Monthly Economy and Travel Industry Summary: December 2024

Travel continues to trend upwards even with uncertainty ahead.

Federal Reserve Delivers December Rate Cut but Expects Fewer in 2025

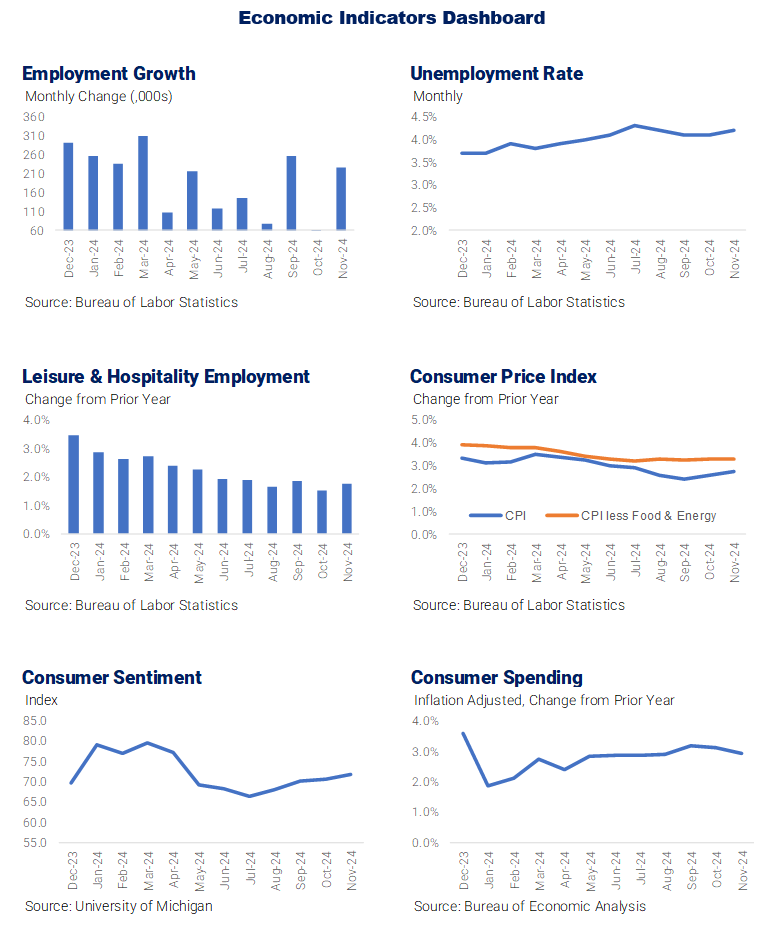

As widely expected, the Federal Reserve cut the federal funds rate by 25 basis points at its meeting in December, the third cut in four months following a 50-basis point reduction in September and a 25-basis point cut in November. However, comments by Federal Reserve Chairperson Jerome Powell indicated the Federal Reserve anticipates just two cuts in 2025.

Several factors argue for a more cautious approach to cutting rates next year, beginning with an economy doing better than the Fed expected. The labor market remains relatively healthy, and consumer spending is strong, thus the need to stimulate activity by lowering rates is not considered urgent. Additionally, some recent inflation data has been more substantial than the Fed would like to see, and there is a high degree of policy uncertainty as a new administration prepares to move into the White House.

Consumers are the engine propelling the economy, and higher-income households are the pistons generating most of its power. Their outsized contribution will likely continue, thanks to a formidable financial cushion buoyed by surging stock prices and housing equity. Moreover, that cushion is undercounted, as the nearly $3 trillion in cryptocurrencies held mainly through wealthy investors are not considered a financial asset by the Federal Reserve.

The consumer’s health was reinforced by a substantial increase in November retail sales, which reflected a decent rise in non-store (i.e., online) sales during the traditional holiday shopping season. The ongoing cleanup from hurricanes Helene and Milton also boosted sales.

Even though job growth is trending lower, a combination of nominal wage gains and slowing inflation translates into solid growth in real disposable incomes. The strong position of household balance sheets and declining interest rates means the US consumer is likely to remain a pillar of strength. We expect consumption growth to be 2.8 percent next year, up from 2.5 percent this year, indicating that consumers’ wallets will likely remain firmly open.

Meanwhile, inflation is proving to be stickier than expected, bolstering the argument that the Fed should pause until there is more evidence the disinflation trend is still unfolding. The headline CPI increased 2.7 percent in November from a year ago, up from 2.6 percent in October, while the core CPI increased 3.3 percent for the third consecutive month.

Some of the sources of inflation in November were consistent with our view that consumers, particularly high-income earners, show no signs of tightening their purse strings. The price pressures were mostly in discretionary items, including motor vehicles, lodging away from home like hotels, and airfares. Some softening in the stickier components of inflation, including shelter, highlighted that the disinflationary trend has room to run.

However, there is some concern about low-income households under financial pressure because of past price increases and the noticeably more modest gain in household wealth. The goods and services that comprise the bulk of lower-income households’ spending basket are still rising. The CPI for energy and tenant rents rose between October and November. Prices of medical care and food purchased for home use also rose faster during the month, which is more meaningful for lower-income households and seniors.

We believe that the disinflation trend has temporarily stalled, not stopped. The road to the 2 percent target is turning out to be bumpier than the Fed would like. Still, rebalancing the labor market, a pickup in productivity, and slower wage growth will take more steam out of inflation in 2025, setting the stage for additional rate cuts. For now, we are maintaining our baseline outlook that the central bank will pause in January and lower rates three times in 2025, although the risk of fewer rate cuts has risen based on Chairman Powell’s recent comments.

Of course, this generally favorable economic outlook assumes external shocks or policy missteps do not derail the economy’s growth engine. These risks can’t be dismissed in a combustible global environment where military conflicts abound and political upheavals, most recently in Syria, threaten alliances, which, along with unforeseen climatic events, can once again disrupt supply chains. Fortunately, the U.S. economy has so far weathered these external shocks, further displaying the resilience it has long exhibited.

In addition to these external shocks, much attention is focused on policymakers’ decisions, which can make or break promising economic expectations. The policy decisions of President-elect Trump will remain a work in progress for months to come as the incoming administration provides details of its plans for tariffs, taxes, and deportation and to what extent they will be implemented.

Yet, despite misgivings over the potential adverse effects of higher tariffs, household and business confidence has improved significantly since the election. While the link between confidence and behavior is not particularly tight, improving mindset does impart an upward bias to hiring, business investment, and consumer spending in the coming months. We expect the economy to turn into another solid performance in the current quarter, with real GDP slowing only modestly from the robust 3.1 percent growth rate in the third quarter and remaining on an above-trend growth path throughout 2025.

Thanksgiving Brings Busiest Day Ever in U.S. Airports

Passenger traffic in U.S. airports continues to set records in 2024. Daily passenger volume through TSA checkpoints in U.S. airports exceeded 3 million for just the second time ever on December 1, the Sunday after Thanksgiving, setting a record for the busiest day ever. The previous busiest day ever, and the first day to exceed 3 million passengers through TSA checkpoints, was July 7th, the Sunday after the July 4th holiday.

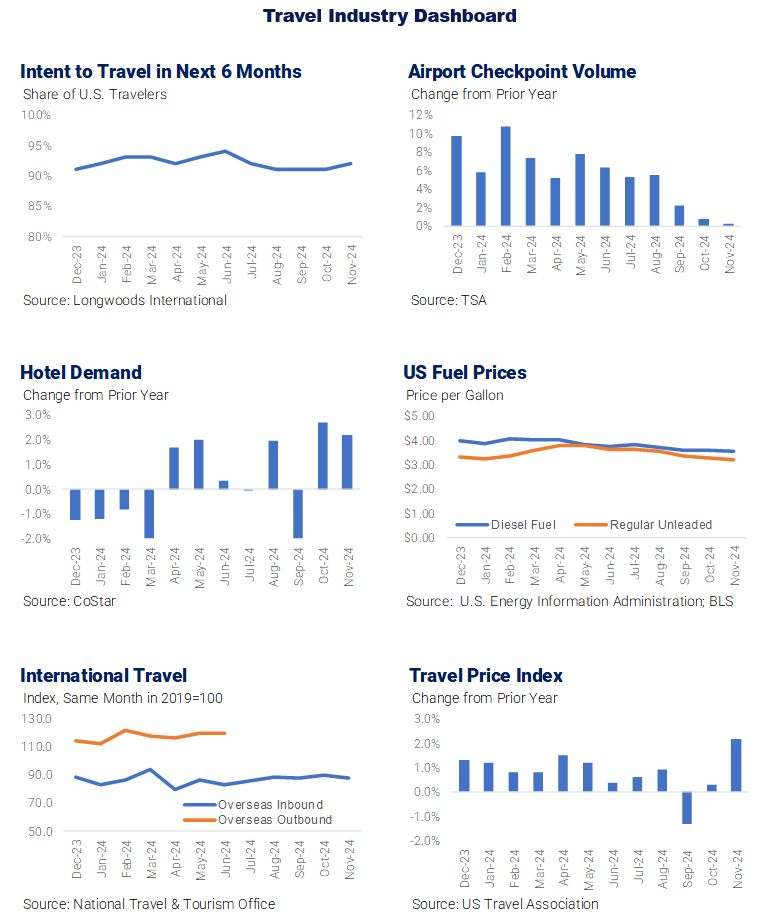

TSA checkpoint volume in U.S. airports set monthly highs from February through November, but the growth rate has slowed recently. The TSA checkpoint volume in November was just 0.2 percent higher than last year’s, and October’s checkpoint volume was 0.8 percent above the prior year’s level. In contrast, checkpoint volume rose more than 5 percent every month from January through August.

The slower growth in recent months is largely attributable to the tough comparisons against record volumes in the same months last year.

Additionally, airfares have begun to climb in recent months and could have some effect on passenger volumes. The airfare component of the U.S. Travel Association’s Travel Price Index declined every month from April 2023 through August 2024. Airfares have risen in the past three months, including a 4.7 percent year-over-year increase in November that lifted the Travel Price Index by 2.2 percent, the most significant year-over-year increase in the index in more than a year.

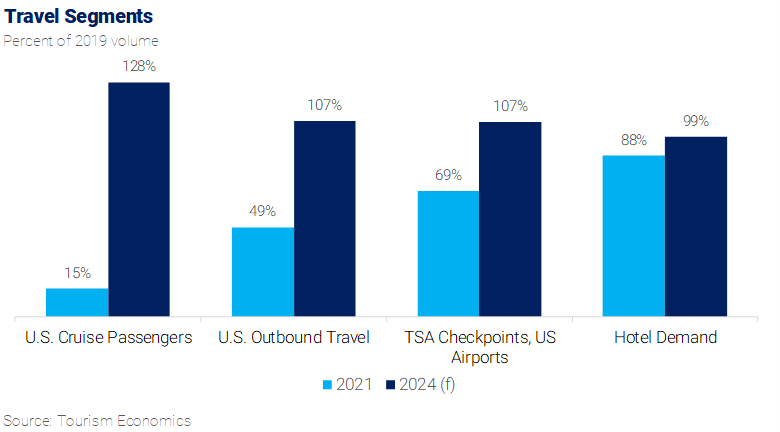

The cruise industry is another travel sector that is performing exceptionally well. U.S. cruise passenger volume surpassed pre-pandemic levels in 2023, as did TSA checkpoint volume, and has experienced robust growth throughout 2024.

U.S. cruise passenger volume is on pace to exceed 18 million in 2024, an 8 percent increase from 2023 and 28 percent above 2019’s pre-pandemic baseline of 14.2 million.

The introduction of newly built and feature-rich mega-vessels, ships with a capacity for more than 4,500 passengers, primarily on Caribbean cruise itineraries, has contributed to the strong growth.

Moreover, as cruise ships get larger, shorter itineraries are growing in popularity. This allows for more frequent sailing, generating a higher number of cruisers.

The cruise industry’s record performance in 2024 is all the more remarkable, considering how severely the pandemic impacted the industry. U.S. cruise passenger volume in 2021 was just 15 percent of 2019, far lower than other travel indicators, including TSA checkpoint volume and hotel demand. However, in 2024, the cruise industry will be farther ahead of its pre-pandemic baseline than other segments.

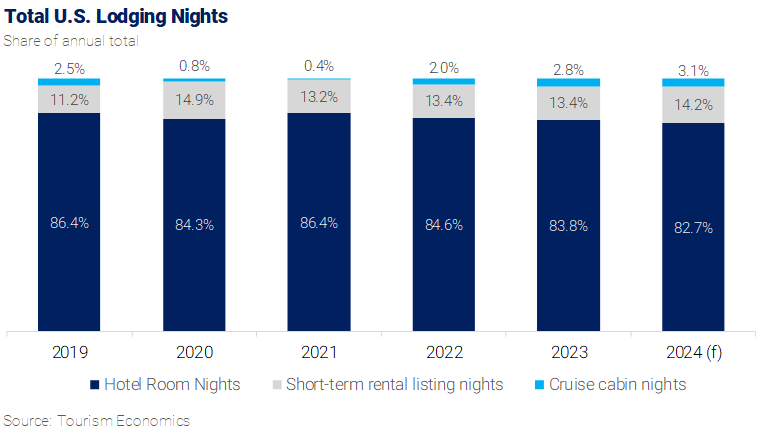

While the cruise industry, TSA checkpoint volume, and international travel by U.S. residents have surpassed pre-pandemic levels, the number of U.S. hotel rooms sold in 2024 is still about 1 percent below the 2019 benchmark. As a result of the slow recovery in hotel demand, hotels are losing a share of total U.S. lodging demand.

U.S. lodging demand is the sum of sold U.S. hotel room nights, booked U.S. short-term rental listing nights on Airbnb and VRBO, and estimated cabin nights sold on cruises that embark from U.S. ports.

With the help of substantial gains in short-term rental and cruise demand, total U.S. lodging demand fully recovered to its 2019 levels in 2023. This aligns with air travel, measured by TSA throughputs, which fully recovered in 2023.

U.S. hotel demand has “nearly recovered” to its pre-pandemic levels since 2022, when it fell three percentage points short. Despite strengthening business, international, and leisure demand primarily toward large urban centers in 2024, hotel demand has still not fully recovered. Furthermore, the recovery has been far from even. Economy hotel demand has declined for much of 2023 and 2024. In contrast, the demand for luxury hotels has fully recovered with continued healthy growth.

Conversely, the cruise industry’s remarkable growth since 2022 has increased its share of total U.S. lodging demand from 2.5 percent in 2019 to 2.8 percent in 2023 and is forecast to reach 3.1 percent in 2024.

Although short-term rentals’ share of total U.S. lodging demand has retreated from its peak in 2020 during the pandemic, the industry’s share remains above its pre-pandemic benchmark.

In 2024, U.S.-based cruises will add more incremental demand than US hotels. Sold cabin nights on U.S.-based cruises are expected to grow by 5.4M cabin nights in 2024, while U.S. hotel demand is forecast to grow by 4.4M room nights. Based on cruise lines’ scheduled itineraries for next year, there is little reason to doubt the industry will experience another strong year in 2025.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.