Motorcoach Sales Exceed 2,000 Units for Second Straight Year as Industry Enters Next Phase of Growth

Operators invest with confidence as major global events and long-delayed fleet replacement drive demand for safer, more advanced vehicles

The American Bus Association (ABA), the leading voice in North America’s motorcoach, charter bus, group travel and tourism industries, announces the Fourth Quarter 2025 Motorcoach Builders Survey. The survey, produced by the ABA’s research arm, the American Bus Association Foundation, reports quarterly on data collected from surveys of major motorcoach manufacturers that sell vehicles in the United States and Canada.

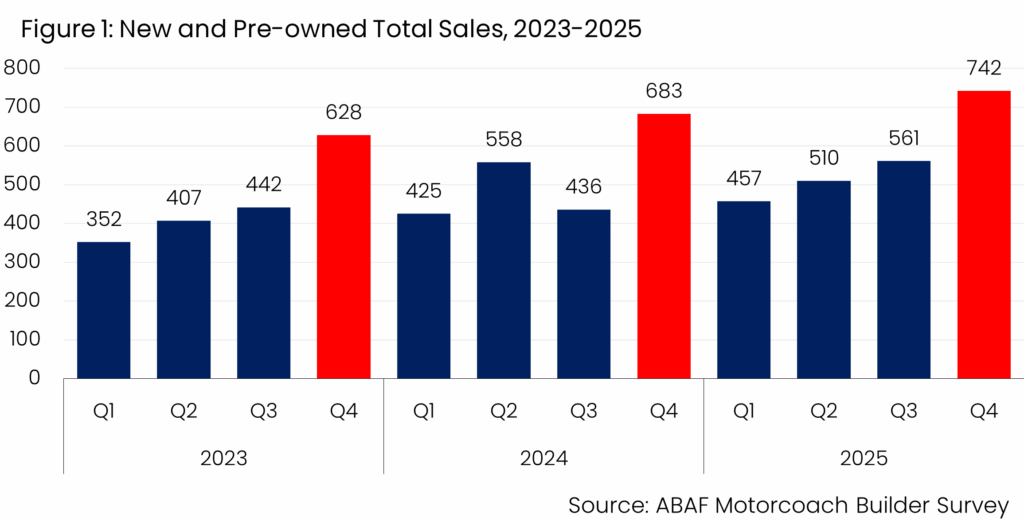

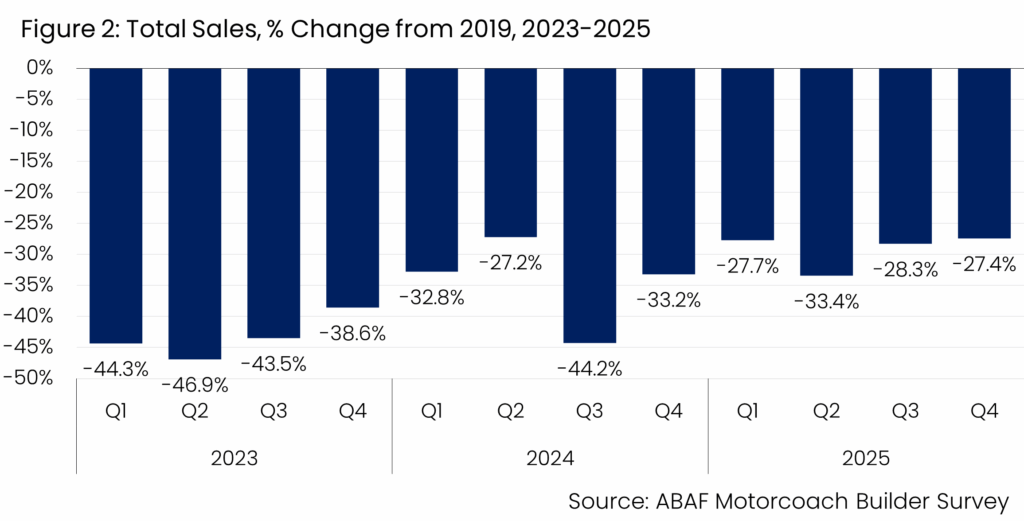

This quarter, the participating manufacturers sold 657 new and 85 pre-owned coaches, for a total of 742 motorcoaches. This compares with 683 during the fourth quarter of 2024 (Figure 1). The year-over-year increase reflects continued replacement demand as operators modernize fleets that were held longer during the pandemic and supply-chain disruptions. Despite this improvement, fourth-quarter 2025 sales remain 27.4% below the same quarter in 2019, underscoring that overall volumes are still below long-term growth expectations (Figure 2). Taken together, the data point to cautious forward momentum rather than a broad-based expansion, with operators preparing for major international events while prioritizing reliability, safety, and cost control in purchasing decisions.

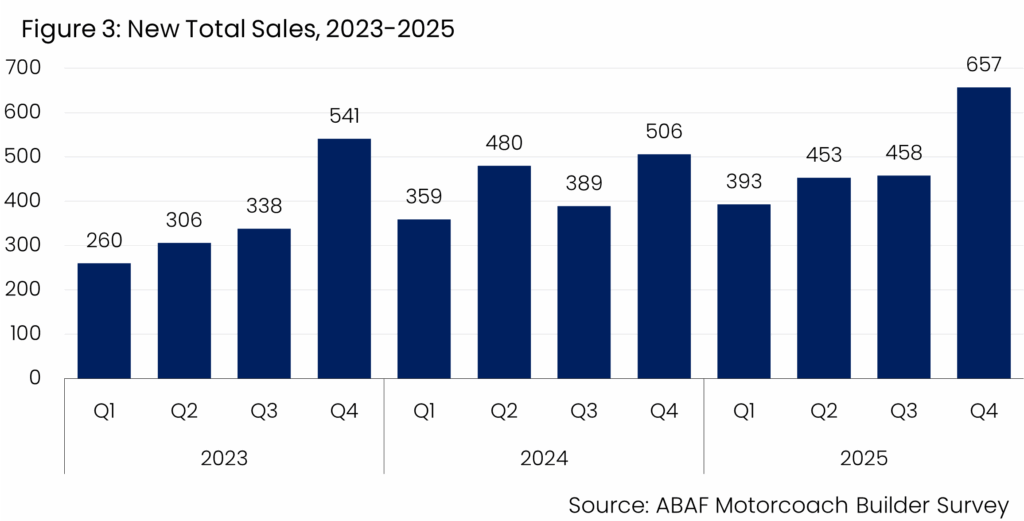

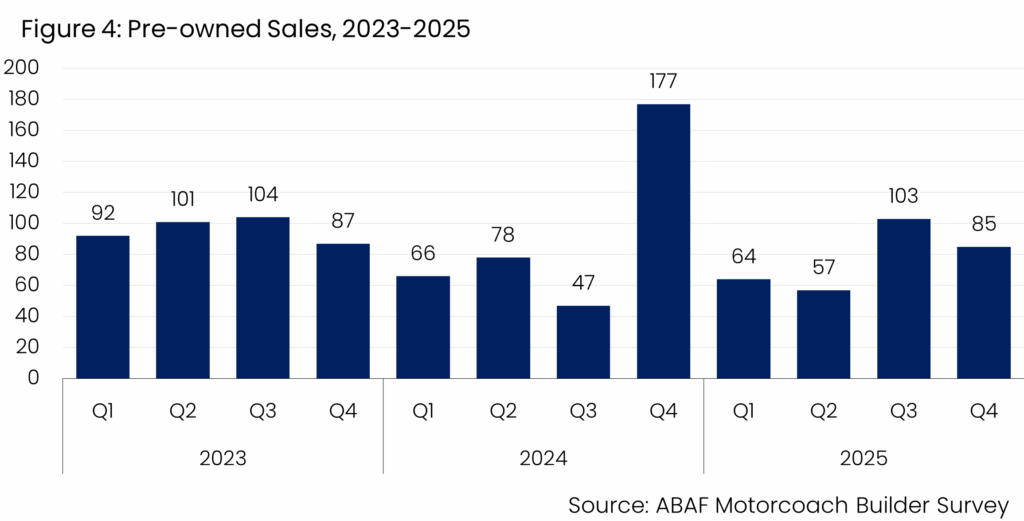

Sales of new motorcoaches have increased by 29.8% compared to the same quarter in 2024, with the sale of pre-owned motorcoaches 52.0% lower (Figures 3 and 4). The sharp divergence between new and pre-owned sales underscores the evolving cost dynamics facing the industry. While new motorcoach purchases accelerated as operators sought to lock in pricing and delivery timelines, the decline in pre-owned sales suggests tightening availability and rising prices in the secondary market. Together, these trends point to a market balancing near-term affordability concerns against the need for long-term fleet efficiency and compliance.

“While higher equipment costs driven by global trade policy remain a major factor in the health of the bus industry, they have not slowed operators’ commitment to upgrading their fleets,” said Fred Ferguson, President & CEO of the American Bus Association. “Back-to-back years of more than 2,000 units sold show an industry that has moved beyond recovery and into a steadier replacement cycle. At the same time, rising insurance costs and misguided policies advanced by environmental advocates remain potential headwinds. Even so, operators are investing in newer vehicles with advanced safety, technology, and performance features as they respond to growing consumer demand for bus-based transportation—demand reinforced by greater public awareness, stronger support for motorcoaches as an efficient travel option, and major events on the horizon that are driving long-term planning and confidence across the market.”

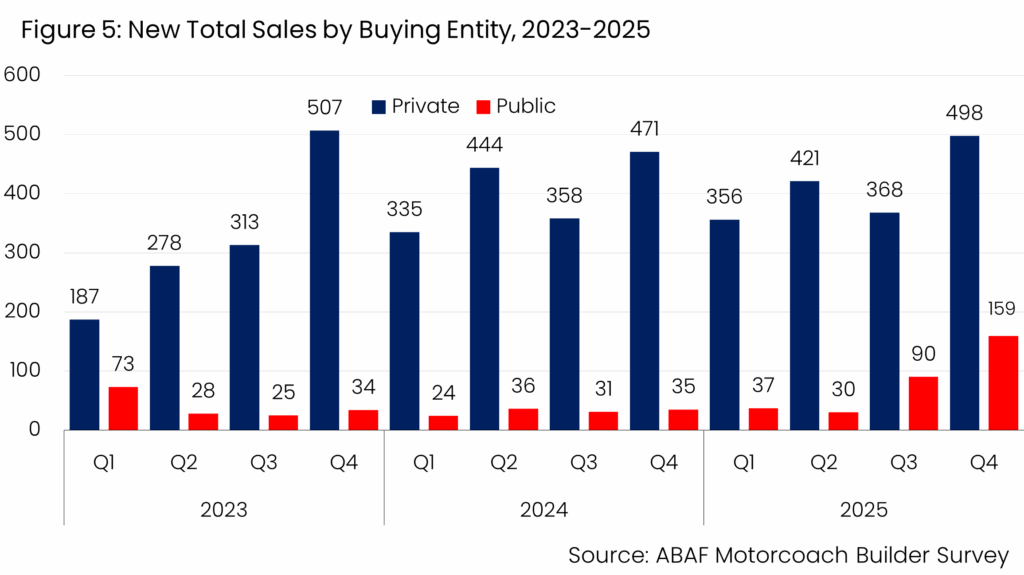

Sales to both private and public entities increased in Q4 compared to the same quarter in 2024, increasing by 5.7% and 354.3%, respectively (Figure 5). Looking ahead, sustained recovery in the motorcoach market will depend on predictable trade policy, manageable financing conditions, and continued investment in domestic manufacturing capacity. While sales are approaching pre-pandemic benchmarks, prolonged cost pressures could constrain future fleet renewal and slow the adoption of newer, safer, and more efficient technologies without supportive policy and economic conditions.

About the American Bus Association Foundation

The American Bus Association Foundation (ABAF), the philanthropic arm of the American Bus Association, is dedicated to advancing the motorcoach, travel, and tourism industry through research and education. The Foundation’s mission is to support the motorcoach travel and tour industry with research and scholarships that benefit the ABA, policymakers, and the public. The ABA Foundation has awarded more than $1 million in financial support to more than 300 scholars since the program began following the passing of then-ABA President and CEO George T. Snyder Jr. in 1995. Our scholarship programs help ABA members and the public earn degrees that support the motorcoach travel and tour industry and promote academic excellence and diversity.

For more information about the ABA Foundation and its scholarship program, please visit www.buses.org/aba-foundation.

About Oxford Economics

Oxford Economics is one of the world’s foremost independent global advisory firms, providing reports, forecasts and analytical tools for 200 countries, 100 industrial sectors and over 3,000 cities. With our Tourism Economics subsidiary, we deploy best-in-class global models and analytical tools to forecast external market trends and assess their business impacts. Headquartered in Oxford, England, with regional centers in London, New York, and Singapore, Oxford Economics has offices across the globe, employing over 600 full-time staff and one of the largest teams of macroeconomists and thought-leadership specialists. Learn more at www.tourismeconomics.com / www.oxfordeconomics.com.

Media Inquiries:

Ben H. Rome

Director, Communications & Brand| American Bus Association

+1 (202) 218-7220

[email protected]

Geena Bevenour

Marketing Manager | Tourism Economics, An Oxford Economics Company

+1 (610) 995-9401

[email protected]