Monthly Economy and Travel Industry Summary: February 2025

Uncertainty with current economic policies might disrupt travel growth in the U.S.

US Economic Outlook Clouded by Trade Policy Uncertainty

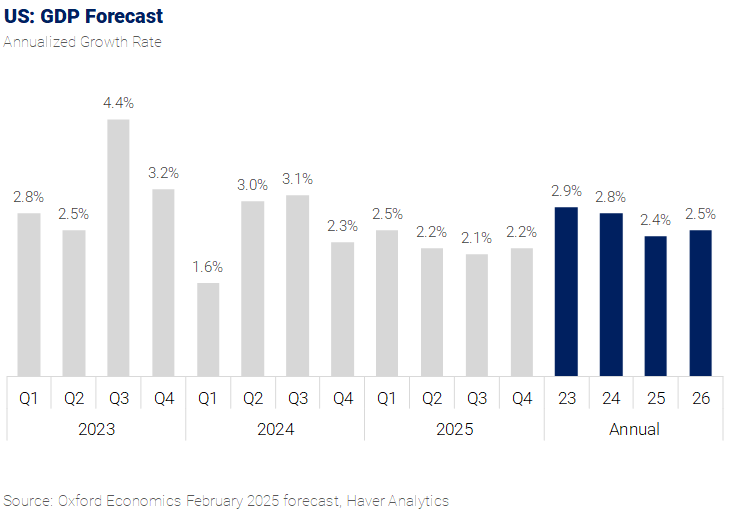

The US economy has demonstrated remarkable resilience over the past couple of years in the face of rapid inflation and high interest rates. Gross domestic product (GDP) rose a healthy 2.9% in 2023 and 2.8% in 2024 despite the Federal Reserve’s interest rate increases, which were employed to slow inflation from a peak of 9% in mid-2022.

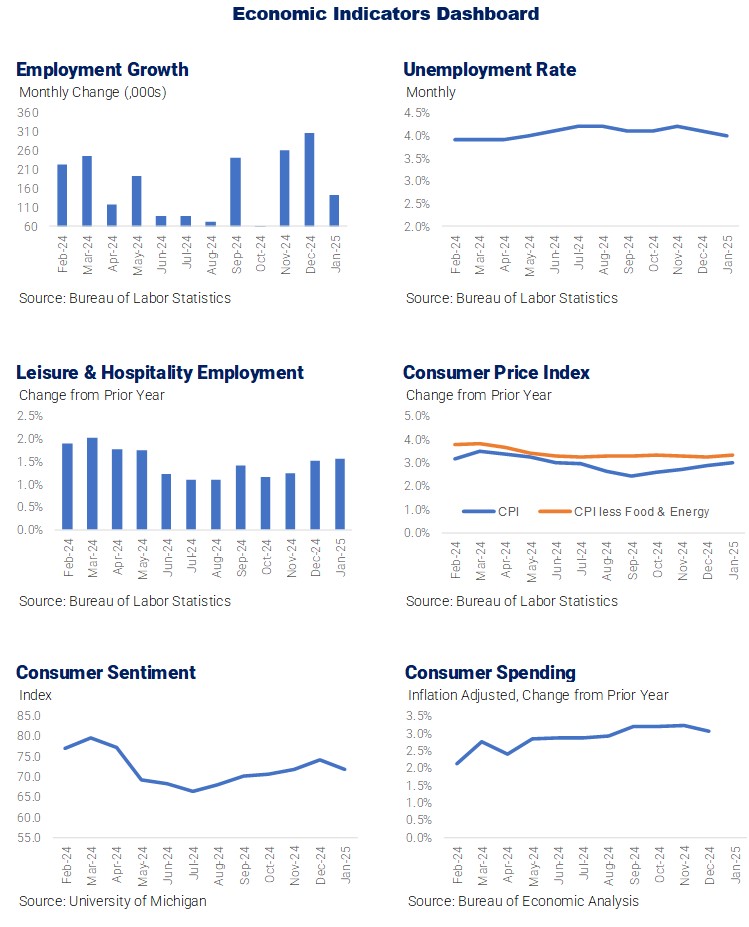

By late 2024 the rate of inflation had fallen below 3%, prompting the Federal Reserve to lower interest rates, the unemployment rate remained at historically low levels near 4%, and growth in real (inflation-adjusted) income contributed to robust consumer spending.

The resilience of the US economy will be tested again in 2025, this time by heightened trade policy uncertainty. In his first month in office, President Trump has imposed additional tariffs on China while pausing the proposed tariffs on Mexico and Canada until early March. Trump has also announced a 25% tariff on steel and aluminum from all countries effective March 4, and plans to add tariffs on imports from Europe, Taiwan, and others, as well as on various critical industries like copper, pharmaceuticals, and semiconductors.

Tariffs and the threat of tariffs carry both direct and indirect economic costs. Tariff threats increase trade policy uncertainty, and history has shown that uncertainty can dampen business investment in non-residential structures and equipment.

Trump’s actions and rhetoric on tariffs have prompted us to move the implementation of tariffs to Q3 this year from Q1 2026. We’ve also added a 10% across-the-board tariff on imports from the EU. The adjustments to our tariff assumptions reduced our US GDP growth forecasts by 0.2ppts to 2.4% in 2025 and by 0.1ppt to 2.5% in 2026.

Progress on the inflation front appeared to stall near the end of 2024, and the spate of tariff announcements has contributed to expectations for higher inflation in 2025. Given that the labor market appears in relatively good shape, higher inflation expectations have likely shifted the Federal Reserve’s focus away from full employment and towards stable prices. As a result, we removed two of the three 25bps rate cuts in our January baseline. After three cuts to the Federal Funds Rate in the last four months of 2024, the Federal Reserve isn’t expected to cut again until December of this year.

Inflation has been particularly strong among essentials (e.g. food, shelter, clothing) which has more significantly impacted middle- and lower-income households. High-income households tend to be insulated from these price gains by budget flexibility and wealth effects from gains in equity and home prices. On the other hand, low and middle-income household budgets remain under financial pressure from past increases in prices for food, rent, transportation, and energy.

Nevertheless, consumer spending is expected to remain the main growth driver in 2025, buoyed by a sturdy job market, rising wages, and rising household wealth. That is largely attributed to the resilience of high-income households, who account for most of the consumption.

The job market has softened but remains healthy overall. The unemployment rate of 4% in January was the lowest since May 2024, and unemployment is expected to remain low this year even though the hiring rate has slowed. Slower labor force growth is expected this year, in part due to tighter restrictions on immigration, and will help keep the unemployment rate low. Weaker labor force growth lowers the bar for the number of jobs the economy needs to create to keep the unemployment rate stable.

However, the low hiring rate is still concerning. It stabilized at 3.4% during the second half of 2024, but a hiring rate at that level has typically been associated with a much higher unemployment rate.

The seeming mismatch between the low hiring rate and the unemployment rate reflects what other labor market indicators have shown for some time – the rise in the unemployment rate has been limited because layoffs remain low. The layoff rate averaged 1.1% in 2024, 0.1ppt below the pre-pandemic average of 1.2%. So, it’s a good time to be employed, but it is harder for those who have lost their jobs to find new work.

Taken as a whole, the picture painted is of a labor market that is better balanced than it has been for some time and is healthy enough to allow the Federal Reserve to keep policy on hold for most of 2025 while it waits for progress on lowering inflation amid much uncertainty about tariffs and fiscal and immigration policies.

The Trump administration’s policies pose risks to our forecast for the labor market in 2025, which calls for job gains to moderate as labor force growth slows. We also assume a modest uptick in the unemployment rate to 4.3% by year-end.

Probably the most salient near-term risk is a reduction in the number of employees due to layoffs of federal workers and the spillover effect on other industries, including contractors and support industries.

While not diminishing the impact of job losses on affected workers, layoffs of federal workers are unlikely to have a substantial negative impact on the broader labor market and the economy. Even under the most extreme scenario, where federal employment is reduced by nearly 400,000 to 2mn – to which we assign a low probability – the impact would be a 0.16ppt increase in the unemployment rate.

On the other hand, restrictive immigration policies represent a downside risk to the unemployment rate, meaning unemployment could fall further. Slower labor force growth due to significantly reduced immigration would put some upward pressure on nominal wage growth and, by extension, inflation. We don’t view this as a significant risk to inflation as long as productivity remains strong. Productivity growth will allow for a tight labor market without being a source of inflation.

US Travel Outlook Faces Risks from Trade Policy

Economic conditions in 2025 are forecast to support continued growth in travel. Growth in consumer spending, supported by low unemployment, rising wages, and rising household wealth, should translate to modest growth in leisure travel in 2025 in the range of 2%. We also expect a continued return of business travel, with 4% growth in 2025.

However, the outlook has substantial risks due to potential policy effects. Tariffs have the potential to damage equity markets and further downgrade the economic outlook.

Perhaps more acutely, isolationist policy, restrictive immigration, and nationalist rhetoric all have the potential to negatively impact inbound travel through direct travel restrictions and shifts in sentiment. This would mirror the effects observed during the first Trump administration, which saw declines in Mexico, China, and the Middle East. The current situation warrants broader concern, including Europe.

Additionally, travel to the US could be negatively impacted by visa impediments, such as reductions in consulate staffing or greater scrutiny of travelers from certain origins. While our December 2024 forecast of inbound travel to the US anticipated growth of 9% in 2025, this combination of factors adds significant downside risk that could delay the US inbound recovery for several years.

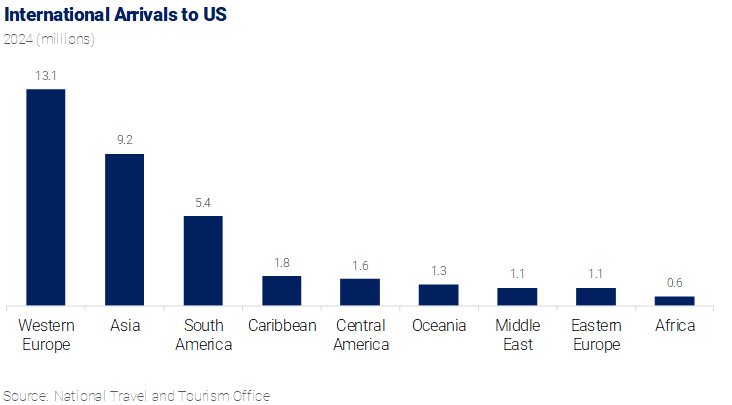

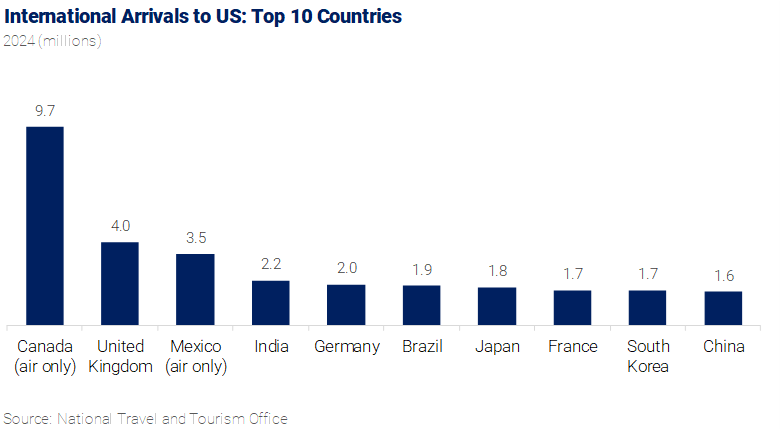

Canada, Mexico, China, and, more recently, Europe have been central to many discussions regarding tariffs. By far the largest source of international visitors to the US, visitors from Western Europe rose 7% in 2024 but were still 10% below 2019’s level. The administration’s tariff threats against Europe and related rhetoric, along with the potential alienation of Europe over Ukraine, represent risks to the leading source of international visitors to the US.

Trade policy poses similar risks to visits from Asia, the second largest source of international travel to the US. Visits from Asia grew a robust 22% in 2024 but remained 25% short of the 2019 benchmark.

Visitation from certain Middle Eastern countries is also at risk, but the potential impact on US cities is more limited due to the smaller size of these origin markets.

Western Europe includes the United Kingdom, the largest origin country outside North America. The next largest origin markets in Western Europe are Germany and France. Asia encompasses four of the ten largest origin countries: India, Japan, South Korea, and China.

In terms of downside risks to international inbound travel, US cities with significant exposure to these origins are likely to feel the greatest impacts.

Seattle, Las Vegas, and Orlando are the US cities with the highest number of Canadian visitors. Conversely, Seattle, Portland, and Jacksonville lead the list of US destinations with the highest share of Canadian visitors relative to their total international arrivals. If travel from Canada were to decline, these cities could potentially experience a pronounced impact.

Canadian Prime Minister Trudeau recently suggested Canadians should reconsider traveling to the US in response to tariff threats and disparaging comments about Canada being the 51st state. Some Canadian travel agents have reported fewer bookings for US travel, suggesting there is a genuine risk to Canadian travel.

Similarly, the US cities with the highest number of Mexican visitors are San Antonio, Los Angeles, and Houston. However, El Paso, San Antonio, and Austin top the list of US destinations based on Mexican visits as a share of the destination’s total international visits.

Los Angeles, New York City, and San Francisco lead the list of US cities with the most Chinese visitors in 2024. Ranked by China’s share of the city’s total international arrivals, Riverside, Indianapolis, and Los Angeles are arguably the most exposed to a downturn in travel from China.

The impact of the President’s policy decisions on travel won’t be known for months as negotiations play out in Washington, DC, and elsewhere. However, President Trump’s first term lends credence to the notion that international travel can be impacted by government policy and rhetoric. The average annual growth in international visitor arrivals slowed from 5% per year in the seven years prior to Trump’s first term to 1% per year from 2017-2019. During those years, the US experienced a loss of global market share and outright declines in arrivals from China, Mexico, and the Middle East.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.