Monthly Economy & Travel Industry Summary: July 2024

Economy Trending Towards a Soft Landing

Early this year, Oxford Economics forecast that economic growth would slow, but the economy would avoid falling into a recession. The so-called ‘soft landing’ would manifest in slower but still positive economic growth, easing inflation, and a modest increase in the unemployment rate.

Unexpectedly weak first-quarter growth in gross domestic product (GDP), the measure of total economic output, raised some fears that the economy was slowing more rapidly than anticipated, but we maintained our forecast that it was not tilting into a recession.

The recently released second-quarter GDP report showed the economy growing at an annualized rate of 2.8%, faster than predicted. This reacceleration in GDP growth should help temper concerns about the expansion’s durability. The healthy growth rate also reinforces our view that the Federal Reserve won’t start reducing interest rates before its September meeting.

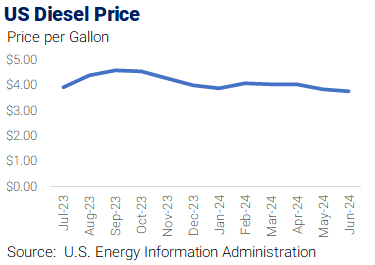

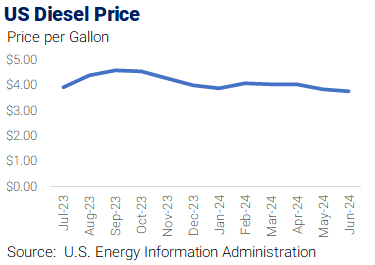

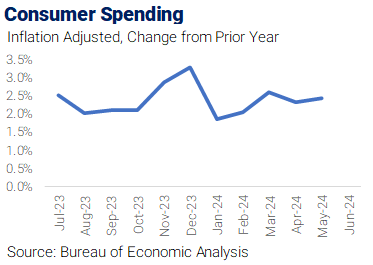

Strong underlying retail sales in June suggest real consumer spending rose close to 2% annualized in Q2, slightly faster than forecast. Gas station sales declined due to lower gas prices, and a widespread cyberattack on auto dealerships impacted auto sales, but spending in almost every other category rose strongly on the month, and there were significant upward revisions to previous months’ gains.

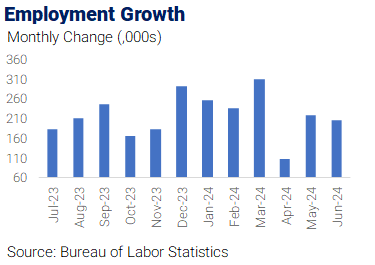

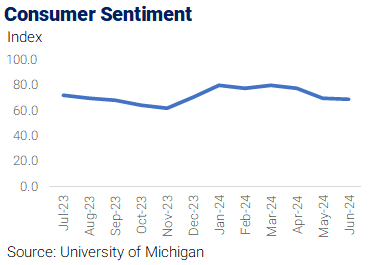

Given the strength of household balance sheets and the resilient labor market, we expect consumer spending growth over the second half of the year to continue near its current healthy pace. Low-income consumers are coming under strain amid elevated interest rates and a slowing labor market, but we expect only moderate increases in the unemployment rate. Meanwhile, higher- and middle-income consumers, who account for the vast majority of overall spending, are still in decent shape, thanks to the sharp rise in household wealth underpinning spending and will keep the saving rate low over the coming years.

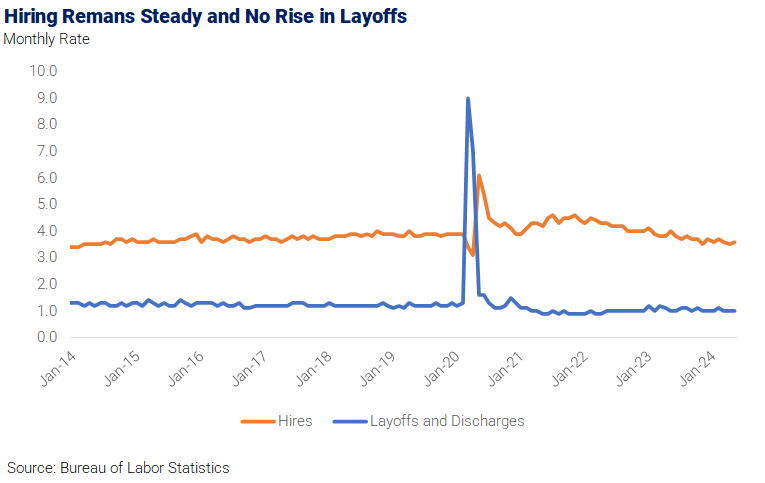

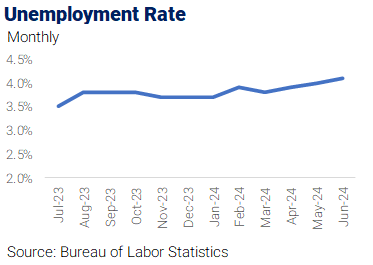

The key risk to the consumer would be if we saw more concrete signs the labor market was faltering. The unemployment rate rose to 4.1% in June, from 3.6% in the same month last year, but unemployment remains at historically low levels. The rise in the unemployment rate is primarily a supply story related to growth in the labor force – the hiring rate has remained stable over recent months and the rate of layoffs hasn’t risen this year. All this suggests labor demand, while softer than a few years ago, is still resilient.

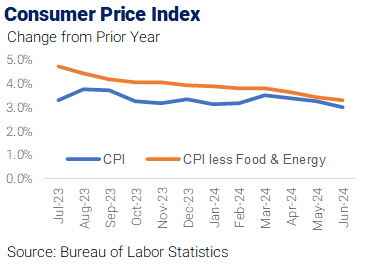

The Federal Reserve’s primary responsibilities are maintaining stable prices and full employment, known as the Fed’s “dual mandate.” Elevated inflation has caused the Fed to prioritize the stable prices component of its mandate for the past couple of years. Still, recent favorable inflation readings will allow the Fed to focus more on the downside risks to the labor market from leaving interest rates at current levels for too long. We expect a rate cut in September, followed by cuts at every other meeting until the federal funds rate reaches 2.75%, half the current federal funds rate of 5.5%.

Robust Summer Travel Including Record Airline Volumes

Surveys of travel intentions conducted during the spring predicted robust summer travel and key travel indicators show growth over prior year levels.

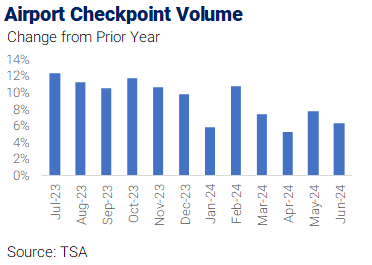

TSA airport checkpoint volume in June was 6% above the same month last year and the highest monthly volume ever. Additionally, the July 4th holiday fell on Thursday this year, and many travelers used the holiday as part of a long weekend. Travelers returning home after the holiday weekend lifted Sunday, July 7, to the highest daily volume ever, with more than three million travelers passing through security checkpoints in U.S. airports.

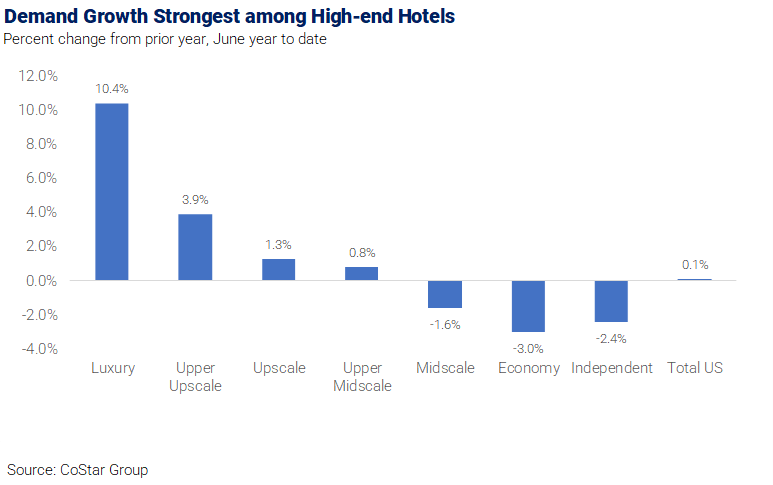

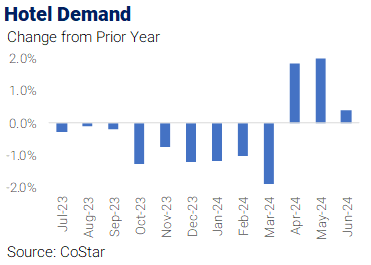

Hotels have experienced a rebound in demand after a slow start to the year. Demand was down 1.4% in the first quarter of 2024 but rose similarly in the second quarter, leaving demand in the first half of the year essentially unchanged from last year. Continuing a trend that emerged in 2023, higher-end hotels are experiencing healthy demand levels while demand in Economy and Midscale hotels is down due to the impacts of inflation and higher interest rates on some household budgets.

Long weekends tied to the July 4th holiday also benefited hotels. This was the fourth time since 2000 that July 4th fell on a Thursday (2002, 2013, 2019, 2024), and this year’s room demand for the holiday weekend was the second highest of the four behind 2019.

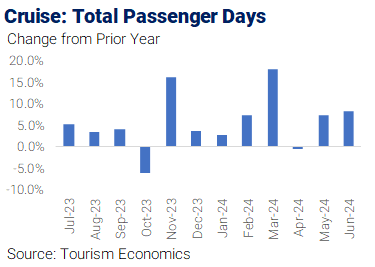

Cruise lines are also experiencing elevated demand in 2024 with total passenger days up 7% through June. The Easter shift contributed to an 18% increase in March but a slight 1% decline in April. Growth resumed in May when total passenger days rose 7%, followed by an 8% increase in June.

Consumer surveys indicate healthy travel volumes will likely persist through the summer and into the fall. According to the latest edition of the American Travel Sentiment Survey by Longwoods International, 92% of travelers have travel plans in the next six months, compared to 89% at the same time last year.

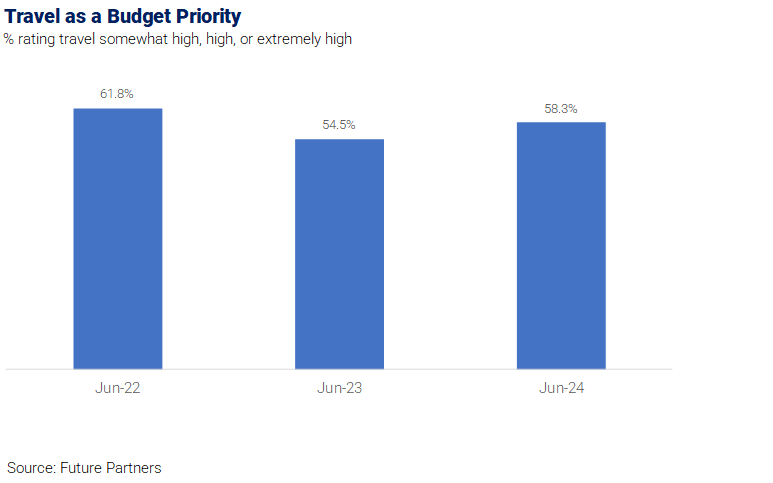

Additionally, a June consumer survey by Future Partners found that 58% of consumers prioritize travel in their budgets. That compares favorably to 55% last year but falls short of 62% in June 2022, which was still benefitting from pent-up demand from the pandemic.

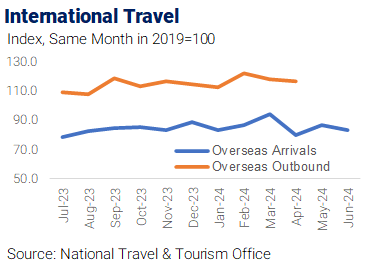

International travel to the U.S. continues to recover. Overseas arrivals (excluding Canada and Mexico) were up 18% in the first half of 2024 compared to last year. Year-to-date overseas arrivals totaled 85% of the same period in 2019, a significant improvement compared to the first half of 2023, when they equaled 72% of 2019 levels.

Travel to the US from Mexico is also experiencing robust growth but Canadian arrivals have weakened in 2024. Year-to-date arrivals from Mexico were up 20%, while U.S. visits from Canada were down about 6%. Despite the strong recent growth from Mexico, visits from Mexico were still about 12% below the comparable period in 2019. Conversely, arrivals from Canada were 2% above the same period in 2019, even with the year-over-year decline. Canadian travel to Europe, Asia, and the Caribbean is growing, and it’s possible Canadians who substituted the US for a long-haul destination due to pandemic-era restrictions are now fulfilling pent-up demand for long-haul travel.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.