Monthly Economy & Travel Industry Summary: March 2025

Ongoing uncertainty continues to stifle growth in tourism and travel sectors

Ongoing Uncertainty Is Suffocating the Economy

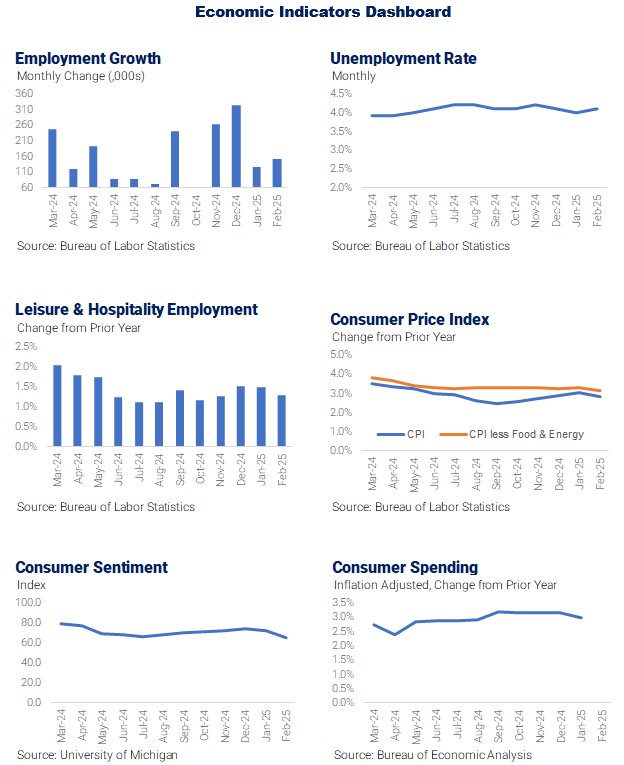

Uncertainty is weighing on the economy, which is on track for a weak performance in the first quarter of 2025. Falling consumer confidence, disappointing retail sales, and slow hiring all point toward little to no growth in gross domestic product (GDP) in Q1. Additionally, falling equities may hurt high-income spending via the wealth effect. Nevertheless, fundamentals still show that consumers are in decent shape and support our view that a recession this year remains unlikely.

The weaker start to the year, adjustments to our tariff assumptions, and the relentless policy uncertainty prompted us to downgrade GDP growth to 2.0% in 2025, from last month’s forecast of 2.4% and last year’s growth of 2.8%. Additionally, we raised our forecast for the unemployment rate due to the large reduction in federal employment.

Our subjective odds of a recession have therefore risen to 30% from 20% due to the heightened threat to the economy from tariffs, worsening sentiment, and falling stock prices.

Consumer balance sheets are generally healthy but concerns about the economy could cause a pullback in spending. Manufacturing and housing recovery will be slowed as rising inflation expectations prompt the Federal Reserve to delay action on interest rate cuts. On the other hand, import growth and inventory accumulation will be stronger as firms frontload ahead of tariffs.

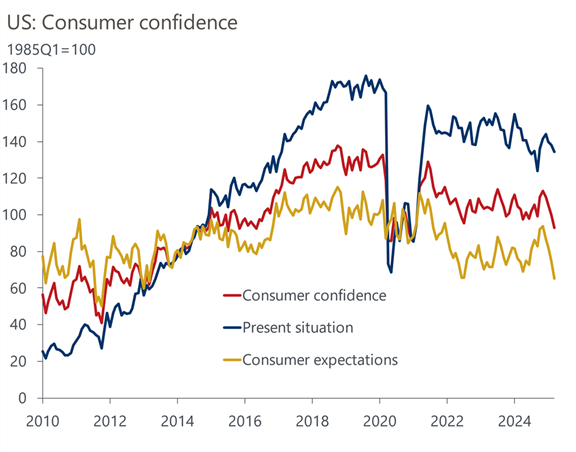

The Conference Board’s measure of consumer confidence saw another sharp decline this month, falling from a reading of 100.1 in February to 92.9 in March. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—decreased 3.6 points to 134.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—dropped 9.6 points to 65.2, the lowest level in 12 years

The decrease was mostly driven by consumers being more downbeat about their expectations for the future. Falling stocks, an uptick in the unemployment rate, and stalling progress in inflation amid tariff uncertainty all took their toll on the consumer psyche this month. Inflation expectations continued to tick up, thanks to stalling progress on disinflation and worries over the price effects of tariffs. Year-ahead inflation expectations rose to 6.2% in March from 5.8% in February, their highest level since May 2023.

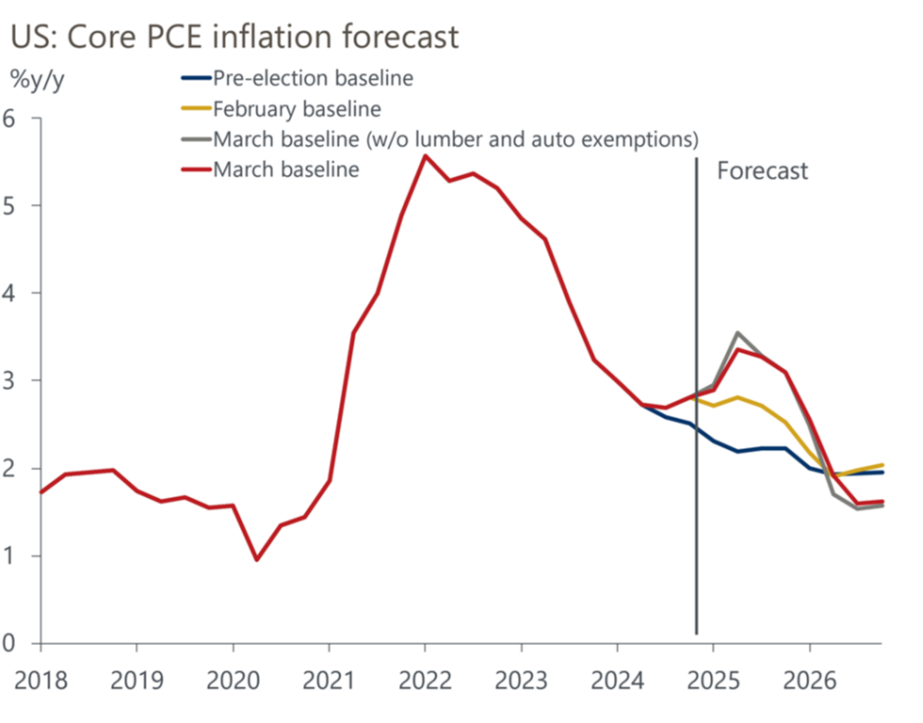

Consumers are becoming more concerned about the inflationary impacts of tariffs after Trump placed an additional 10% blanket tariff on China this month, raising the effective tariff rate on Chinese products to 30%, and placed 25% tariffs on steel and aluminum this month. We don’t expect inflation fears will subside in the near-term, as April 2nd is when the tariff exemptions for USMCA-compliant goods from Canada and Mexico may be lifted and more announcements on retaliatory tariffs are expected.

The relationship between total consumer spending growth and sentiment is loose, particularly in the short run. We think that higher tariffs will prompt consumers to reel in their spending, but not by enough to trigger a recession. Healthy household balance sheets will continue to support spending by high- and middle-income consumers. We expect to see 2.0% growth in consumption on a Q4/Q4 basis, compared to 2.4% growth in our February baseline.

The wealth effect, whereby wealth gains leave households feeling more sanguine about their personal finances and more willing to loosen the purse strings, has been a more important contributor to consumer spending in recent years than in the two previous business cycles. This is unsurprising, given the ferocious rise in asset prices since the pandemic and the increasing number of retirees, who tend to sell assets to finance their spending.

A stronger wealth effect is a tailwind for overall consumer spending, of which high-income households account for a disproportionate share. But it could just as easily turn into a drag on consumer spending if recent volatility in the stock market turns into a full-on bear market. The more aggressive approach to tariffs has caused us to raise our inflation forecast, with core PCE now expected to exceed 3.5% later this year and average 3.1% over the full year. We currently expect the Federal Reserve will remain on hold until December but could extend its pause until well into 2026 if inflation expectations remain elevated.

Pharmaceuticals, vehicles, and clothing goods prices are most exposed to tariffs, and commodities prices will also be lifted. A bright spot has been the recent decline in global oil prices to their lowest level since September. Lower oil prices and the warmer weather moderating natural gas demand should help bring down fuel prices over the coming months.

In addition to the impact of tariffs on inflation expectations, impacts to business decisions are also beginning to emerge. Business inventories rose 0.3% month over month in January, the largest monthly gain since August, powered by a 0.8% increase in wholesalers’ inventories. The strong inventory build in January reflected an urgency among firms to stockpile goods in anticipation of a second East and Gulf Coast port strike that was ultimately averted and the imposition of tariffs under President Donald Trump.

The acceleration in stockpiling dovetails with the latest surge in goods imports that has caused the trade deficit to expand to its widest ever at the beginning of the year, and the front-loading of imports hasn’t ended. Businesses are preparing for an expansion of trade protectionism starting in early April that will likely include reciprocal tariffs on trading partners and sectoral tariffs on autos and critical supplies. Odds are rising that inventory stockpiling will provide a temporary boost to GDP growth in the second quarter of 2025 but become a drag on growth in the second half of the year as inventory growth subsides until the stockpiles are sold off.

In the midst of heightened uncertainty and weakening consumer confidence, the February employment report showed the private labor market is still solid. Low layoffs have kept unemployment stable but hiring rates are falling and employment opportunities for those who are unemployed are harder to come by. The surge in policy uncertainty could cut into the hiring rate further while businesses sit on their hands until there is more clarity on the tariff front. Tariffs can slow hiring rates through business uncertainty and decreased profit margins. Federal layoffs are likely to dent, but not derail, the labor market. Federal layoffs will have the largest impacts at the metro-level, particularly in the DC-adjacent metros in Northen Virginia and Maryland.

However, there are a couple of reasons why the impacts may take time to filter into the data despite all the layoff announcements across various federal agencies. For one, some of the layoffs, particularly among probationary workers, have been tied up in the courts. Another reason is that many of the laid-off workers have been put on paid administrative leave, making them ineligible to file for unemployment insurance benefits, for now.

Slow Start to Tourism in 2025

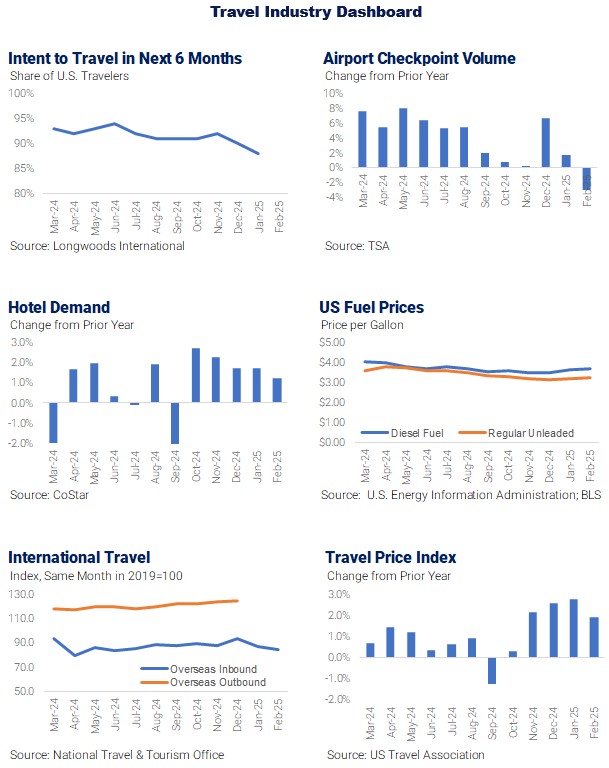

The tourism industry experienced relatively modest growth in the first two months of the year, with hotel demand up 1.4% through February. Overseas arrivals were up 1.6% in the first two months of the year while security screenings in US airports were down 0.6%. The screening data is not adjusted for February 2024 being a leap year, and screenings were up approximately 1% when adjusted for the extra day last year.

Tariffs and related rhetoric ramped up in February so the available data largely predates actions taken in the past few weeks. Results for March are expected to provide the first indications of any impacts to tourism.

Of some concern are the consecutive declines in the share of US travelers planning to take a trip in the next 6 months, from a monthly survey conducted by Longwoods International. While still high, the share dipped below 90% for the first time in nearly two years.

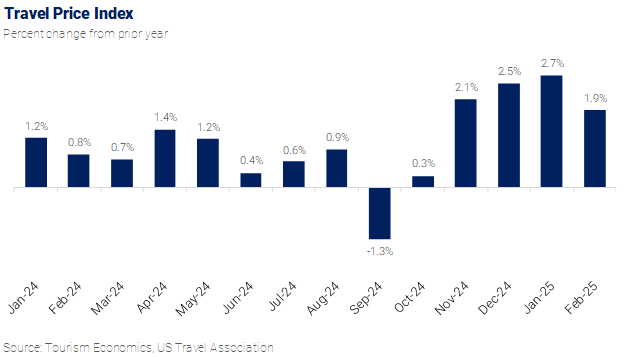

Similar to the overall economy, rising inflation expectations represent a potential risk to the travel outlook. The Travel Price Index (TPI), a combination of travel-related prices, mirrored the acceleration of growth in consumer prices near the end of last year. The TPI had experienced very modest growth through most of 2024 until price growth surged in November.

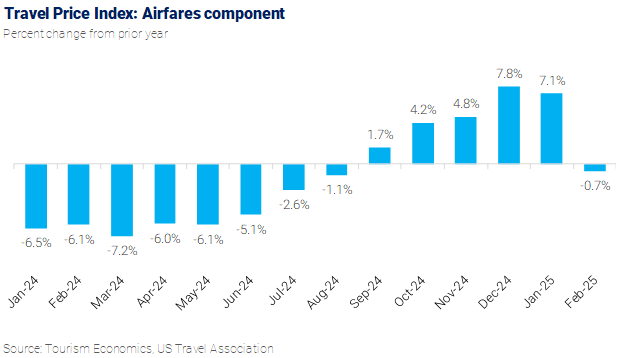

Strong growth in airfares from last October through January contributed to the acceleration in the Travel Price Index. Growth in airfares weakened in February, but higher prices for recreation services and food away from home contributed to the 1.9% increase in February’s TPI.

The current strength of the US dollar compounds higher prices for international travelers, making the US a more expensive destination. The US dollar has further appreciated since the US presidential election, reaching its strongest level in almost 40 years. This makes the US more than 20% more expensive as a destination than the average during the past 15 years, on a tourism-weighted exchange rate basis.

Adding to the concerns about higher prices and a stronger dollar is talk of a ban or significantly restricted travel to the US from a large number of countries. There appear to be roughly 10 countries that will have a full visa ban, including Afghanistan, Cuba, Iran, Libya, North Korea, Somalia, Sudan, Syria, Venezuela, and Yemen.

A second group of countries face partial visa suspensions, affecting tourists, students, and other visas. It will affect five countries, including: Eritrea, Haiti, Laos, Myanmar, and South Sudan. A third group of countries are vulnerable to a partial visa suspension.

These countries do not represent significant volumes of visitors to the US, and security concerns understandably overshadow tourism. Our concern is that the travel bans are layered on top of tariffs, restrictive immigration policies, and political rhetoric, collectively presenting the US as unwelcoming to international visitors. This has the potential to impact international visitation to the US from countries beyond those directly impacted by a ban or other restrictions on travel.

A ban on travel from a similar, albeit smaller group of countries during President Trump’s first term coincided with the US experiencing a loss of global market share and outright declines in arrivals from China, Mexico, and the Middle East during those years. Reports of tourists being detained for days or weeks, including Canadian and German citizens, have contributed to countries issuing updated travel advisories about the US. Some European countries, as well as Canada, are warning their citizens who travel to the United States to strictly follow the country’s entry rules or risk arrest and detention.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.