Monthly Economy & Travel Industry Summary: April 2025

Tariffs and other policies slowing consumer spending growth

Changes Loom After Solid First Quarter

Indications of a weakening economy have largely been concentrated in anecdotal and sentiment data so far. While recent economic releases paint a picture of an economy in solid shape, it is important to remember that economic data tends to be rear-facing. Forward-looking measures, such as consumer and business confidence, suggest a much rockier path lies ahead.

March data reflected a generally healthy labor market. The number of jobs added accelerated in March from January and February’s subdued levels, and the unemployment rate of 4.2% showed little indication of accelerating layoffs.

There was also positive news on the inflation front, as March’s 2.4% year-over-year increase in the consumer price index (CPI) was the lowest since early 2021. Though tariffs didn’t have a noticeable impact on consumer prices in March, they will soon as there are lags between tariff adjustments and when they appear in consumer prices.

A strong rebound in retail sales in March was boosted by a surge in auto sales and a more general front-loading of consumer spending ahead of tariffs, payback for poor weather earlier this year, and lingering support from tax refunds.

Surveys show consumers say now is a good time to buy ahead of an anticipated tariff-driven rise in prices. Front-loading and the subsequent hangover in spending will exacerbate volatility in the data over the coming months.

We expect consumer spending growth to slow to 1.5% in 2025, from 2.8% last year, reflecting the hit to real incomes caused by tariffs, the additional drags from increased uncertainty, and the hit to household wealth.

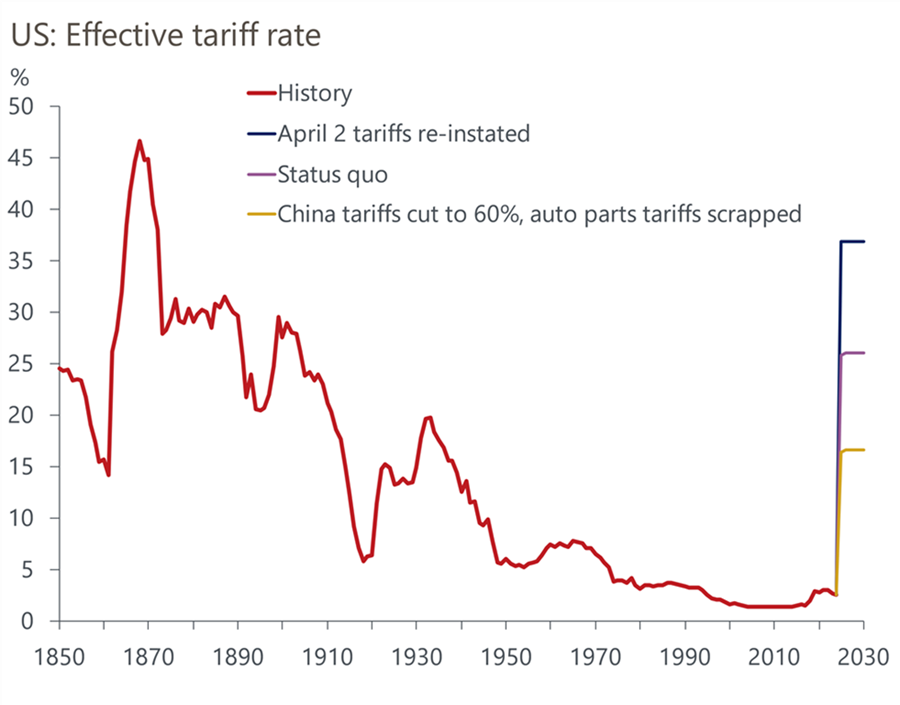

The impact of tariffs will progressively increase in the economic data over the coming months. Preliminary data indicates tariff revenues nearly doubled in April to $15 billion, suggesting the effective tariff rate jumped to 5.5% from less than 3%.

April and beyond is a different story entirely. Most importers remit tariff revenue with a month lag, so the April data reflects the impact of March tariffs, which include 20% additional tariffs on imports from China and the steel and aluminum tariffs that applied during the second half of the month.

One of the first places to feel the impacts of the tariffs will be US ports. The port of LA forecasts it will process roughly 50% more inbound freight in late April compared to a year ago. However, by mid-May, freight levels are forecast to be down 35% year-over-year, underlining the scale of the whiplash coming in domestic logistics from the front-loading ahead of tariffs and the subsequent overhang in inventory and plunge in shipments due to prohibitively high tariffs.

As things stand, we expect the effective tariff rate to jump close to 25%. However, there is considerable uncertainty about tariff policy, in both directions.

Temperatures cooled a bit on policy after Easter, as Trump hinted at a de-escalation of trade tensions with China and softened his attacks on Fed Chair Powell. The White House’s friendlier tone stoked optimism in the financial markets, sending stock prices appreciably higher. Even the beleaguered U.S. dollar got a modest lift, bouncing off its three-year low.

How long the respite lasts is up in the air, as policy uncertainty remains elevated and traders are skittish.

Households, meanwhile, remain as nervous and jumpy as ever. The April University of Michigan survey of household sentiment put the finishing touches on the preliminary study taken in the middle of the month. Unsurprisingly, people’s nerves remained unsettled, albeit a bit less so over the second half of the month following the announced 90-day pause of the more extreme tariffs and the positive response of the markets. Still, the full-month reading was anything but comforting; if the hard data resembles household sentiment revealed for April, the economy is in for some rough sledding.

The real story is what households expect over the foreseeable future. The survey’s economic expectations suffered the steepest three-month decline since the 1990s recession. Even worse, expectations for inflation over the next year soared to the highest level since 1981, and expectations for inflation over the next 5-10 years were the highest since 1991.

To be fair, the link between household expectations and their actual behavior is loose and has become weaker in recent years. That’s an important point to remember, as tariff announcements heavily influence household expectations, which have proven to be chaotic and subject to change at any moment. Should a truce on the tariff front surface appear sustainable, household sentiment would turn more upbeat. So too would the financial markets, and any sustained wealth-building rally in the stock market would bolster the outlook for spending.

Likewise, any retreat in policy uncertainty would brighten the spirits of businesses, where tariffs already on the books have put a crimp on investment spending plans and are wreaking havoc on inventory management. This is particularly harmful for small businesses as they attempt to manage their cash flow amid a backdrop of fluctuating tariffs, adding volatility to their input costs.

Many business leaders have been vocal about their distaste for tariffs, as they portend higher input costs, stifle global trade and growth, and invite retaliation by trading partners that weakens exports and, hence, revenues from overseas sales.

So far, the business angst has not resulted in widespread layoffs, in part because trade tensions might de-escalate and render those dire prospects moot. Companies do not want to be put in the position of firing workers and then struggle to rehire them if pessimistic forecasts are not realized. However, given the risks associated with allocating new funds to expensive capital equipment outlays, business leaders are understandably turning more cautious until there is more clarity on the policy front.

Hence, new orders for nondefense capital goods slipped in February and March following three months of solid gains. What’s more, the reading would have been considerably softer if not for the boost from transportation orders, which were propelled by the front-loading of orders for autos and parts to beat tariffs scheduled to take effect in April. We expect that capital spending will show a decent gain in the first quarter but turn softer later on unless trade tensions abate significantly and sentiment turns brighter.

All of this uncertainty is suffocating for the US economy and is one of the reasons why, in April, we lowered our 2025 GDP growth forecast for the US by 0.8 percentage points to 1.2%.

The unemployment rate is now expected to average 4.4% this year, up from 4.2% in our March forecast. Employment is expected to decline in the second half of the year because of the slowing economy, the federal hiring freeze, and federal layoffs, which will push the unemployment rate to 4.8% in Q4 of this year.

A risk to our forecast is that the impact of uncertainty could be amplified if concerns about a recession intensify, which would further worsen sentiment and business investment. A recession isn’t in our baseline forecast, but any additional increases in the effective tariff rate would push the US into recession.

International Travel to US Falls Sharply in March

Due to a high degree of noise in the data, it was hard to get a clear picture of the travel industry in the first quarter of 2025. Wildfires in California impacted hotel performance, and calendar shifts further muddied the water, including a normal 28-day February versus Leap Year a year ago and the Easter shift from March last year to April.

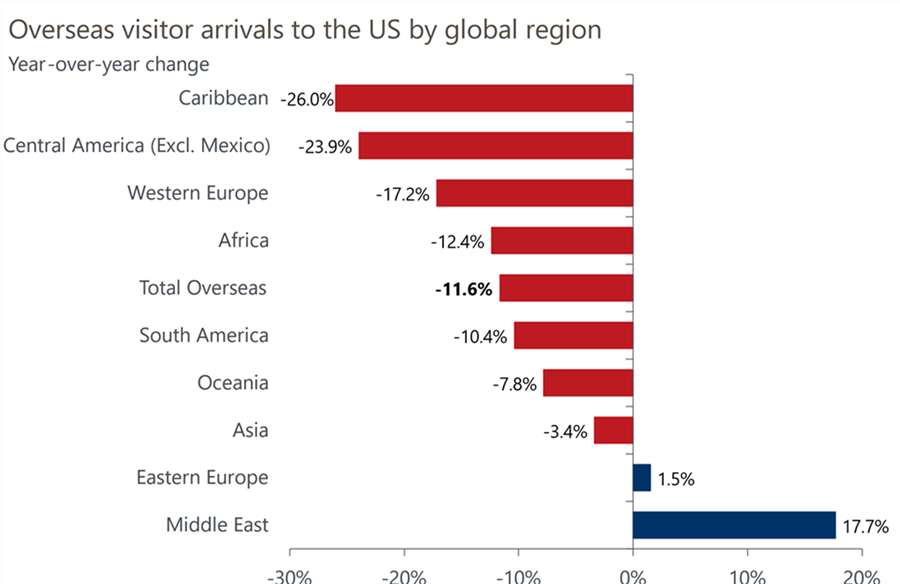

One thing that has become clear is a marked slowdown in international arrivals to the US. While some of the declines can be attributed to Easter’s later date, the magnitude of the declines suggests there is more going on than just a calendar shift.

Policies and pronouncements from the Trump administration have contributed to a growing wave of negative sentiment toward the US among potential international travelers. Heightened border security measures and visible immigration enforcement actions are amplifying concerns, creating additional barriers for those considering travel to the US.

Canadians returning from visits to the US by land plunged 31.9% year-over-year in March, while air arrivals to the US fell 13.5%. Overseas visitor arrivals to the US in March contracted 11.6%, presenting the first meaningful decline in overseas arrivals since the pandemic.

Visits from Western Europe dropped 17.2% in March, with Germany and the UK—which issued updated travel advisories to the US in March—falling 28.2% and 14.3%, respectively. Combined, these two countries were responsible for about half (51%) of the drop in overseas visits. Shorter-distance regional markets contracted the most year-over-year, led by the Caribbean (-26.0%) and Central America (-23.9%).

Mexico residents traveling by air to the US, who account for 20% of all Mexican visitors, fell 22.9% in March. March land visitor arrivals data from Mexico is yet to be published by NTTO or Customs and Border Patrol.

The contractions observed in March represent early ramifications of a potent mix of negative sentiment, which has developed abroad in response to polarizing rhetoric and policy actions by the Trump administration, as well as concerns around tighter border and immigration policies. The strong US dollar, prior to its recent slide, added to the situation, making the US a relatively more costly destination.

The timing of Easter, which occurred on March 31 last year but not until April 20 this year, contributed to the weakness, as some leisure arrivals are expected to shift into April this year. We estimate March overseas arrivals were about five to seven percent weaker than typically would be expected given the Easter holiday timing, indicating the April date of Easter was only partially to blame for the shortfall.

The declines in March may be just the beginning. Airline booking data indicates bookings for travel to the US from Canada are down an average of 18% each month from April through September, compared to the same time last year, and air bookings from the rest of the world are down an average of 5% each month.

At the beginning of the year, we forecast that international travel to the US would rise 10.5% in 2025 and international arrivals were on track to reach the previous peak set in 2019 by 2026. We have revised our forecast to a decline of 9.4% in 2025, and full recovery to the pre-pandemic level of international arrivals won’t be reached until 2029.

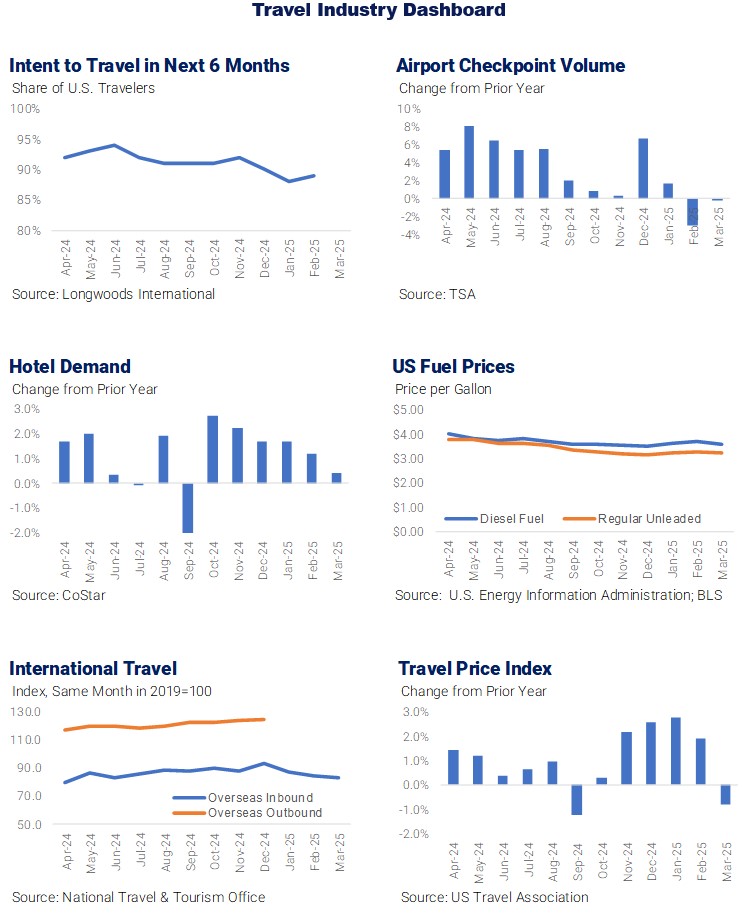

We also saw the first indication that the uncertain economic climate may impact domestic travel this year. A survey of American travelers in early April by MMGY found a 4% drop in travel intentions over the next 12 months compared to the mid-February survey.

Additionally, 80% of U.S. consumers say their travel behavior will change in the next six to 12 months as a result of the recent financial news. Among those likely to change their travel behavior, one-third (33%) said they will travel closer to home, 24% will change to a less expensive mode of transportation, and 22% anticipate adjusting their length of stay.

Over half (53%) of U.S. consumers believe that American travelers will be less welcome in other countries as a result of the recent tariff policy decisions. This likely contributed to 29% saying they will change from an international destination to a domestic destination, representing a potential silver lining for the US travel industry.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.