Quarterly Economy & Travel Industry Summary: First Quarter 2026

Upgraded Outlook for 2026 Still Reflects Two-Track Economy

- We raised our 2026 GDP forecast, driven by tailwinds from the artificial intelligence investment boom.

- Although economic activity is resilient, the labor market remains fragile. Layoffs are low, but weak hiring is keeping job gains modest.

- We think inflation has peaked and forecast it will fall close to 2% in the year ahead.

The Details

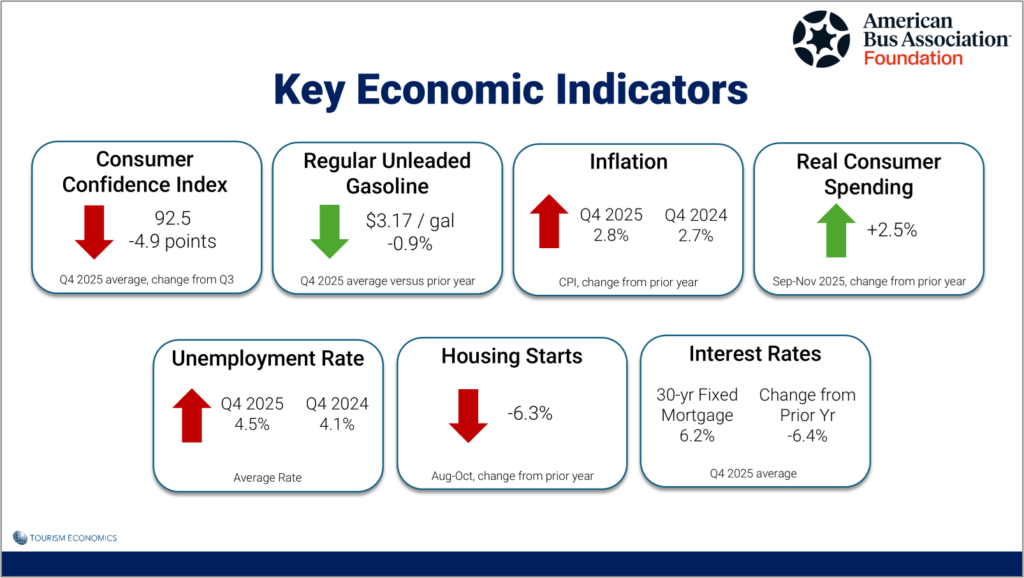

The flood of shutdown-delayed data shows economic activity was resilient in the second half of 2025. While the record-long government shutdown hurt activity in the fourth quarter, continued strong consumer spending and ongoing tailwinds from business investment in artificial intelligence (AI) will help keep economic growth solid.

The shutdown widened the economic split already shaping the landscape. Lower- and middle-income households felt the sting from missing paychecks and suspended benefits, such as the Supplemental Nutrition Assistance Program (SNAP), even as rising stock prices padded the balance sheets of wealthier individuals. That financial cushion helped keep spending rolling through the all-important holiday period. Retail activity snapped back sharply in November, proving yet again the economy’s resilient base of support in the face of formidable headwinds.

The closing months of the year tell a familiar story: steady demand, fading price pressures, and a job market showing pockets of strain mostly among younger and lower-wage workers. Wage gains cooled, but inflation cooled faster, leaving spending power modestly intact. The unevenness, however—where top-tier households with financial reserves and AI-fueled business investment keep growth afloat—suggests the economy will continue to run on two tracks.

Fortunately for the near-term outlook, the sturdier track is still pulling most of the weight. There should be no letdown in the top-line growth rate, which will continue to be supported by robust AI spending and sustained support from older and wealthier households holding sizeable past gains in their financial assets.

We’ve raised our forecast for real GDP growth in 2026 by 0.3 percentage points to 2.8%, based on updated assumptions around the tailwind from AI spending. While investment in the sector is likely to slow over the coming twelve months, we expect the bigger story for this year will be a turnaround in broader business investment. Fading policy uncertainty, the investment incentives under the One Big Beautiful Bill Act – including full expensing for new equipment and immediate expensing of domestic R&D – and the decline in business borrowing costs will support business equipment spending outside of AI in 2026.

Although economic activity is still rising at a solid pace, the labor market remains fragile. Firms are still reluctant to fire workers, with the layoff rate at a historic low, but the hiring rate is also near its lowest level in more than a decade.

As a result, the employed are generally faring well, and the slowdown in hiring disproportionately impacts youth employment and others trying to enter the workforce. It is also a challenging environment to find new employment for those who lose a job, and the share of long-term unemployed continues to trend higher.

Inflation will remain close to 3% in the near term but is expected to trend lower through 2026. Fading tariff effects, which we think are close to peaking, and continued housing disinflation underpin the benign inflation outlook. We expect the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred measure of inflation, will fall to 2.2% by the fourth quarter of 2026, a shade above the Fed’s 2% target.

The consumer outlook remains divided by income level and age, with older, richer households likely to drive a 2.4% rise in consumer spending this year. The top 20% of consumers by income account for nearly 40% of total spending in the economy, and a record share of their spending is on discretionary goods and services. By contrast, middle-class Americans are increasingly dedicating their budgets to essentials.

Consumer spending will get a boost in Q1 from larger tax refunds, resulting from retroactive individual tax cuts in the OBBBA since the start of 2025. The biggest benefits will go to higher-income households because of the federal increase in the state and local tax deduction. A continued tailwind from rising financial wealth also benefits higher earners the most. Spending by lower- and middle-income households is more sensitive to labor market conditions and the low hiring rate is adding pressure, particularly on younger consumers.

That said, the low level of layoffs, gradually declining inflation, and still-solid wage growth should mean real disposable income growth rises slightly this year.

The splits between consumer categories mean seemingly contradictory trends could play out simultaneously. Delinquency rates among the most heavily indebted households will rise as lower-income consumers remain under pressure despite a low unemployment rate. Meanwhile, spending growth can remain solid despite depressed sentiment.

After delivering three rate cuts in late-2025, the Fed has clearly signaled a move to the sidelines. With interest rates now close to levels most officials think are neutral, it would take a larger risk to the labor market to justify another significant cut in interest rates.

Given we expect labor market conditions to stabilize amid solid economic growth while inflation remains above target, we expect officials will move cautiously, lowering interest rates in June and in September, as it becomes clearer inflation is nearing its target.

An improving inflation outlook gives the Fed flexibility to lower rates sooner if the labor market weakens more, but we don’t see evidence of that in the data.

Global Travel Trends in 2026 and Implications for the US

- Bifurcated consumer trends lead to bifurcated travel trends.

- FIFA World Cup 2026 will support a rebound in international travel to the US.

- Travelers continue to embrace AI tools when planning and booking travel.

The Details

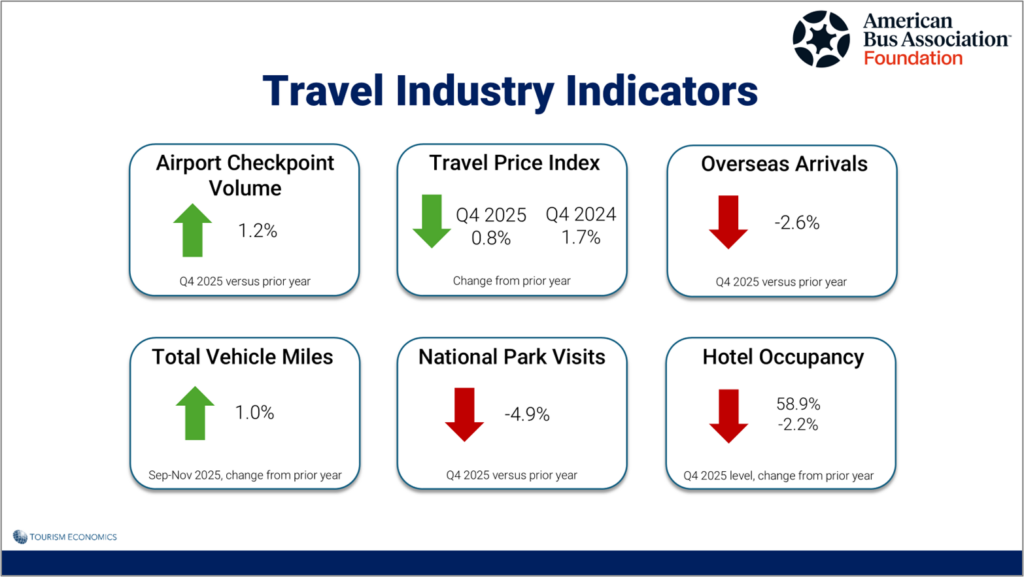

The diverging consumer spending trends between higher-income households and middle and lower-income households have impacted travel performance, perhaps most clearly in the hotel industry. Room nights sold (aka ‘demand’) rose 2.5% in Luxury hotels in 2025, while demand in Midscale and Economy hotels fell 2.4%. Demand growth, or the lack of it, affects hotels’ pricing power. Therefore, it’s not surprising that average daily rates (ADR) rose 3.0% in Luxury hotels, while ADR in Midscale and Economy hotels fell 1.7%.

A similar trend played out in the airline industry. Total passenger volume was essentially flat (+0.3%) in 2025, based on the volume of persons passing through TSA security checkpoints in US airports. However, Delta Airlines exemplified the bifurcation in travel when, in a recent quarterly earnings call, the airline noted main cabin ticket sales were down 7% year-over-year but premium cabin ticket sales rose 9%.

Furthermore, Delta plans to expand seat capacity by 3% in 2026 through interior upgrades and new aircraft, and Delta’s CEO Ed Bastian was quoted as saying, “Effectively, none of our growth in seats will be in the main cabin. Virtually all will be in the premium sector.”

In addition to the bifurcation in travel performance, we have identified a few other trends expected to characterize travel in 2026, beginning with further evidence of the travel industry’s remarkable resilience.

Global travel will remain resilient, despite global economic slowdown

Global travel demand will defy the slowdown in economic growth over the coming year, despite ongoing uncertainty, which largely stems from risks surrounding tariffs and geopolitical tensions. International visitor growth is expected to accelerate to 8% in 2026, up from 5% in 2025, while global GDP growth will slow to 2.7% (from 2.9%).

Performance in North America will turn a corner, following recent large declines and notably in Canada-US travel when tariff increases were introduced in 2025. International arrivals to the US will grow 4% in 2026, following a 6% decline in 2025. We are unlikely to see a full reversal of these falls as the stance by the US government is unlikely to change in the coming year. However, we anticipate a moderate rise in arrivals across most source markets, with demand further supported by the FIFA World Cup.

Value for money will remain top of mind in travel decisions

Value for money will remain an important tourism trend in 2026. This follows several years of heightened inflation, which has remained stubbornly above target rates in many countries. Central Banks have been more cautious in lowering interest rates, exacerbated by the ongoing economic uncertainty and risks of a further inflation uptick.

The combined effect of elevated inflation and slower interest rate cuts has eroded incomes and spending power, meaning that value-seeking behavior will remain top of mind for consumers in making travel decisions. Value-seeking is not a new phenomenon; 83% of respondents in our Travel Industry Monitor (TIM) identified value as important last year. This has increased to 92% in our latest survey. However, value-seeking doesn’t automatically mean travelers seek out the cheapest option. Rather, travelers will increasingly focus on the perceived value of the experience relative to the cost.

Artificial Intelligence uptake will continue to increase and play a key role in value seeking

AI will continue to grow in importance for the travel industry, especially in supporting consumers’ travel decisions as value-seeking behavior intensifies. Our Travel Trends Survey (TTS) shows an uptake in AI usage, with the number of respondents using AI chatbots and/or virtual assistants rising from 10% in 2024 to 18% in the latest survey. While usage is still relatively low, other popular trip-planning tools, including OTAs, review sites, and social media, are increasingly introducing AI features within their platforms that users can access to make travel plans.

AI usage in travel planning is much more prevalent among younger generations. Our TTS indicates that more than 70% of Gen Z & Millennials prefer using travel-related services on mobile devices, compared with around 40% of Gen X and Boomers. Furthermore, when asked about specific tools, Gen Z & Millennials were more than 3 times more likely to use AI chatbots/virtual assistants and social media for trip planning. They are also much more likely to rely on social media and multi-purpose apps than older generation, both of which are increasingly powered by AI. Therefore, the prevalence of AI in travel planning will continue to grow as younger generations take a larger share of the travel market.

Events will be a key driver of destination performance

Events will remain a key driver of growth in many destinations. This has long been true, with business travel, including group meetings and trips that combine leisure with business purposes, commonly cited as a key growth opportunity by more than half of industry experts in our Travel Industry Monitor. Attendees are increasingly taking the opportunity to maximize business travel opportunities with longer stays for more work activity as well as extensions to enjoy leisure activities in a destination.

Leisure-based events have grown in prominence in recent years, including concerts, where we have seen significant contributions from artists such as Taylor Swift, Oasis, and Coldplay, among many others.

The 2026 FIFA World Cup will be held in North America and will arguably be the most high-profile event in the coming year. We estimate this will bring 1.24 million international visitors to the US, representing an incremental increase of ~60% (742k visitors). This will contribute 1.1% to the international visitor growth forecast in 2026 – a much-needed boost given recent declines.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.