Monthly Economy & Travel Industry Summary: December 2025

While the year ended on stable footing in the economy, the coming year looks to be defined as one with more challenges for the travel industry

At a Glance: 2026 To Be Characterized by Jobless Growth

- Recent data releases show the economy is ending 2025 on stable footing.

- Consumer spending remains solid, although the consumer is divided, with high-income consumers leading the increase in real spending.

- Key themes for 2026 include jobless growth, a bifurcated economy, and the Federal Reserve pausing.

The Details

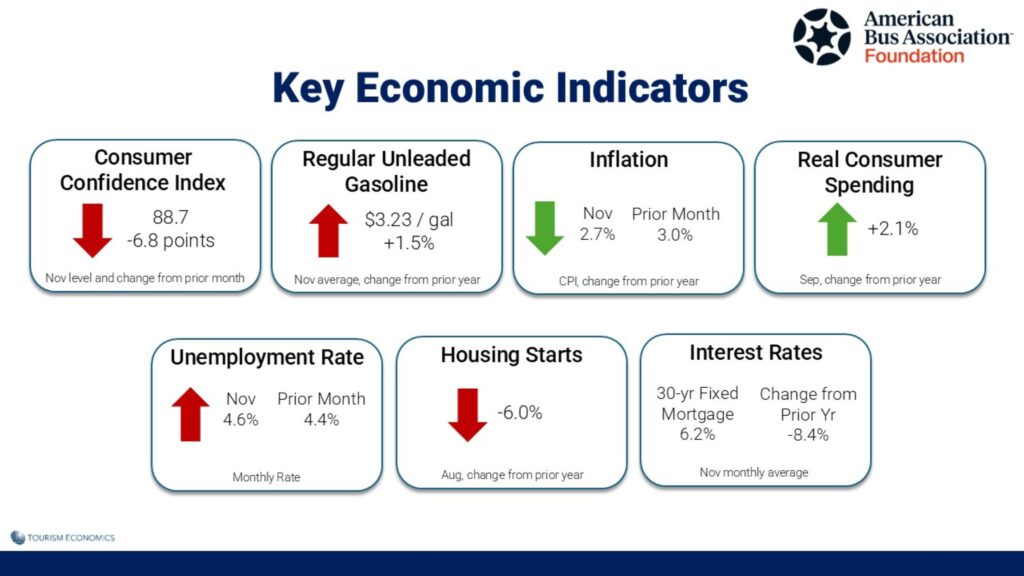

The jobs data for October and November, released simultaneously due to reporting delays caused by the government shutdown, was a touch stronger than expected after factoring out job losses related to federal worker resignations. Against that backdrop, and barring a significant weakening of labor market conditions, we anticipate the Federal Reserve will keep interest rates on hold until mid-2026 following the December 2025 rate cut.

The jobs report showed a loss of 105,000 jobs in October, but this was attributable to federal employment plunging by 162,000 workers as the impact of the Trump administration’s deferred resignation offer from earlier this year began to materialize. Federal employment declined by another 6,000 workers in November.

Private sector employment, a better barometer of underlying labor market conditions, rose by 69,000 in November and 52,000 in October, pushing the three-month moving average of private sector job gains to 75,000. That is well above the break-even rate of job growth, the number of jobs that need to be created each month to keep the unemployment rate steady.

The unemployment rate rose to 4.6% in November but the drivers of the rise in the unemployment rate were not overly worrisome. Growth in the labor force and a rise in workers on temporary layoff were the largest contributors, while permanent layoffs remain low.

A report on October retail sales indicated that spending remains solid. Though headline retail sales were unchanged in October, that was entirely due to a drop in vehicle sales following the expiration of the EV tax credit. Excluding autos, sales posted a strong gain.

The strength of underlying retail sales in October is consistent with the resilience of private payroll growth, which continued through to November, as well as the ongoing boost to spending among older, wealthier households driven by the positive wealth effect from a buoyant stock market. Those stock gains are concentrated among the top 20% of households by income, but they represent 40% of total spending across the economy, and an even higher share in the most discretionary spending categories.

Resilient consumer spending prompted us to raise our forecast for US real GDP growth in 2026 by 0.1ppt to 2.5%. Though consumer fundamentals have softened this year, with job gains slowing sharply and elevated inflation eating into real wage gains, we expect both headwinds to fade slightly next year.

Real disposable income growth will benefit from inflation moderating more quickly in 2026 than we previously thought. The forecast for the headline consumer price index was revised lower for next year as we incorporated new projections for global oil prices, but inflation will remain above the Fed’s 2% target.

Looking ahead to 2026, key themes we will be watching include the economy remaining bifurcated while flirting with a jobless expansion, and the Federal Reserve delaying the next rate cut until mid-year.

Jobless growth. Next year will be another decent year for those employed, as we expect layoffs to remain low and real wage growth to improve. It’ll be another challenging year for the unemployed or those not in the labor force but looking to enter it. The hiring rate will remain low, contributing to longer unemployment durations and no improvement in the odds of exiting unemployment.

The slow pace of hiring has the economy on track for a jobless expansion in which GDP increases but employment gains are modest, at best. Conditions contributing to a jobless expansion include over-hiring in the post-pandemic years, robust productivity growth, technological advancements, and increased policy uncertainty.

We forecast nonfarm employment will rise by an average of 30,000 per month, which we estimate to be in line with the break-even rate, or the number of jobs needed to keep the unemployment rate stable.

The economy can grow without creating many jobs if productivity growth translates into real wages and, consequently, increases in real disposable income. Real disposable income drives consumer spending, which helps sustain economic growth even as hiring remains slow.

A bifurcated economy. Large businesses have weathered tariffs better and have outperformed small ones. Employment among small businesses, the backbone of the labor market, has barely budged and fundamentals remain unfavorable, reinforcing recent labor market weakness.

The consumer will also remain divided next year. High-income consumers are doing well while lower-income households are struggling. The net impact of tariffs and fiscal policy will reduce the real disposable income of the lowest-income quintiles while boosting the incomes of the highest-income quintiles.

Consumer spending will get a temporary boost from retroactive individual tax cuts in the OBBBA since the start of 2025. The majority of these benefits will be reflected in tax filings in 2026, leading to lower final tax bills or larger refunds. This will partially aid low-income households’ discretionary spending, but a good chunk will go toward higher-income households because of the federal increase in the state and local tax deduction.

The Fed could pause for an extended period. The challenge facing the Fed is the potential jobless expansion, when GDP increases but employment gains are modest. Rate cuts are unlikely to significantly boost the hiring rate, as monetary policy can’t solve many of the issues that have constrained hiring, such as previous over-hiring, productivity growth, and trade and immigration policy.

Meanwhile, inflation is above its target and trade policy remains shrouded in uncertainty. Therefore, we expect the Fed to pause until mid-2026 to allow the recent federal funds rate cuts to feed through to the economy.

At a Glance: The Travel Industry’s Resilience Displayed in 2025

- Domestic trips rose in 2025 despite economic headwinds.

- Cruises, short-term rentals, and international trips by US residents were among the best-performing travel segments.

- International arrivals to the US are expected to rebound in 2026 but face challenges.

The Details

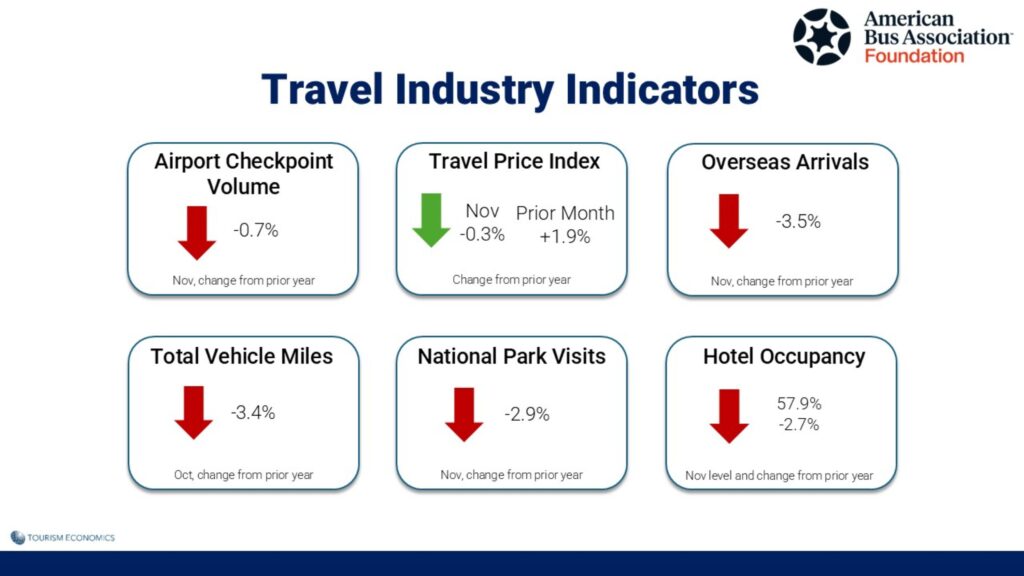

The travel industry demonstrated an encouraging degree of resilience in 2025. Despite a weakening labor market, falling consumer confidence, and rising inflation, total domestic trips are projected to have risen 1.8% in 2025. This stands in stark contrast to international visits to the US, which are on pace to decline about 6% in 2025.

Some travel segments notably outperformed the overall industry. Cruise passenger volume is estimated to have risen 9% in 2025, and short-term rental demand rose 5%. Both segments have pulled share of overnight demand away from hotels, contributing to a slight decline (-0.4%) in hotel demand in 2025.

The downturn in international visitors has also been a drag on the hotel industry, but international visits are projected to rebound in 2026. International arrivals are forecast to rise 3.7% next year, with almost one-third of the gain attributable to next summer’s FIFA World Cup tournament jointly held in the US, Canada, and Mexico (1.1 percentage point impact).

An interesting trend in 2025 was the contrasting performance between airline travel and hotel demand. Air passenger volume, measured by the number of people screened at TSA checkpoints in US airports, rose about 0.5%, while hotel demand declined about 0.5%. Air travel is running nearly 7% above the pre-pandemic (2019) benchmark, while hotel demand has yet to fully recover to pre-pandemic levels.

Both segments, air travel and hotels, were impacted by the drop in international visits. While cruising and short-term rentals eroded some of the hotel industry’s share of overnight stays, air travel still benefited to the extent that travelers flew to their cruise port or destination.

Hotel demand in 2025 remained bifurcated between the upper and lower hotel classes. Through November, demand in Luxury hotels was up 2.8% while demand was falling in the Midscale (-1.1%) and Economy (-3.0%) hotel segments.

This split between demand growth at high-end hotels and weakness at lower-end hotels has been in place since 2023 and mirrors broader economic trends. The post-pandemic surge in inflation was particularly impactful for low-to-middle-income households, and strong growth in rents during those years put significant pressure on the budgets of renters. Although the rate of inflation has slowed from the 9% peak in mid-2022, the level of prices remains high and discretionary spending of middle and low-income households has not fully rebounded.

Higher-income households tend to be homeowners rather than renters, so rising rents were not a factor. These households also tend to have a financial cushion to absorb periods of high inflation. As a result, travel segments that skew towards higher-income households, such as cruises and luxury hotels, have performed the best over the past year.

Outbound international travel is another segment that tends to attract higher-income households, and it has performed extremely well in recent years. Outbound trips by US residents rose 9% in 2024 and were up 4% through three quarters of 2025.

Many of these trends are likely to continue in 2026. Hotel demand is forecast to rise modestly, about 0.5%, and higher-end hotels are again expected to outperform the overall industry. The cruise industry is expected to have another good year, with U.S. cruise passenger volume rising 4% to 5% in 2026.

A return to growth in international visitors is perhaps the most anticipated trend in 2026, but also the one with the most significant downside risks. Lingering negative sentiment over the administration’s international trade policies represents a potential headwind, as do the costs, timing, and complexities of obtaining a visa. The expansion in December of the administration’s travel restrictions to an additional 20 countries and the Palestinian Authority also risks undermining the recovery. While the volume of travel from affected countries is low, the perception that visitors are unwelcome could deter travelers from other origins.

Additionally, the administration announced plans to require millions of foreign visitors to provide their social media handles from the past five years. The proposed change, announced in a U.S. government notice in early December and expected to take effect on February 8, would require travelers from countries in the visa waiver program to submit their social media data. Under the new policy, the U.S. would also require telephone numbers used in the last five years, email addresses used in the last 10 years, and names, birth dates, place of birth, and residences of family members (parents, spouse, siblings, and children). The government notice (US CBP Notice Dec 10 2025) is open for public comment for 60 days.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.