Declining Trend in Bus and Bus Passenger Border Crossings Since 2019

Cross-border bus travel still lags behind 2019

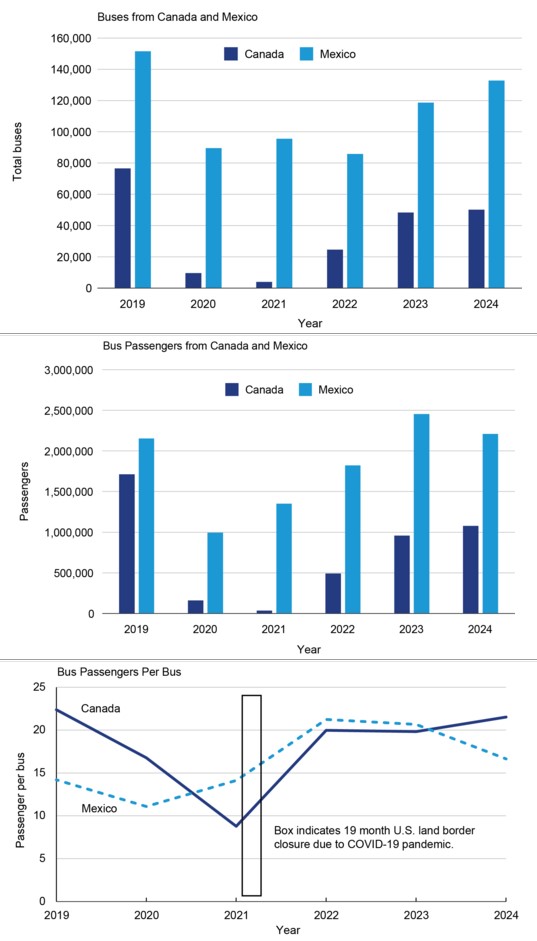

Between 2019 and 2024, cross-border bus traffic into the United States declined sharply, according to new data from the U.S. Bureau of Transportation Statistics (BTS). Bus entries from Canada dropped by 34.5 percent, while entries from Mexico fell by 12.4 percent. These declines indicate broader shifts in international mobility and transportation habits in the wake of the COVID-19 pandemic and ongoing changes in cross-border travel demand.

Passenger volume mirrored this decline. While overall individual crossings into the U.S. from Canada and Mexico were down 13.5 percent and 0.7 percent, respectively, those traveling by bus decreased at an even higher rate. This suggests that bus travel, which serves both tourism and essential mobility needs, experienced a slower recovery compared to other transportation modes like personal vehicles and air travel.

Much of this shift began in 2020, when pandemic-related travel bans and border restrictions nearly halted cross-border bus service altogether. While other sectors of the transportation industry started to rebound in 2022 and 2023, bus travel from Canada remained substantially below pre-pandemic levels through 2024. Routes from Mexico saw a somewhat more substantial return, though they too have yet to recover fully.

According to BTS, the slow rebound may be attributed to several lingering factors, including traveler hesitancy, workforce disruptions in the transportation sector, changes in immigration and visa policies, and an overall decline in cross-border commuter patterns. Additionally, some travelers who previously relied on buses may now opt for private vehicles or flights, either due to convenience or a perceived increase in safety.

In 2024, Texas led the nation in bus passenger border entries, receiving nearly 1.58 million passengers. New York followed with about 476,000, and California saw around 403,000. Other significant entry points included Washington, Michigan, Vermont, New Mexico, and North Dakota, underscoring the geographic diversity of cross-border bus travel.

These trends have broad implications. For transportation providers, lower ridership translates to reduced revenue and tighter margins. For policymakers, the data calls for a re-evaluation of infrastructure investment and the need to support cross-border services through modernization and targeted incentives.

As of mid-2025, recovery remains uneven. Stakeholders are encouraged to monitor these trends closely and explore strategies to restore demand. This could include improved scheduling, marketing campaigns aimed at cross-border tourism, or streamlined border processing for motorcoach passengers. With strategic planning and support, the industry may begin to rebuild the robust network of international bus routes that once played a vital role in North American mobility.