Tariffs Reshape Motorcoach Buying Patterns as Pre-Owned Sales Surge 119% in Q3

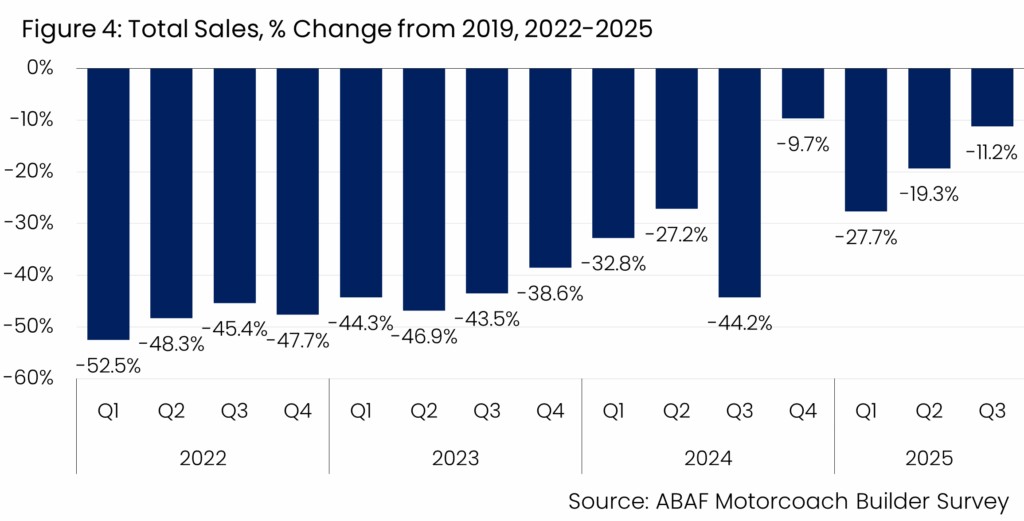

Tariffs risk slowing the industry’s recovery, despite Q3 marking the second-strongest quarter relative to pre-COVID sales trends

The American Bus Association (ABA), the leading voice in North America’s motorcoach, charter bus, group travel and tourism industries, today announced the Third Quarter 2025 Motorcoach Builders Survey. The survey, conducted by the ABA’s research arm, the American Bus Association Foundation, produces a report each quarter with data collected from surveys of major motorcoach manufacturers that sell vehicles in the United States and Canada.

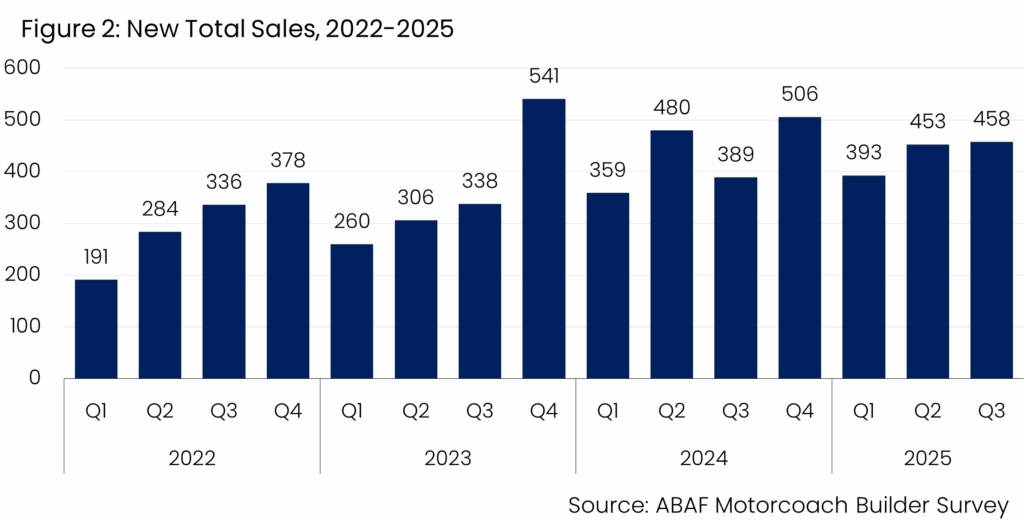

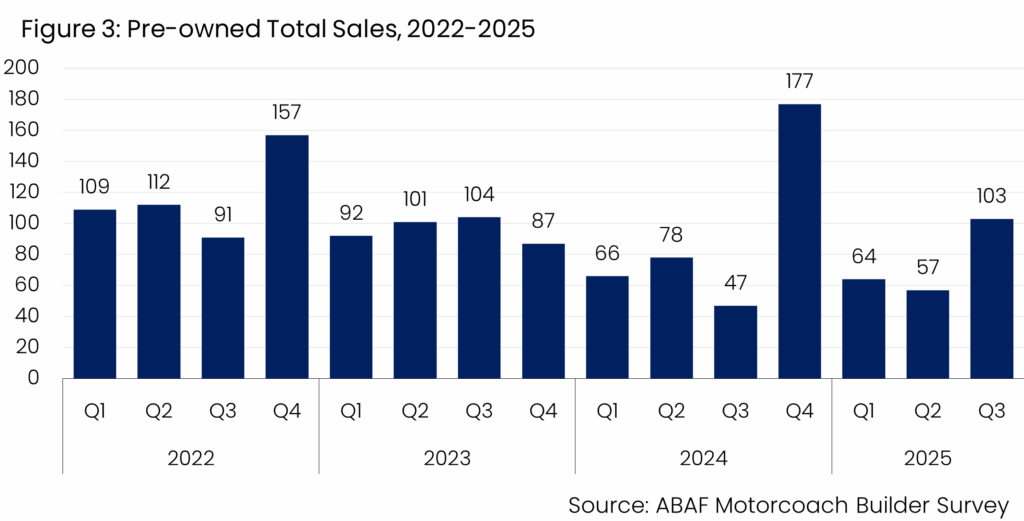

This quarter, the participating manufacturers sold 458 new and 103 pre-owned coaches, for a total of 561 motorcoaches. This compares with 436 during the third quarter of 2024 (Figure 1). Sales of new motorcoaches have increased by 17.7% compared to the same quarter in 2024, with the sale of pre-owned motorcoaches 119.1% higher (Figures 2 and 3).

“We’re seeing the market respond in real time to federal trade policy,” said Fred Ferguson, President & CEO of the American Bus Association. “Recent tariff announcements have provided near- and medium-term clarity on rates, and our sector benefits from lower tariff levels than other commercial vehicle categories. But that certainty still comes with a higher price tag. Operators are making necessary adjustments—accelerating purchases, diversifying buying strategies, and leaning more heavily into pre-owned inventory—to manage risk and avoid rising costs.

“The surge in pre-owned sales may be understandable in the short term, but it is not a sustainable growth model for our industry. If these trends persist, higher costs will slow the recovery, sideline safety and efficiency innovation, and further squeeze margins for operators and manufacturers alike. We’re nearing pre-COVID benchmarks, but affordability, a healthy domestic manufacturing base, and continued investment in modern, safe equipment are essential for long-term progress.”

According to the data, Q3 data for 2025 show an 11.2% decrease compared to the same quarter in 2019, indicating that the market continues to stabilize, though momentum has moderated somewhat from late 2024 highs (Figure 4).

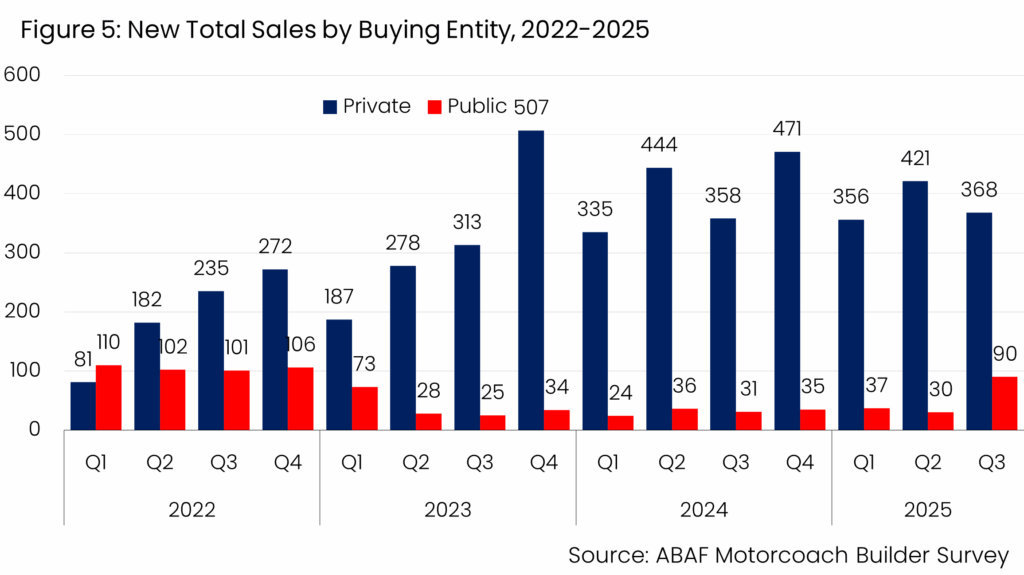

Sales to both private and public entities increased in Q3 compared to the same quarter in 2024, increasing by 2.8% and 190.3%, respectively (Figure 5).