Monthly Economy & Travel Industry Summary: June 2024

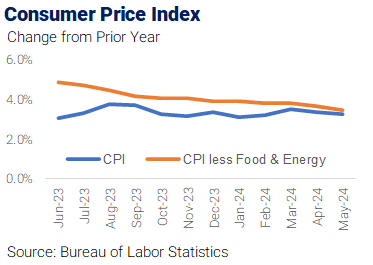

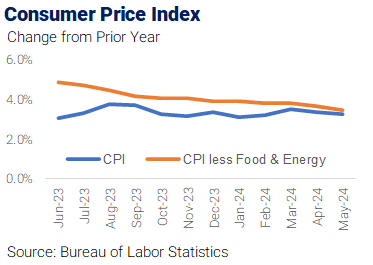

Slowing Inflation Reinforces Expectations for September Rate Cut

A trifecta of May inflation readings – the Consumer Price Index (CPI), Producer Price Index (PPI), and import prices – surprised to the downside, and many of the underlying details in the reports indicate that a slowdown in inflation is back on track.

However, after a string of upside inflation surprises early in the year, the Fed will need to see more than one month’s good data before it is confident that inflation is on a sustainable path to 2%.

As a result, the Federal Reserve remains focused on the potential risk of a re-acceleration in inflation. The Federal Open Market Committee’s updated economic projections point to just one rate cut this year, but those forecasts were done before the recent good news on inflation. We expect two rate cuts this year, with the first coming in September and a second in December.

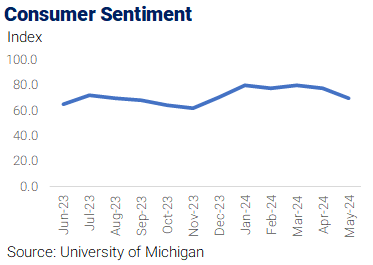

The preliminary reading of the University of Michigan’s consumer sentiment index for June was 65.6, down from 69.1 in May to 77.2 in April. The decline in the index was driven by consumers’ adopting a weaker view of current economic conditions. Higher prices, delayed interest rate cuts, and slowing income growth are weighing on consumers, although recent good news regarding inflation could lift sentiment in the coming months.

Declines in consumer sentiment over the past couple of months have been greatest among low- and middle-income households. Many low-income households feel a renewed squeeze on their disposable incomes as they have depleted the excess savings they built up during the pandemic and are more sensitive to higher inflation and interest rates.

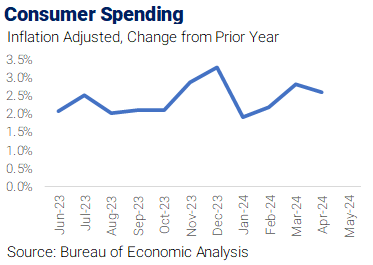

Falling sentiment bears watching, but concerns over the declines are limited because there has not been a strong correlation between consumer sentiment and consumer spending in recent years. Consumer spending’s resilience is dependent on the state of household balance sheets, which remain strong for middle- and high-income households.

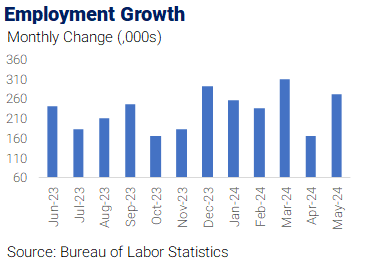

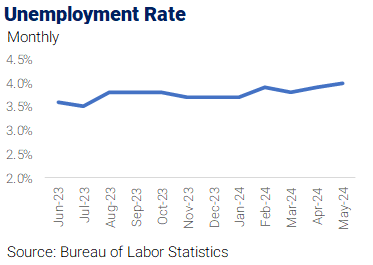

Mixed messages about the labor market have generated some jitters about the expansion’s durability, but this nervousness is likely overdone. The unemployment rate reached 4.0% in May, the highest since January 2022 but still historically low.

The increase in May could be taken with a grain of salt because of the end of the school year, which varies from year to year and can wreak havoc on attempts to adjust the data for seasonality. The seasonal adjustment expected more younger workers, those 16 to 25, to get a job, but this did not come to fruition.

In May, household employment among those 16 to 24 dropped noticeably, and the unemployment rate increased by one percentage point. That will likely be reversed over the next couple of months. Meanwhile, the unemployment rate for those 25 and older remained at 3.2%.

Economic Indicators Dashboard

Travel Intentions Remain High as Summer Begins

Ninety-four percent of travelers plan to take a trip in the next six months, according to the June edition of the Traveler Sentiment Survey by Longwoods International—the highest on record. The share of travelers planning a trip in the next six months has exceeded 90% since September of last year.

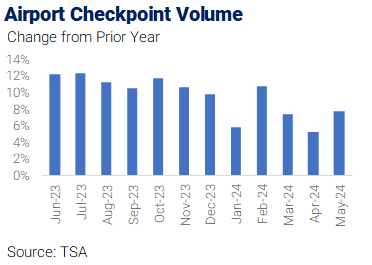

Strong travel intentions are generating record numbers of travelers through U.S airports. Over 360 million travelers passed through security checkpoints in U.S. airports from January through May, up 6% versus the same period last year and the highest volume ever through the first five months of the year. The first few weeks of June are pacing 7% ahead of 2019 volumes.

The year-to-date total includes more than 10 million travelers who went through security in U.S. airports from Friday through Monday of Memorial Day weekend, up 7.7% versus last year’s holiday weekend and 11% higher than the comparable period in 2019.

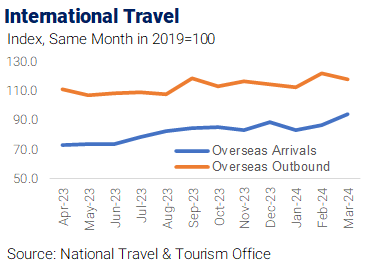

Continued international travel growth contributes to the increased traffic in U.S. airports. Total international outbound trips by U.S. residents in the first quarter of 2024 surged 13% ahead of last year and 8% above the first quarter of 2019. Conversely, overseas inbound arrivals through April remained 15% below the same period in 2019, despite a 20% gain over the same period last year.

The recovery of international travel to the United States has varied by region. The strongest rebound has been from Central America, with arrivals posting a 15% gain over the first four months of 2019. Only one other region has surpassed 2019 levels; year-to-date visits from Africa were 2% above 2019.

Those two regions represent relatively small shares of overseas visits to the U.S., accounting for only about 6% of all overseas visits thus far in 2024. Western Europe’s largest origin market accounted for 38% of arrivals through April. Visits from Western Europe have risen 13% in 2024 but registered 9% below the same period in 2019.

While Asia lags all major regions, visits to the US from India have been a bright spot. Visits from Asia rose 40% through April but were still 28% below the same period in 2019. However, Arrivals from India surpassed 2019 levels last year and rose 40% in 2024.

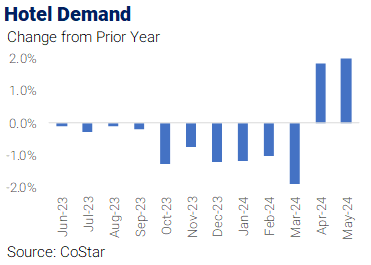

Hotel demand has experienced a modest recovery in recent months. Demand rose 1.8% in April, the first year-over-year increase since May 2023. Shifts in the timing of Easter can make it difficult to gauge demand trends, and it was unclear how much of April’s gain was due to business travel and group meetings shifting from March to April due the holiday’s earlier date in 2024. However, demand posted back-to-back gains by rising 2.0% in May, an encouraging sign as the industry heads into summer.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.