Monthly Economy & Travel Industry Summary: September 2025

The Federal Reserve follows through with rate cuts; hotel demand continues to sag

At a glance: Federal Reserve Follows Through with September Rate Cut

- Federal Reserve lowered interest rates by 25bps at its September policy meeting.

- Strong retail sales growth in August suggests aggregate spending is back on track following a weak first half of the year.

- Inflation ticked up in August, and rising import prices could be evidence that exporters are no longer absorbing the cost of tariffs in their margins.

The Details

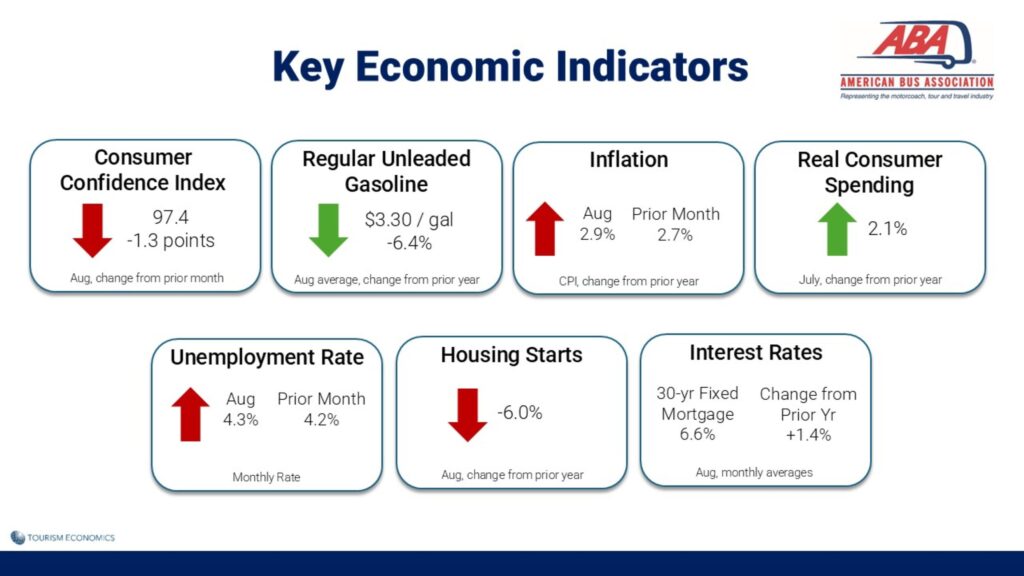

As anticipated in last month’s economic summary, the Federal Reserve lowered interest rates by 25bps at its September policy meeting. The central bank is increasingly attuned to the downside risks to the labor market, and the decision to cut rates at the Federal Reserve’s October meeting will hinge on the September employment situation.

For the Fed to cut again in October, there will need to be a clear indication that the trend in employment is worsening. Although we don’t believe the labor market is cracking, there are areas of concern. The jobless rate rose in August, driven by new entrants. The duration of unemployment is rising, as is the number of people working part-time for economic reasons. Although the number of people on permanent layoffs has been growing, the increase in the prime-age employment-to-population ratio is encouraging.

In short, the labor market remains in a state of slow hiring and slow firing, and the August unemployment rate of 4.3% remains low by historical standards.

Despite the very slow rate of hiring, a more pronounced rise in the unemployment rate is being prevented by slowing growth in the labor supply. The break-even rate of employment growth, or the pace of job growth required to maintain a stable unemployment rate, has fallen to approximately 50,000 per month.

This unusually low threshold for job growth can be attributed to a slowdown in labor supply growth. The economy needs to create fewer jobs when fewer people are entering the workforce. Baby boomers leaving the labor force for retirement, and a sharp slowdown in labor supply growth from immigration, are constraining growth in the labor supply.

Concerns about the labor market persist, weighing on consumer confidence. The Conference Board Consumer Confidence Index fell by 1.3 points in August to 97.4 (1985=100). Notably, consumer perceptions of current job availability fell for the eighth consecutive month.

The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell by 1.6 points to 131.2. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—decreased by 1.2 points to 74.8. Expectations remained below the threshold of 80, which typically signals a recession ahead.

Despite eroding consumer confidence, recent economic data has largely painted a stronger near-term picture than widely anticipated.

Following declines in the spring, retail sales have risen strongly over the past three months. August retail sales soundly beat expectations, rising 0.6% month-over-month. Non-store (i.e., online) sales propelled spending last month, but discretionary categories, including recreation retailers and food services, also boasted solid gains.

The retail sales figures suggest aggregate spending is now back on track following a weak first half of the year, but we think much of that strength has been concentrated among higher-income households, who are responsible for most spending. Spending among low-income consumers is still under pressure from a weakening labor market and a policy mix that is weighing on real disposable incomes. We expect this dynamic to persist in 2026, even as overall spending remains stable.

Moreover, consumer spending is expected to receive a fiscal boost in early 2026 as taxpayers receive larger-than-average refunds due to the new individual income tax cuts enacted in the Republican fiscal package this summer.

Import prices increased in August, driven entirely by a rise in nonfuel prices. The import price data support our expectations for pressure on consumer prices to accelerate in the months ahead. Higher capital goods prices may reflect ongoing heightened demand for AI-related investment in equipment and software, while a rise in consumer goods prices could be evidence that exporters are no longer absorbing the cost of tariffs in their margins.

Importers are also contending with a weaker dollar, after it depreciated by roughly 7% between January and July, which renders foreign goods relatively more expensive. While the dollar index has steadied over the last couple of months, we expect the weakening in the dollar that occurred through July will push import prices higher in the near term.

At a glance: Airport Volume Rebounding, but Hotel Demand Isn’t

- Airport volumes have risen in the past two months.

- Hotel demand has fallen for three consecutive months and four of the past five months.

The Details

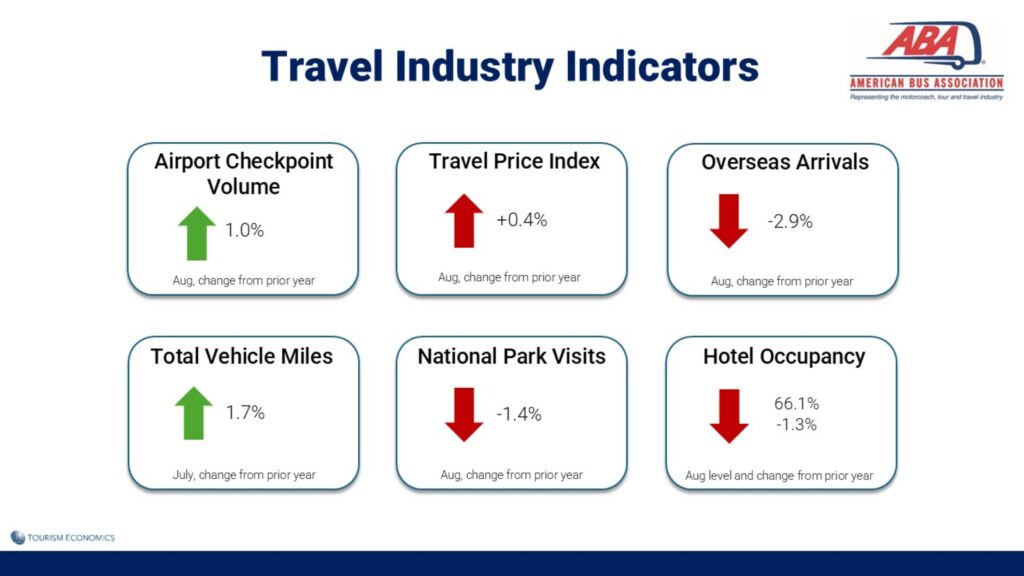

Airport volumes, measured by the number of people passing through TSA security checkpoints in US airports, have rebounded following a lull in the spring and early summer months. Checkpoint volume rose 1.1% in July and 1.0% in August, and year-to-date volume is nearly on par with last year (-0.2%).

Furthermore, some airlines cited improved booking trends during recent earnings calls. American Airlines reported that bookings started to firm around the July 4th weekend, and added that September was better than August, and October is going to be better than September. United Airlines likened the improvement in bookings to a “light switch” in late July and early August, noting it was across segments and industries.

On the other hand, hotel demand has not demonstrated the same improvement in recent months. Hotel demand has lagged prior year levels for three straight months and four of the past five months.

There is a sizeable variance in hotel performance between the two ends of the hotel spectrum. Demand in Luxury hotels was up 5.1% year-to-date through August, while demand in Economy and Independent properties was down 1.8% and 2.6%, respectively.

Strong demand growth tends to support pricing power, and year-to-date growth in Luxury hotels’ average daily rate (ADR) is +5.0% versus industry-wide ADR growth of 1.0%. The bifurcation in hotel performance mirrors that seen in consumer spending, where the strength has been concentrated among higher-income households while low- and moderate-income households are in weaker shape.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.