Monthly Economy & Travel Industry Summary: November 2024

Post-election projections, hotel positivity, and travel upticks.

Election Uncertainty Resolved, but Policy Questions Linger

The November elections resolved uncertainty over who will govern the nation in the coming years but not over what policies will prevail. Campaign promises do not necessarily translate into actual policies, and the ones that do may have unintended consequences. Many questions will remain unanswered for some time, setting the stage for heightened volatility in the financial markets.

Historically, bold campaign promises tend to be watered down before becoming reality. Despite gaining the popular vote and control of both chambers of Congress, presidents cannot ram through proposals deemed unacceptable by legislators whose constituents are not keen on what they contain. Even if President-elect Trump uses his executive power to raise tariffs, the ramifications would be highly uncertain depending on whether there is a tit-for-tat response by trading partners. Likewise, tax and spending proposals will navigate a complex landscape of public scrutiny over what should go and what stays.

Simply put, elections clarify who proposes, but not what the proposals will eventually look like.

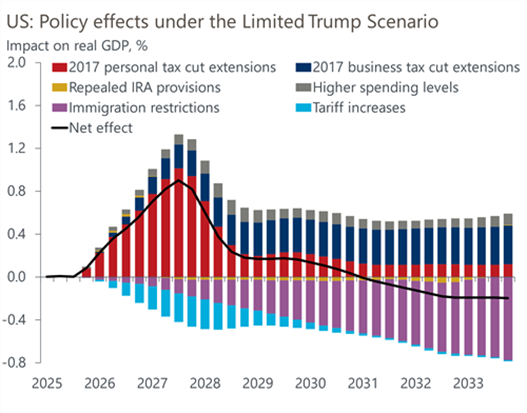

In this climate of uncertainty, Oxford Economics has developed new baseline U.S. economic forecasts based on assumptions of the policies most likely to be implemented by the incoming administration. The updated forecast, the “Limited Trump Scenario,” assumes Congress extends the personal tax cuts under the 2017 tax law and enacts higher spending, and President Trump uses his presidential powers to reduce immigration and impose targeted tariffs.

The Oxford Economics global economics team also maintains a “Full-Blown Trump Scenario” in which the Administration implements more severe policies with greater impacts in certain areas than in the baseline scenario. The forecast models will be updated as the new administration’s policies become clearer.

In the new baseline forecast, expansionary fiscal policy is expected to put a charge in the economy over the short-run. The personal tax cuts in the Tax Cuts and Jobs Act (2017) are set to sunset at the end of 2025 but Republican lawmakers are expected to extend portions of the tax cuts such as:

- lower marginal tax rates on individual income;

- the higher Alternative Minimum Tax exemption;

- the larger standard deduction; and

- an expanded Child Tax Credit.

Republicans are also assumed to restore some of the business tax provisions, such as 100% bonus depreciation, and increased Federal spending is expected to boost economic growth in the short run.

This baseline scenario assumes immigration policy turns more restrictive starting mid-2025. Lower net migration will likely reduce labor supply, particularly for lower-wage jobs. This will increase competition for workers, raising wage costs for businesses that are particularly reliant on this group of workers.

The impact of lower immigration on the labor market will play out over a period of years. This is partly because new immigrants become progressively more attached to the labor market over time, and immigrant cohorts from the previous two years will continue to enter the labor force a year after immigration constraints are implemented.

Perhaps the most anticipated aspect of the next Trump presidency is his campaign promise to raise tariffs. The baseline scenario assumes Trump’s calls for across-the-board tariff increases are only a negotiating tactic. Instead, the incoming administration is expected to target certain products and trading partners with tariff hikes.

Tariffs result in higher prices for imported goods, which reduces households’ purchasing power. However, some of the impact can be mitigated if substitutes not subject to the tariffs are available.

We expect a lag between tariff announcement and implementation. The forecast assumes tariff increases will be announced in 2025, implemented at the start of 2026, and phased in over the course of the year. This will delay the inflationary impact, with the first noticeable effects coming in 2027.

Changes to the baseline forecast had a limited impact on the 2025 outlook, as the policy changes take effect over time. The updated forecasts anticipate slightly stronger GDP growth in 2026 and 2027 relative to the previous baseline from the extension of the 2017 personal and business tax cuts plus higher federal government spending in 2026. However, the contribution to growth will weaken by 2028 as the negative macroeconomic consequences of higher tariffs and immigration restrictions are fully felt.

The inflationary impacts of tariffs and tighter restrictions on immigration aren’t likely to become evident for a few years and will have little bearing on the Federal Reserve’s decisions regarding monetary policy in the near term. Rather, the Fed’s decisions will continue to be determined by the economic data. The latest batch of data on inflation and consumer spending came in stronger than expected, adding a small degree of uncertainty to the Fed’s next move. The headline consumer price index increased 2.6 percent from a year ago in October, up from 2.4 percent in September, marking the first acceleration since March.

While we still believe another short-term interest rate cut in December is likely, the odds have risen that the Fed will slow the pace of rate cuts in 2025. The jobs and inflation reports for November will be released before the Fed meets in mid-December and could influence the rate-setting decision.

The November jobs report will particularly come under the spotlight, as it will reveal how strongly the labor market recovered from October’s hurricane and strike -related losses. If the recovery delivered considerably more than just the catch-up of lost payrolls, the Fed could worry less about softness in job growth and pay more attention to signs that inflation’s retreat is stalling.

Although job growth has slowed, consumers are still in good shape thanks to healthy balance sheets for most Americans and cooling inflation that is bolstering real incomes.

October’s retail sales report confirmed that households are still capable of keeping their wallets and purses open. Not only did total sales stage a stronger gain in October than expected, but the increase in September was also revised sharply higher. Hence, the economy entered the fourth quarter riding more momentum than thought, giving heft to the growth rate over the year’s closing months.

We expect personal spending to be a pillar of strength for the economy through the fourth quarter and next year. Stronger productivity is boosting the economy’s potential growth rate, the labor market has come into better balance, and inflation expectations have receded, settling close to the Fed’s two percent target. While the risk has increased that the Fed may slow the easing pace next year, rates are still highly restrictive. A softening job market and cooling inflation should support further cuts to interest rates.

Growing Incomes Contribute to Higher Travel Intentions

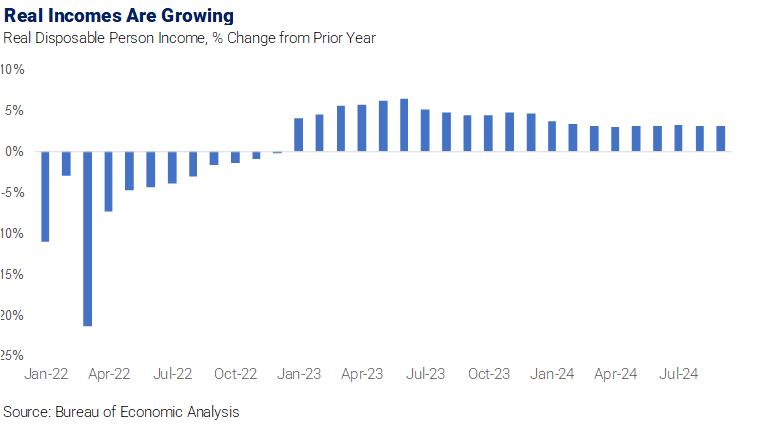

Leisure travel is a form of discretionary spending that is subject to consumer finances and perceptions about their financial well-being. Encouragingly, consumer finances are in pretty good shape, and they appear to have more confidence in their financial situation.

Real incomes, meaning incomes adjusted for inflation, have been rising for over a year thanks to the slowing rate of inflation. Contrast that with 2022, when the high inflation rate meant prices were rising faster than nominal incomes, causing real income to decline.

Consumers seem to be drawing confidence from the positive economic trends of falling inflation, growing real incomes, and the Federal Reserve’s interest rate cuts. The Consumer Confidence Index posted a strong gain in October, with consumers feeling better about their present situation and more optimistic about the outlook for their household finances.

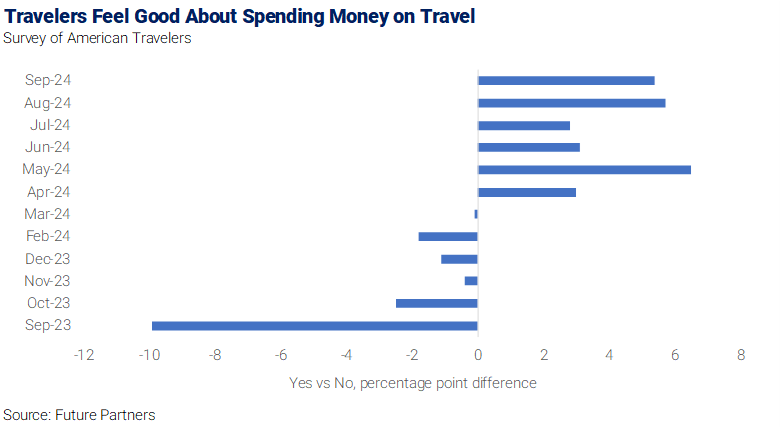

Consumer attitudes about travel have also improved in recent months. A recent consumer survey asked if now is a good time to spend money on leisure travel, and 35% of respondents said Yes while 29% said No, a difference of +6. Conversely, there were more No than Yes responses from last fall through this spring, resulting in a negative difference between the Yes and No responses.

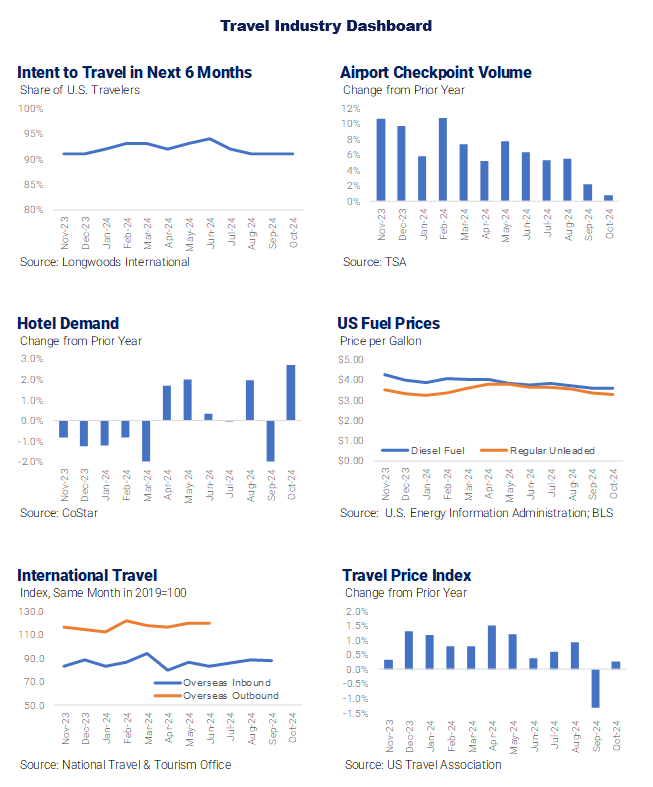

The swing from a negative to a positive net score corresponds with hotel performance. Hotel demand trailed prior year levels in the fall of last year and through the first quarter of this year but demand experienced year-over-year growth through the spring and summer months. After declining 1.3% in the first quarter of this year, hotel demand grew 1.0% from April through October compared to the same period last year. Consumers’ positive feelings toward spending their money on travel suggest the industry will continue to perform well in the coming months.

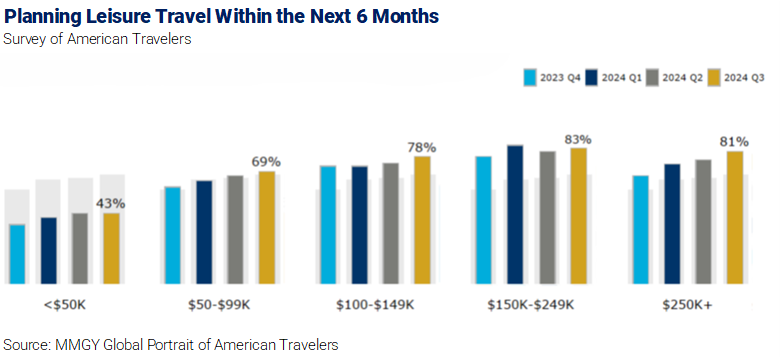

A recent survey of travel intentions provided another positive indicator for the travel outlook. In the most recent edition of the quarterly survey, the share of U.S. travelers planning a trip over the next six months rose.

The increase in travel intentions among the lowest income categories was particularly encouraging. Over the past year, hotel demand has been strong among high-end hotels, but demand in Midscale and Economy hotels has been falling for more than a year. The lift in travel intentions among lower-income households may be an indication that demand in the lower hotel classes will begin to improve in the coming months.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.