clean energy provisions will be rescinded this year. The electric vehicle tax credits are on the chopping board, as are several loan, grant, and rebate programs intended to accelerate the deployment of clean energy technologies. Nevertheless, we expect that the bulk of the IRA’s tax credits, which target electricity generation from renewable resources, clean energy manufacturing, and energy efficiency improvements, remain in place. Announcements of clean energy investments since the IRA’s passage have disproportionately benefited red states, and many House Republicans have argued against a full repeal of the IRA’s tax incentives.

Taxes and spending: Republican leaders circulated a list of policies that, at first glance, would amount to nearly $10tn in net savings over the next decade. However, a couple of caveats are warranted. There is a lot of overlap between several of the proposed savings, and some policies that would significantly reduce spending or raise revenue are unlikely to garner enough support in a razor-thin Republican House majority. These include repealing the State and Local Tax Deduction, eliminating the Mortgage Interest Deduction, instituting a Border Adjustment Tax, and establishing across-the-board 10% tariffs.

For now, this is a policy wish list and still leaves much uncertainty over the contours of a future Republican-only piece of fiscal legislation. We will make adjustments to our fiscal assumptions once the list of viable policies begins to be reduced.

Federal workforce: Trump implemented a federal hiring freeze, something we assumed in the baseline forecast, but he went further and ordered an end to remote work. We will therefore nudge our forecast for federal employment lower this year. However, it’s important not to overstate the risk to overall public-sector employment, as the state and local government workforce is much larger than that of the federal government.

The outlook is favorable for state and local government employment. States are flush with cash and a resilient U.S. economy should support the fiscal health of states and localities through steady revenue growth from income taxes, sales taxes, and property taxes.

Strong Travel Growth in 2024 and Positive Outlook for 2025

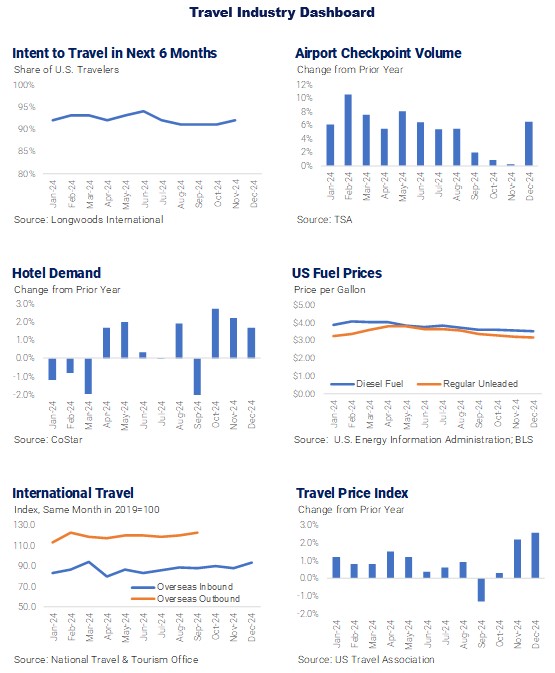

The travel industry experienced robust growth across most segments in 2024 including air travel, cruising, and international travel by U.S. residents.

Airports have never been more crowded, based on passenger volume through TSA checkpoints in U.S. airports. TSA checkpoint screenings in U.S. airports set monthly highs every month except January. Additionally,

- 904 million passengers through TSA checkpoints in U.S. airports in 2024, the busiest year ever;

- 84 million in July 2024, the busiest month ever; and,

- 3 million on Sunday, Dec 1, the busiest day ever.

U.S. cruise passenger volume rose 8% in 2024 to an estimated 18.2 million passengers, breaking the record of 16.9 million U.S. cruise passengers in 2023. After plummeting due to the onset of the COVID-19 pandemic in 2020, the U.S. cruise industry has experienced a remarkable recovery with 2024 passenger volume nearly 30% higher than the pre-pandemic peak set in 2019.

The cruise industry appears to be a floating enactment of the voice whispering “if you build it, they will come” in the movie Field of Dreams. The introduction of newly-built and feature-rich mega-vessels, ships with the capacity for more than 4,500 passengers, primarily on Caribbean cruise itineraries, has contributed to the strong growth.

Moreover, as cruise ships get larger, shorter itineraries are growing in popularity. This allows for more frequent sailings, generating a higher number of cruisers.

Americans are also traveling outside the country in record numbers. Data from the U.S. National Travel & Tourism Office (NTTO) indicates overseas travel by U.S. residents was up 12% from January through September 2024, versus the same time in 2023, and was 18% higher than the same period in 2019.

In contrast, international arrivals have not rebounded as quickly as outbound travel by U.S. residents. Overseas arrivals to the U.S. rose 13% in 2024, according to NTTO, but were still 14% below 2019’s pre-pandemic peak.

The slower recovery of inbound arrivals versus outbound travel has created an international travel imbalance. That imbalance, and the remarkable growth in cruising, have contributed to a plateauing of hotel demand over the past two years. Other contributing factors include weak demand in Economy and Midscale hotel classes and the slow recovery of business travel.

As a result, U.S. hotel demand rose just 0.5% in 2024, following a 0.9% increase in 2023. Hotel demand in 2024 remained approximately 1% less than in 2019.

We anticipate travel trends in 2025 will generally mirror 2024. U.S. cruise passenger volume is forecast to rise about 5% in 2025 to 19.0 million, the third consecutive year of record volume.

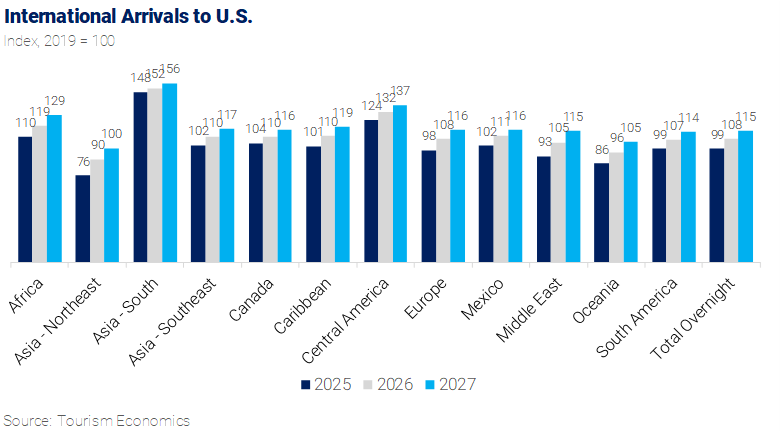

Outbound travel by U.S. residents is forecast to rise 9% in 2025, and inbound arrivals are likewise projected to increase 9%. Based on the current forecast, total international arrivals in 2025 will fall short of 2019’s baseline by about 1%, with full recovery to pre-pandemic levels occurring in 2026.

The recovery of international arrivals is being held back by a few lagging origins. Arrivals from the Middle East are expected to reach pre-pandemic levels in 2026, primarily due to ongoing conflict and political unrest in the region. Long-haul travel from Asia-Pacific has been very slow to return, and arrivals from Oceania and Northeast Asia aren’t expected to fully recover until 2027 due to slow growth from Australia and China.

Growth in U.S. hotel demand is forecast to rise 1.1% in 2025 versus the 0.5% increase in 2024. The ongoing recoveries of international travel to the U.S. and business travel are expected to support modestly stronger growth in hotel demand.

However, the recovery in international travel faces potential headwinds in 2025. Tariffs, restrictive immigration policies, and nationalist rhetoric all hold the potential to negatively impact inbound travel through direct travel restrictions as well as shifts in sentiment.

Trump’s first term was marked by actions that strained international relations, including trade tariffs and an executive-order travel ban on seven majority-Muslim countries. Though insignificant in terms of travel volume, the ban drew concerning links between the President’s policies and international travel to the United States.

During this period, the average annual growth in international visitor arrivals slowed from 5% in the seven years prior to Trump’s first term to 1% per year from 2017-2019. The U.S. experienced a loss of global market share and outright declines in arrivals from China, Mexico, and the Middle East during those years.

Additionally, travel to the U.S. could be negatively impacted by impediments to visas such as reductions in consulate staffing or greater scrutiny of travelers from certain origins. Fortunately, visitors from many key origins can visit the U.S. without a visa and are not expected to be impacted. Countries in the Visa Waiver Program accounted for 28.0% of arrivals in the U.S. over the past 12 months, and previously issued visas, such as with 10-year terms, will continue to allow many travelers from other countries to visit.

It is difficult to anticipate the specific actions the Trump Administration and Congress will take in the coming months, and the impact those actions and associated messaging will have on travel. Travel is resilient, but destination choice is discretionary, and the U.S. risks losing market share.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.