Monthly Economy & Travel Industry Summary: July 2025

Tariff impact begins to show as travel sees broad-based slowdown across the industry

At a Glance: Impact of Tariffs on Inflation Becoming Evident

- Inflation data for June indicates tariffs are beginning to rear their ugly head.

- The unemployment rate ticked down in June, but there were some elements of softness beneath the better-than-expected headline number.

- Passage of the One Big Beautiful Bill Act is expected to boost economic growth modestly in 2025 and 2026.

The Details

As with any tax, the person legally responsible for paying the tax, US importers in the case of import tariffs, is not always the same as who actually bears the burden of the tax. Tariffs could be paid by foreign producers by reducing their prices, by US firms through reduced margins, or by US consumers in the form of higher prices.

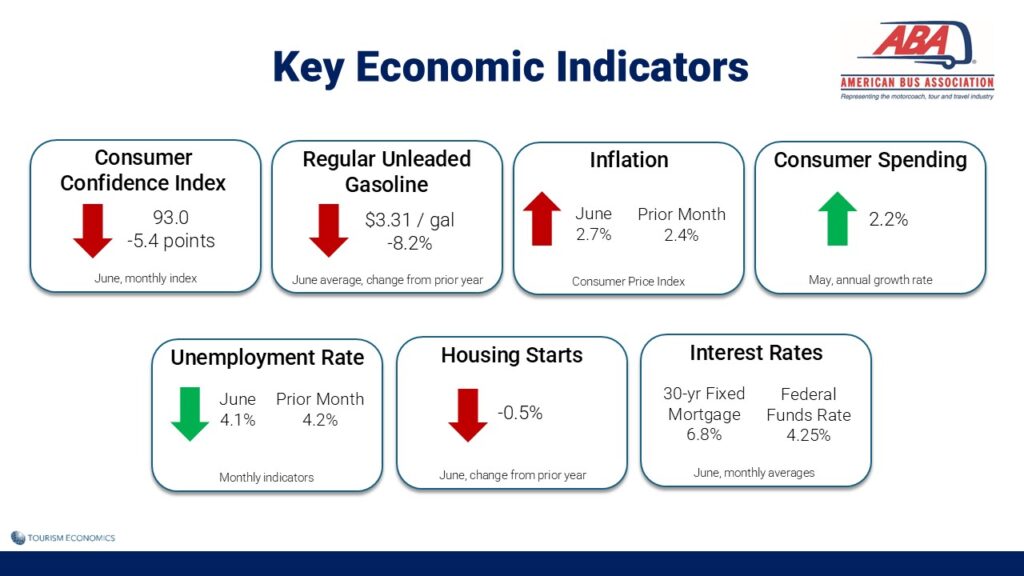

While foreign firms initially absorbed some of the tariffs, the June inflation data showed that more tariffs are being passed onto consumers. Growth in the Consumer Price Index (CPI) accelerated from 2.4% in May to 2.7% in June, and the impact of tariffs was evident in the details. The data showed stronger increases in tariff-exposed goods such as household appliances, apparel, and toys, indicating that consumers are beginning to bear more of the costs of tariffs.

There is a lag between changes in tariffs and when the impact on inflation is evident. Therefore, we anticipate growth in consumer prices to accelerate through this summer and into the fall, and those increases would be exacerbated if threatened additional tariffs become a reality.

Concern about tariffs was a key reason the Conference Board’s Consumer Confidence Index declined from 98.4 in May to 93.0 in June. However, a preliminary reading of the University of Michigan’s Consumer Sentiment Index for July suggests consumers were feeling more optimistic in recent weeks.

Consumers had a lot to feel better about in July, as equity markets continued to post strong gains, the unemployment rate dipped to 4.1%, and gas prices remained low and stable.

However, the preliminary results also showed sentiment declined for those in the lowest income bracket. Unlike those in high- and middle-income brackets, low-income households are not expected to benefit from gains in equity markets and will be the first to feel the impact of tariffs on their budgets.

Recent tariff pauses also helped sentiment begin to rebound, but downward pressure on sentiment could resume if new tariffs take effect.

The stock market shrugged off the recent tariff announcements as the most punitive tariffs are on countries that account for a low share of US imports, and lingering hopes that tariffs won’t be as inflationary as initially feared.

But evidence is mounting that tariffs are boosting prices of tariff-exposed consumer goods, and more is on the way because of lags between the implementation of tariffs and pass-through to consumers. Financial markets are sensitive to new data on inflation, and one surprisingly strong inflation report could rattle markets with knock-on effects to consumer confidence.

Additionally, the strong market reaction to previous tariff announcements was credited with encouraging the administration to back off its most extreme positions. A lack of reaction in financial markets could embolden the administration to move forward with even higher tariffs.

The weakness in consumer confidence has yet to translate into a significant slowdown in consumer spending. Earnings continued to grow faster than inflation in June, and this growth in real (inflation-adjusted) income is expected to support modest growth in consumer spending this year.

The growth in wages stems from a solid labor market, with the unemployment rate sliding from 4.2% in May to 4.1% in June, although a closer look reveals some softness beneath the positive headline. The private sector added significantly fewer jobs in June than in May, and the June increase in payrolls was narrowly based, with healthcare and leisure and hospitality explaining almost all the gains.

We still expect the unemployment rate to creep higher over the second half of 2025, peaking at 4.4% in Q4. Slower growth in the labor supply, due to an aging population and a sharp fall in immigration, will prevent the unemployment rate from rising further even as hiring remains subdued.

We’ve nudged up our US GDP growth forecasts by 0.1 percentage point to 1.6% in 2025 and 0.3 percentage points to 2.1% in 2026 based on the stimulus aspects of the One Big Beautiful Bill Act that was passed in July. Faster economic growth in 2026 will be supported by fiscal stimulus, less policy uncertainty, and support from AI-related business investment.

Nevertheless, the economy remains vulnerable and has little margin for error. New country and sector-specific tariffs would add further weakness to the economy, as core inflation would be pushed higher, and real disposable income and consumer demand would take a further hit.

At a Glance: Summer Travel Falling Short of Last Year

- Travel indicators show a broad-based slowdown across the travel industry.

- International arrivals are experiencing the most pronounced slowdown.

- Falling prices for airfares and fuel are contributing to lower travel prices.

The Details

Key economic indicators continue to paint a picture of a slowing but resilient economy, but travel indicators show a much more pronounced slowdown.

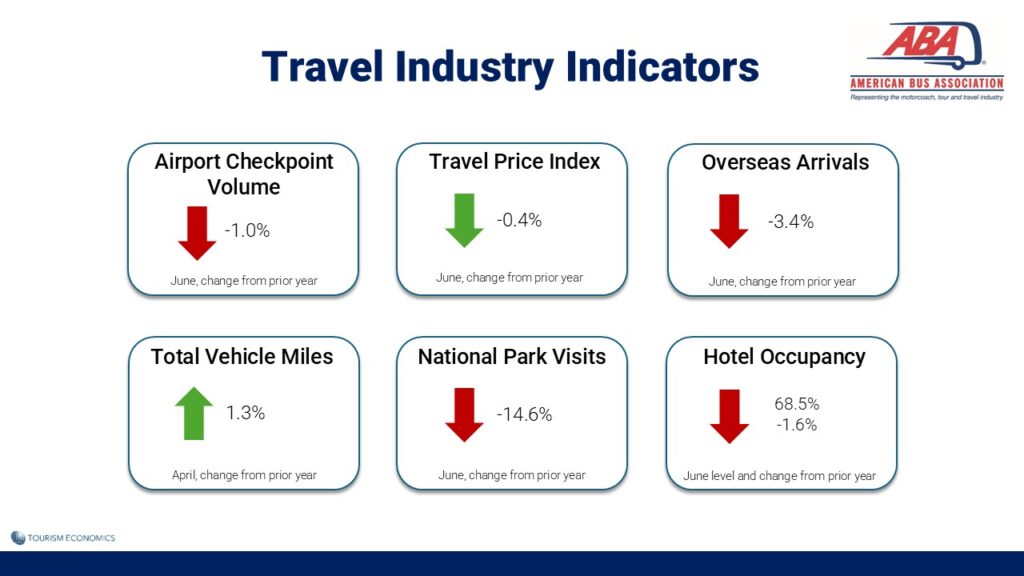

TSA checkpoint volume has plateaued in 2025 after setting a record in 2024 as the busiest year ever. The combined volume in March and April, which accounts for shifts in Easter, was flat compared to the same period last year. Declines in May (-1.7%) and June (-1.0%) undoubtedly reflect a softening travel environment, particularly for international inbound arrivals. Year to date through June, checkpoint screenings were down 0.7% versus the first half of last year,

The average hotel occupancy rate in June was 1.6% lower than in the same month last year, marking the fourth consecutive month that hotel occupancy lagged behind prior-year levels. Hotel occupancy was down 0.6% through the first half of the year, as supply growth of 0.7% exceeded the slight 0.1% increase in hotel demand.

Weekdays and weekends serve as a reliable proxy for business and leisure travel trends, respectively. Weekdays have consistently underperformed relative to weekends over the past two months, suggesting a weak business travel environment.

The hotel data also reflects a gap in performance between high-end and economy hotels. Hotel demand in Luxury hotels was up 5.2% through June, while demand in Economy hotels was down 2.3%. Hotel rates tell a similar story. The average daily rate (ADR) in Luxury hotels was up 5.5% in the first half of the year, and ADR in Upper Upscale hotels rose 1.5%. Conversely, the remaining hotel segments experienced ADR growth of 0.6% or less.

Total vehicle miles traveled remains a positive indicator amidst the signs of softening. While TSA checkpoint volume is indicative of fewer air passengers, growth in vehicle miles traveled could suggest some travelers are substituting a road trip for air travel. Hotel data adds some credence to this, with hotel demand at airport locations down 0.7% through June while demand in interstate locations was up 0.7%.

The weakening travel landscape is likely eroding pricing power in the industry. As a result, the Travel Price Index, a measure of price growth within the travel industry, declined in June. The average hotel rate increased just 0.4% in June, while motor fuel and airline fares were lower than last year.

The TPI has declined for four consecutive months, with transportation prices being the primary contributors, including motor fuel, airfares, and intercity transportation. Conversely, the most substantial price increases have been in recreation services and food away from home.

International travel to the US remains a weak spot. Overseas (excluding Canada and Mexico) arrivals declined 3.4% in June, a further erosion from the 2.8% decline in May. Overseas arrivals were down 1.2% through the first half of the year.

The decline in US inbound arrivals during the first half of 2025 is the apparent negative consequence of a mix of Trump administration policies and statements that have shifted sentiment and raised concerns among many potential travelers. For example, adversarial trade negotiations, statements challenging national sovereignty, and immigration and border security measures have garnered media attention and prompted travel warnings from origin countries. The recent announcement of a travel ban is expected to have a limited impact, given the small volume of existing travel from covered markets. However, it is likely to contribute to the perception of the U.S. as a less predictable and welcoming destination.

Nowhere has the shift in sentiment been more pronounced than in Canada, evidenced by a 23.7% decline in visits to the United States from Canada in the first half of the year. This is largely attributable to a 28.0% drop in land visits, while declines in arrivals by air have been less severe (-13.3%). June represented the fourth consecutive month that land arrivals contracted by more than 30%.

Weak booking data for the remainder of the summer season supports the view that international arrivals will continue to decline. We project inbound international arrivals to the US will fall 8.2% in 2025, led by a 20.2% decline in visits from Canada. Arrivals from Mexico are forecast to decline 5.1%, and overseas arrivals are expected to drop 2.8%.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.