Monthly Economy & Travel Industry Summary – April 2024

Economic Growth Likely to Delay Interest Rate Cuts

Recent economic indicators reflect a resilient economy that refuses to bow to the headwinds of inflation and tight monetary policy. As expected, GDP growth slowed in the first quarter of 2024 compared to the second half of last year. The volatile inventory and trade categories were drags on growth, but there were solid gains in actual final sales. Therefore, the deceleration is not likely to concern the Federal Reserve as the details were better than the headline result indicates.

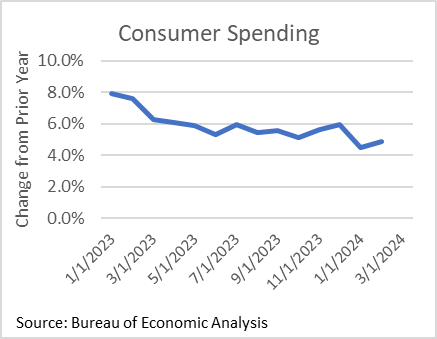

Though positive, the downside to the economy’s resilience is an increased likelihood of the Federal Reserve adopting a “higher-for-longer” approach to interest rates. The odds of a rate cut at the Federal Reserve’s meeting in June are falling, and a growing number of forecasters predict the first reduction in the Federal Funds Rate will be delayed to September.

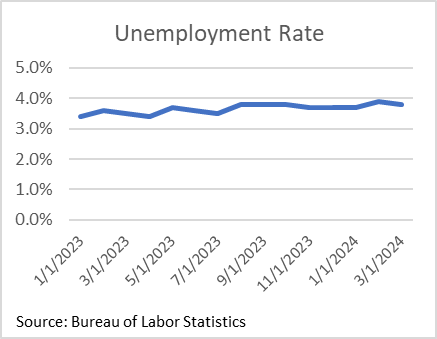

Recent data for the Job Openings, Layoffs & Turnover Survey (JOLTS) was consistent with a labor market that is still relatively healthy, easing concerns among Federal Reserve officials about the downside risks to the economy from taking a patient approach toward rate cuts. Job openings changed a little, and hiring increased modestly. The layoff rate increased slightly but remains below pre-pandemic levels.

Nonfarm payroll employment rose 303,000 in March, but the job growth was narrowly concentrated, with healthcare, government, and leisure and hospitality leading the gains. Average hourly earnings increased by 0.3% m/m in March and posted the smallest year-over-year gain since June 2021. Although annual wage growth has slowed somewhat, it remains too strong for the Fed’s liking. Combined with healthy readings on job openings, hirings, and employment, the labor market provides little incentive for the Federal Reserve to begin lowering interest rates soon.

The labor market remains healthy despite inflation exceeding the Federal Reserve’s 2% target. Once again, the CPI excluding food and energy surprised to the upside in March, rising 0.4% month-over-month (3.8% year-over-year) versus consensus expectations for a 0.3% gain.

Higher rents contribute to inflation’s persistence, rising 0.5% m/m in March. While homeowners with fixed-rate mortgages are somewhat insulated from higher interest rates, renters have experienced significant increases when renewing their lease. A greater share of income going to rent represents a headwind to discretionary spending. Still, with real disposable incomes rising steadily and balance sheets strong, consumption is expected to remain solid through 2024.

Economic Indicators Dashboard

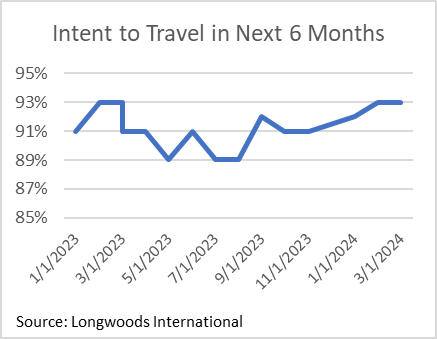

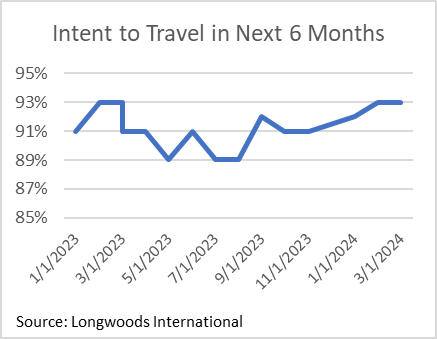

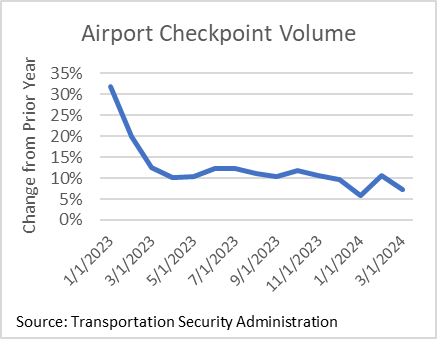

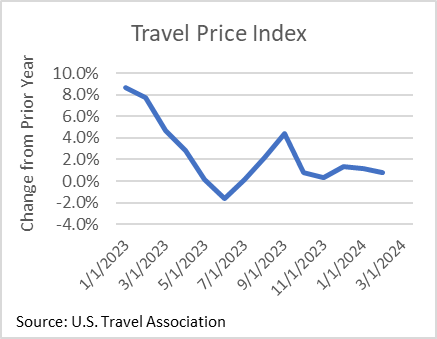

Some Travelers Likely Feeling the Effects of Higher Prices & Interest Rates

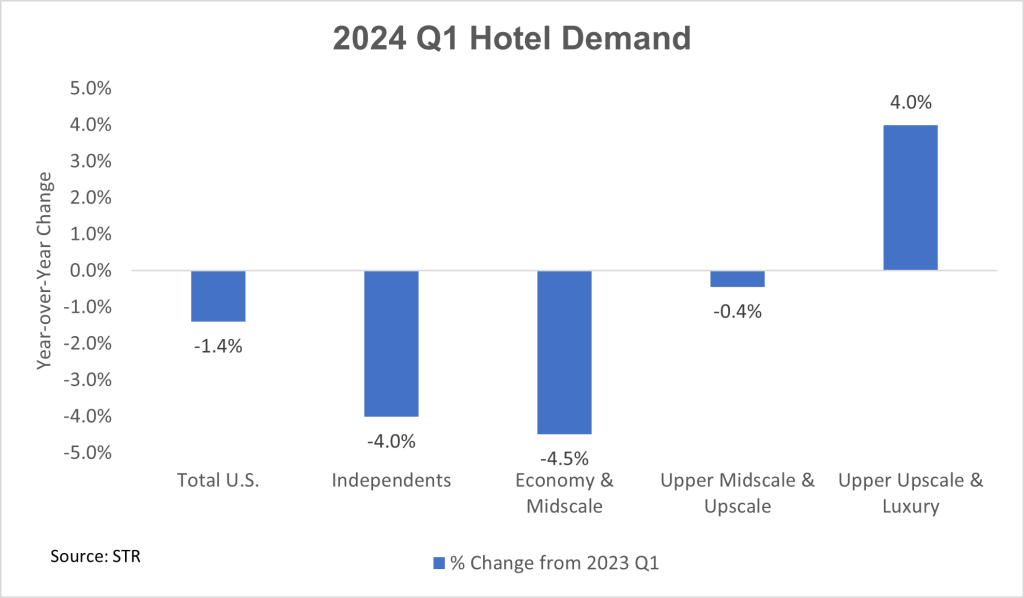

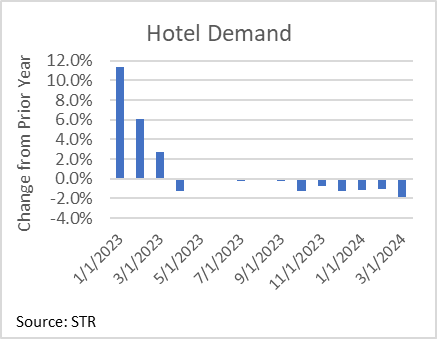

The effects of inflation and higher interest rates are largely regressive, meaning the impacts become more of a burden as household income goes down. The regressive nature of these economic headwinds is leading to a bifurcation in travel performance.

U.S. hotel demand has contracted since mid-2023, but the contraction has not been felt equally across all hotel classes. Hotel demand is trailing prior-year levels among Economy and Midscale chains, while demand in Upper Upscale and Luxury chains continues to grow.

Over the past year, the growth in international travel by U.S. residents is another sign that travel by upper-income households remains strong. According to the Advance Passenger Information System (APIS), international trips by U.S. residents rose 23% in 2023 and were up another 13% in the first quarter of 2024.

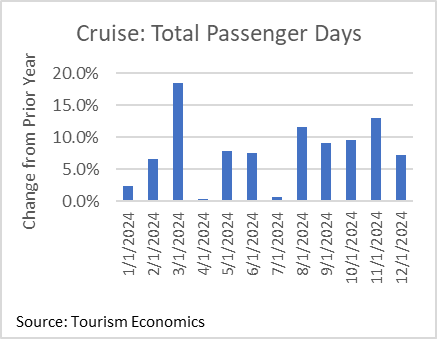

Additionally, the cruise industry continues to perform well and anticipates robust growth in 2024. Total passenger days in 2024, based on cruise lines’ current schedules, are 8% above 2023.

These results suggest well-heeled travelers remain on the go, while the more budget-conscious may be cutting back due to higher prices, rents, and interest rates on credit cards and other variable-rate debt.

Travel Industry Dashboard

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.