Monthly Economy & Travel Industry Summary: June 2025

Despite a steady job market, June data shows weakening travel demand, declining international arrivals, and rising consumer concerns driven by tariffs, housing pressures, and geopolitical risks.

Sign of Weakness Are Evident But a Downturn Remains Unlikely

The Federal Reserve surprised no one by keeping rates unchanged for the fourth consecutive meeting at June’s gathering of the Federal Open Market Committee, leaving the federal funds rate at 4.25-4.50 percent. The economy is not on the cusp of falling off a cliff, workers are holding on to their jobs, and incomes are outpacing inflation, supporting purchasing power and, hence, spending. Given these conditions, the urgency for a rate cut is hard to see.

We suspect that the combination of high interest rates and tariffs will take a greater toll on the economy towards the end of the year, potentially coaxing the Fed towards a more dovish stance. Assuming the inflation impact from tariffs is not persistent, we anticipate the next rate cut will occur at the Fed’s last meeting of the year in December.

So far, it appears that businesses have absorbed some of the initial tariffs, but the largest increase in the effective tariff rate is still underway. Therefore, we are closely monitoring corporate profit margins because if they compress noticeably due to tariff absorption, it will likely lead to a reduction in hours worked and/or an increase in layoffs.

The primary uncertainty facing the Fed remains the impact of tariffs on growth and inflation. The central bank’s updated Summary of Economic Projections (SEP) indicated that both inflation and economic growth would be negatively affected. Compared to the previous SEP presented in March, growth and employment are expected to weaken, and inflation to be higher, raising the specter of stagflation, a toxic combination of inflation and stagnant economic growth. By not cutting rates, the Fed is signaling that the risk of inflation outweighs the risk of recession.

The Fed’s position appears reasonable considering the job market continues to exhibit traditional measures of strength, with the unemployment rate hovering near historic lows at 4.2 percent and generating solid gains in worker pay. Those measures, however, mask some pockets of weakness. The unemployment rate is being held down by slower growth in the labor force, in part due to fewer immigrants entering the labor market, and the hoarding of workers by businesses, fearing rehiring difficulties if future sales hold up better than expected.

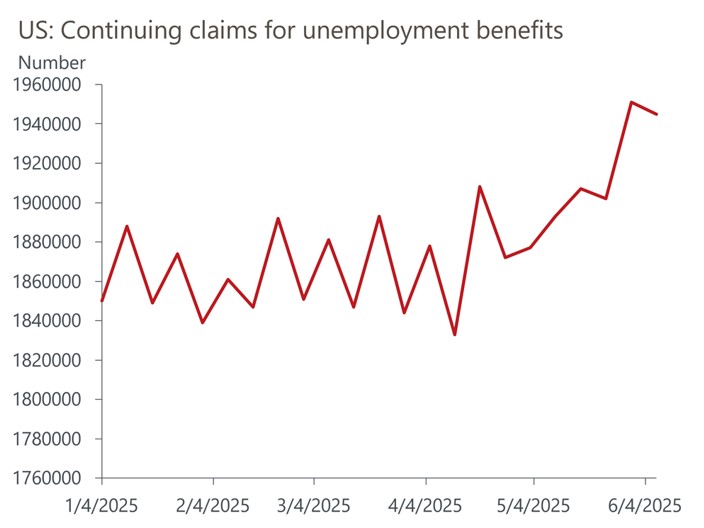

But hiring has slowed, and the “no hire, no fire” strategy is extending the time that job seekers are staying on the unemployment lines. While initial claims for unemployment benefits are slowly, but steadily, rising, continuing claims are climbing at a more alarming pace.

Still, there is little sign that consumer spending is rolling over. True, retail sales in May slipped by a larger-than-expected 0.9 percent, but sales were dragged lower in May by a sharp decline in vehicle sales as front-loading demand ahead of tariffs reversed.

Control group retail sales, which strip out autos, building materials, food, and gas, and feed into early estimates of consumer spending, rose by a solid 0.4 percent, and there were small upward revisions to previous months’ gains. That should give heft to the economy’s main growth driver in the second quarter, as personal consumption is tracking a sturdy 2.0 percent growth rate for the period. However, we expect consumption to weaken in the second half of the year as tariffs weigh more heavily on real disposable incomes.

The Fed should also be mindful that rate-sensitive sectors of the economy are feeling some pain. The poster child among the victims of high interest rates is the homebuilding industry, which has been on a persistent downward trajectory that shows no sign of ending.

Housing starts plunged nearly 10 percent in May to the lowest annual rate since May 2020. Single-family construction is down 14.2 percent from the end of last year, and prospects for single-family construction appear grim, as building permits have fallen in four of the past five months. While high interest rates are a major cause of housing weakness, other influences play a key role, including construction costs, the availability of construction workers and affordability. All these influences are weighing on the sector, and tariffs, along with immigration policies, are exacerbating the problem.

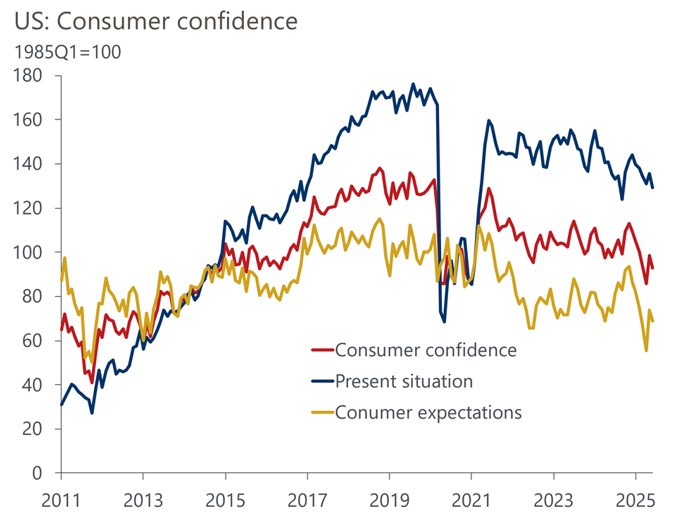

Tariff-related concerns also continue to weigh on consumers. The Conference Board’s measure of consumer confidence declined in June, erasing nearly half of May’s sharp rebound. Confidence fell from a reading of 98.4 in May to 93.0 in June, which was more pessimistic than both our forecast and consensus expectations for a slight rise in the index. All five components of the index weakened, with the largest hits affecting consumers’ evaluation of current business conditions and both current and future employment conditions.

Details from the Conference Board’s press release showed that consumers remained most concerned about tariffs and their inflationary impact, as indicated in their written responses. It appears the initial relief from tariff pauses and talks of trade deals may have subsided, and with many of the tariff pauses set to expire on July 9, we could see further downward pressure on confidence next month.

The latest consumer confidence survey period closed before the US attacked nuclear sites in Iran, and the possibility of renewed war in the Middle East adds more downside risk to consumer confidence. The conflict between Israel and Iran led to volatility in oil prices in June, and if Iran were to block the Strait of Hormuz, where roughly 20 percent of the world’s oil is shipped through, oil prices could skyrocket.

Higher gasoline prices will hurt lower-income households the most, because spending on gasoline accounts for a larger share of their total consumption. High- and mid-income households can tap into savings, a luxury lower-income households don’t have, to absorb higher prices at the pump without coming at the expense of discretionary spending. In aggregate, every penny increase in retail gasoline prices reduces consumer spending by $1.5bn over a year.

However, global oil prices dropped noticeably following a perceived de-escalation in the days after the US bombed Iran’s nuclear facilities, and the odds that Iran closes the Strait of Hormuz have fallen. While the downside risks have subsided, the situation can change quickly, and the balance of risks remains weighted toward higher oil prices.

The economy has clearly lost momentum, and we estimate the odds of a recession during the next 12 months as 35 percent, which is still elevated versus the 15 percent probability of a recession in any given year. Good things are in the pipeline for the economy next year, thanks to deregulation, fiscal stimulus, and reduced policy uncertainty. However, the economy remains vulnerable to any unforeseen developments that may occur through the remainder of this year.

Summer Travel Season Begins Amidst Signs of Softness

Although the labor market and most business indicators are holding up reasonably well, the latest data show a more marked deterioration in some parts of consumer spending,

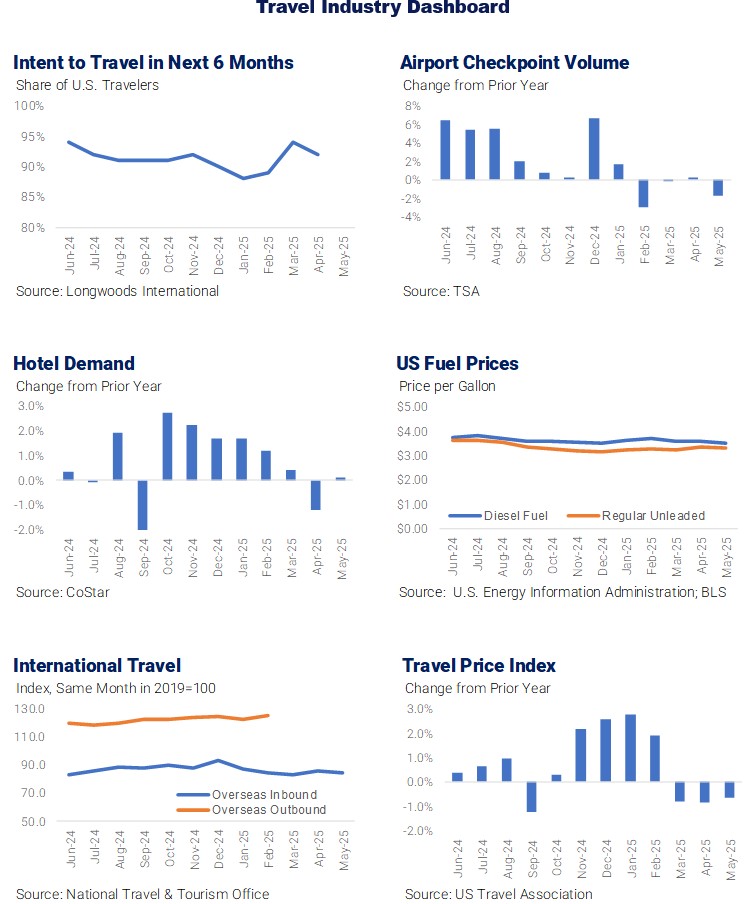

Most of the weakness is evident in travel-related spending, with air passenger travel down year over year by low single digits, with a similar decline evident in hotel occupancy rates. Earlier falls were exacerbated by swings driven by the timing of Easter, but it’s increasingly evident that demand for travel is slowing, with signs of softening among both domestic and international visitors.

The number of people passing through TSA security checkpoints in U.S. airports declined 1.7 percent in May compared to the same month last year, and was down 0.6 percent for the January-to-May year-to-date period. May’s decline occurred despite checkpoint volume surpassing 3 million on Friday, May 23, the start of the Memorial Day holiday weekend and TSA’s third busiest day ever.

The slowdown in TSA airport volume is echoed in the latest hotel data. Hotel demand in airport locations was down 2.0 percent in May and down 0.6 percent year-to-date. Additionally, hotel demand in resort locations was down 1.4 percent year-to-date, suggesting there is some weakness in leisure travel.

Hotel demand, industrywide, was flat in May (+0.1 percent) and year-to-date (+0.3 percent). The strongest performance continues to be concentrated in the Luxury hotel class, with demand and ADR each rising 3.2 percent year-to-date.

The lack of demand growth has eroded hoteliers’ pricing power. The average daily rate rose 0.8 percent in May and was up 1.6 percent year-to-date, well below the overall rate of inflation.

The number of visits to National Parks is also showing a slowdown in travel. According to data published by the National Park Service, recreation visits to national parks have fallen short of prior year levels each month since January and are down 4.2 percent year-to-date through May.

One bright spot for travelers is the recent decline in transportation-related travel prices. The Travel Price Index, which measures a range of travel-related prices, has declined for three consecutive months, with transportation-related prices being the largest contributors to the decline. Motor fuel prices were down 11.9 percent in May, versus the same month last year, and airline fares were down 7.3 percent. Meanwhile, the largest price increases in May for travel-related goods and services were for recreation services (4.2 percent) and food away from home (3.8 percent).

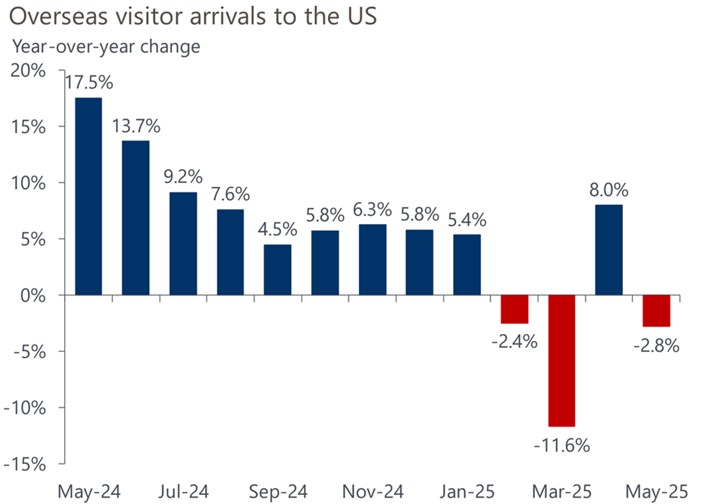

Fewer international visitors are contributing to declines in airport volume, hotel demand, and park visits, as recent data confirm that sentiment headwinds are negatively impacting inbound travel to the United States. Overseas arrivals to the US decreased 2.8 percent in May, pushing year-to-date overseas arrivals down 0.8 percent compared to the first five months of 2025. Through May, visits from Western Europe fell by 1.8 percent compared to the previous year, with Germany and France experiencing particularly steep declines of 10.1 percent and 8.4 percent year-over-year, respectively. Arrivals from Africa (-5.0 percent) and the Caribbean (-3.1 percent) have seen the largest year-to-date percentage declines.

We now expect US international overnight arrivals to decline by 8.2 percent this year, and international spending to fall $8.3 billion (-4.6 percent) compared to last year. We expect the largest declines in visitation from Canada (-20.2 percent), Africa (-6.5 percent), and Western Europe (-4.9 percent).

According to Statistics Canada, the number of Canadians returning from visits to the United States by land plunged 38.2 percent year-over-year in May. This marks the third consecutive month of declines exceeding 30 percent compared to the same period last year. Air travel from Canada has shown a similar downward trend, with air visitors contracting 24.2 percent year-over-year in May. While official US results on Canadian arrivals from the National Travel and Tourism Office (NTTO) are not yet available, the Statistics Canada measure provides a reliable and timely indicator.

The May arrivals data reinforce our view that the Trump administration’s policies and rhetoric have fueled a marked rise in negative sentiment toward the United States among potential international travelers. We see May as an early signal of deeper declines ahead as the all-important summer travel season begins.

On June 4, US President Donald Trump signed a travel ban proclamation fully restricting the entry of nationals from 12 countries, while limiting the entry of nationals from seven others. The newly announced travel ban is broader than the restrictions implemented during the first Trump administration; however, reduced travel from the affected countries is expected to have a minimal impact on overall inbound arrivals. Travelers from the twelve banned nations accounted for just 0.3 percent of total overseas arrivals in 2024. When including the seven countries with limited entry, this total rises to only 1.0 percent.

While the direct effects of these restrictions will be minimal, the latest travel ban could further negatively impact inbound travel by increasing negative sentiment toward the US globally.

Recent escalations in the Middle East, the prospect of a further increase in trade tensions, and a dollar that has eased some but remains strong relative to historical levels, offer additional downside risks to our 2025 arrivals forecast.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.