Monthly Economy & Travel Industry Summary – May 2024

Inflation Slowed More than Expected in April, But So Did Retail Sales

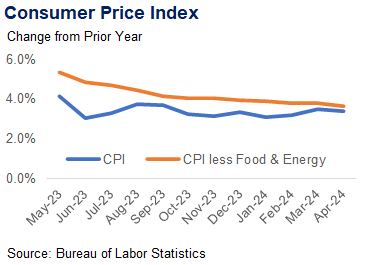

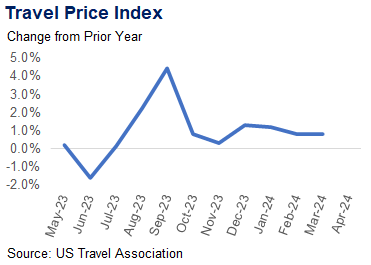

Encouraging news on price gains in April raised hopes that inflation is slowing. Headline CPI was smaller than expected in April and core inflation, which excludes the volatile food and energy categories, experienced the smallest year-over-year increase in three years.

Slowing inflation would represent a key step toward lower interest rates. However, one month doesn’t make a trend, and the Federal Reserve wants to see a few months of slowing price gains before concluding that inflation is on a sustainable path toward the Fed’s 2% target. Therefore, a rate cut before the September meeting of the Federal Open Market Committee remains unlikely.

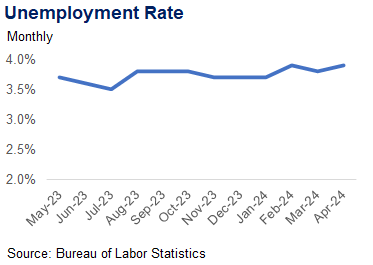

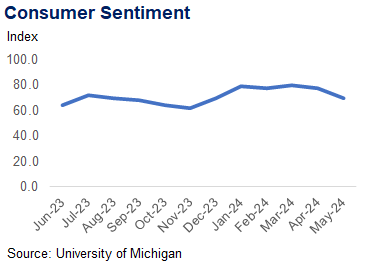

Despite easing inflation, the University of Michigan’s Consumer Sentiment Index fell the past two months, from 79.4 in March to 77.2 in April and to 69.1 in May. Consumers expressed concern over labor markets and expect unemployment to rise in the coming months. Year-ahead inflation expectations rose slightly from April to May, exceeding the range seen in the two years before the pandemic. Consumers seem unconvinced disinflation is in the pipeline, which is another reason the Federal Reserve will want to appear resolute in its determination to bring down inflation.

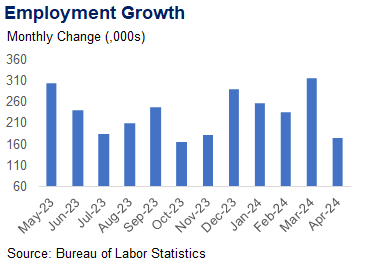

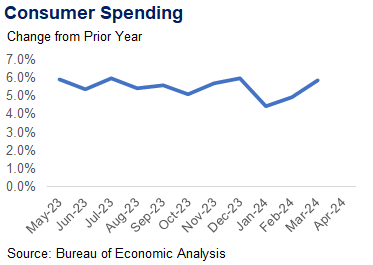

Headline retail sales changed slightly in April, which was a slight disappointment compared to the consensus expectation for a 0.4% month-over-month gain. The weaker-than-expected reading for April was mostly payback for strong sales in March, boosted by online sales promotions and an early Easter. Consumer spending is expected to slow over the rest of the year, but any slowdown is likely to be gradual due to solid household balance sheets and a cooling but healthy labor market.

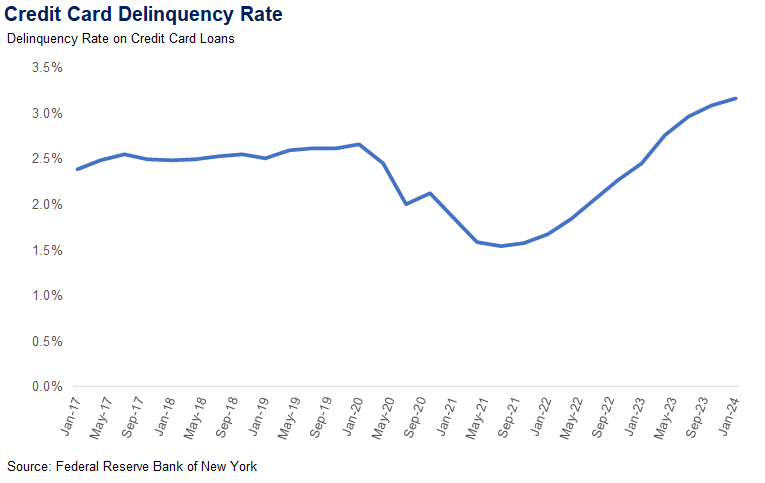

Household balance sheets are strong in the aggregate, but the delinquency rate for credit card debt is rising, particularly among younger and lower-income households. The delinquency rate on credit card debt has surpassed pre-pandemic levels but remains well below the 2009 peak during the financial crisis and recession.

Meanwhile, the sharp rise in net wealth was driven by the jump in house prices during the pandemic, and the recovery in equity markets is benefitting middle- and upper-income households. Households are sitting on a lot of untapped home equity, and the signs that home equity line of credit activity is beginning to pick back up again is early evidence that some households are becoming more confident tapping that equity, even at today’s elevated interest rates.

Optimism Dominates Summer Travel Outlook

The American Automobile Association (AAA) forecasted that travel over Memorial Day weekend would reach an all-time high. Nearly 44 million Americans were expected to travel 50 miles or more from home during the holiday weekend, a 4% increase over last year and just short of the record set in 2005. Considered the kick-off of the summer travel season, robust travel during the three-day weekend bodes well for summer travel.

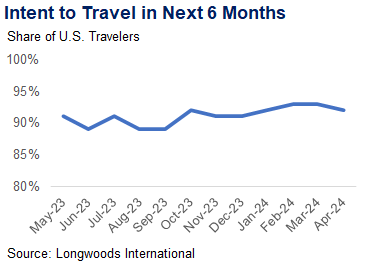

Several other indicators support an outlook of strong travel through the summer. In April, the Traveler Sentiment Survey by Longwoods International found that 92% of travelers plan to take a trip in the next six months. Measured monthly, plans to travel in the next six months have dipped below 90% only three times since the start of 2023.

Similarly, more consumers believe now is an excellent time to spend money on leisure travel. The March edition of a monthly survey by Future Partners found that 34% of consumers believe now is a good time to spend on leisure travel, up from about 31% in the previous three surveys. Only 29% believe this is not a good time to spend money on leisure travel, the lowest share in over a year.

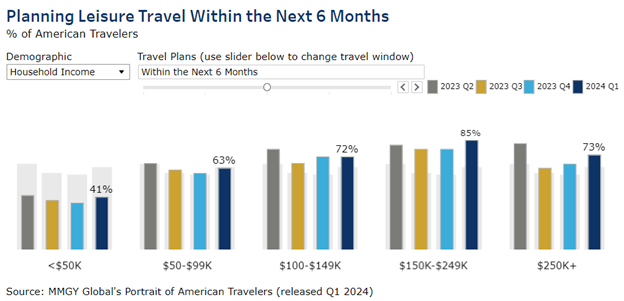

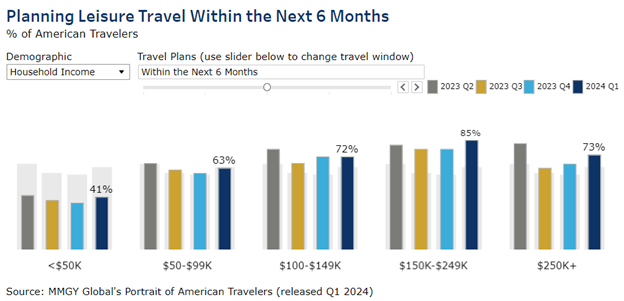

Travel intentions rose across most income categories in the first quarter of 2024. Intent to travel in the lower income brackets had declined in the two previous quarters, perhaps reflecting budgets strained by inflation and higher interest rates on mounting credit card debt. The increase during the first quarter is an encouraging sign for summer travel.

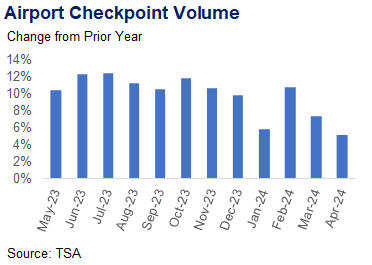

Passenger traffic through U.S. airports has reached record levels. More than 280 million people passed through TSA checkpoints in U.S. airports from January through April 2024, up 7% versus the same period last year and the highest volume ever through the first four months of the year.

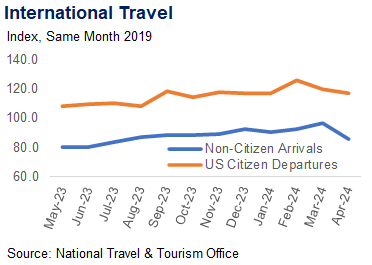

Many of the Americans passing through U.S. airports are traveling internationally. According to the Advance Passenger Information System (APIS), international trips by U.S. residents in the first four months of 2024 were 11% higher than a year ago and 20% above the same period in 2019.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.