Monthly Economy & Travel Industry Summary: May 2025

Uncertainty with tariffs and other policies continue to ripple through the travel industry

Drag From Tariffs in 2025 Will Give Way to Fiscal Boost in 2026

The reconciliation bill passed by the US House of Representatives and new tariff threats in late May reinforced the opposing policy forces that we think will drag economic growth lower in the second half of this year, before boosting the economy in 2026 and beyond. They also add to the upside risks to inflation, which is a key reason we expect the Federal Reserve to remain on hold for most of this year.

The fiscal package passed by the House amounts to a larger up-front fiscal loosening than expected. However, it is important to note that the House bill is a starting point; the Senate will now craft its version. Given the fiscal concerns – underlined by the downgrade from Moody’s and the continued rise of longer-term bond yields – the Senate version may well result in a smaller net fiscal boost.

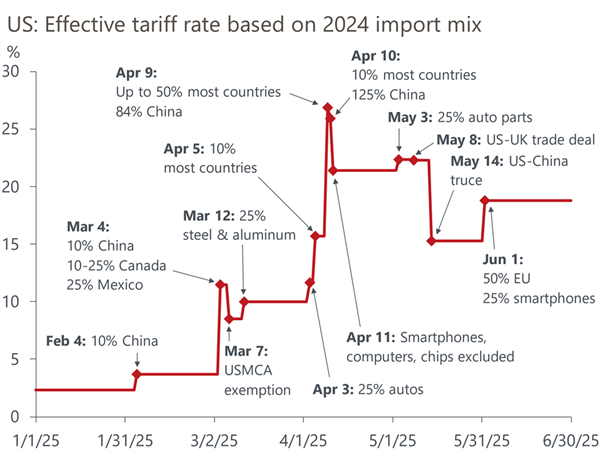

At roughly the same time as the reconciliation bill was making its way through the House, the threat of a 50% tariff on the EU, together with a vaguer threat to apply a 25% tariff on Apple products, represented a re-escalation of trade policy after a few relatively quiet weeks.

The latest news has reinforced that the broad contours of the economic outlook will remain the same – an up-front economic hit from the administration’s trade policies, followed by a fiscal policy-driven rebound in 2026. It also reinforces that the risks to inflation are clearly to the upside. We think that will keep the Fed on the sidelines longer than market pricing suggests, and the next rate cut will still occur in December.

The EU tariff threat interrupted a period of de-escalation in the trade war initiated by trade deals with China and the UK. Those agreements prompted us to raise our 2025 GDP growth forecast from 1.2% to 1.5%, the first and most significant upgrade to the forecast since the start of the year.

The reduction in US tariffs on imports from China will soften the hit to aggregate demand caused by the inflationary impacts of tariffs and related reduction in real disposable income. The Oxford Economics Global Economic Model suggests roughly two-thirds of the rise in tariffs will end up being passed on to consumers in the form of higher prices. Lower tariffs reduce the boost to consumer prices, which will improve real disposable incomes and translate into a larger gain in real consumer spending.

The prospect of stronger consumer spending prompted the upward revision to real GDP growth this year, along with a smaller increase in our forecast of the unemployment rate.

However, raising the 10% tariff on most EU imports to 50% and adding a 25% global tariff on smartphones would push the average effective tariff rate up to 19%, from close to 15% in our current baseline. The new tariff threats, if implemented, would erase the recent forecast upgrade as the resulting shock to real incomes, profits, and sentiment would depress spending by households and businesses.

The proposed tariffs on the EU highlight a significant risk that the Trump administration will use tariffs anytime negotiations hit a snag. The constant threats and rollbacks are a vicious cycle that will keep policy uncertainty elevated.

When uncertainty is high with no reprieve in sight, there is a strong incentive to defer major decisions until the situation is clearer. Uncertainty is especially damaging if it’s persistent and rolling, which is the situation we’re currently in.

By adopting a wait-and-see approach, businesses avoid committing to expensive decisions that could turn out to be unwise if a poor outcome occurs. High and rolling uncertainty will repeatedly lead businesses to defer spending, and potentially hiring. This is a reason that our baseline forecast for real business investment in equipment is set to noticeably drop in the second quarter and then remain relatively unchanged until early 2027, representing a drag on economic growth in 2025 and 2026.

A pullback in hiring by businesses waiting out the tariff rollercoaster represents a risk to a labor market stuck in a low-hiring, low-firing equilibrium. After some stability between October and April, new job postings appear to have resumed their downward trend in May, following survey evidence that firms are becoming more cautious with their hiring plans.

A low hiring rate has been the story of the labor market for some time, but so far, there are few signs of a pickup in private-sector layoffs. The unemployment rate has risen only modestly since hitting a recent low of 3.5% in April 2023, and the current unemployment rate of 4.2% is still arguably consistent with full employment, but there are some cautionary signs in the data. The number of permanent job losers in April reached its highest since October 2021, and the share of the unemployed out of work for more than six months hit its highest level since September, indicating workers who lose jobs are finding it tougher to find new employment amid the slowdown in hiring.

While the labor market remains solid, we know from past cycles that if the labor market begins to deteriorate, it can weaken quickly, as rising unemployment leads to reduced consumer spending, which leads firms to cut back on hiring and so on.

One part of the economy that is suffering amid rising uncertainty and higher longer-term interest rates is the housing sector. April data confirmed the weak state of demand, with existing home sales down 2% in April versus the same month last year, and sales last year were the weakest since 1995. New-home sales were stronger than expected in April, but previous months were revised sharply lower. The active inventory continues to rise, amid the weakness in sales, which will put downward pressure on home price growth over the rest of the year.

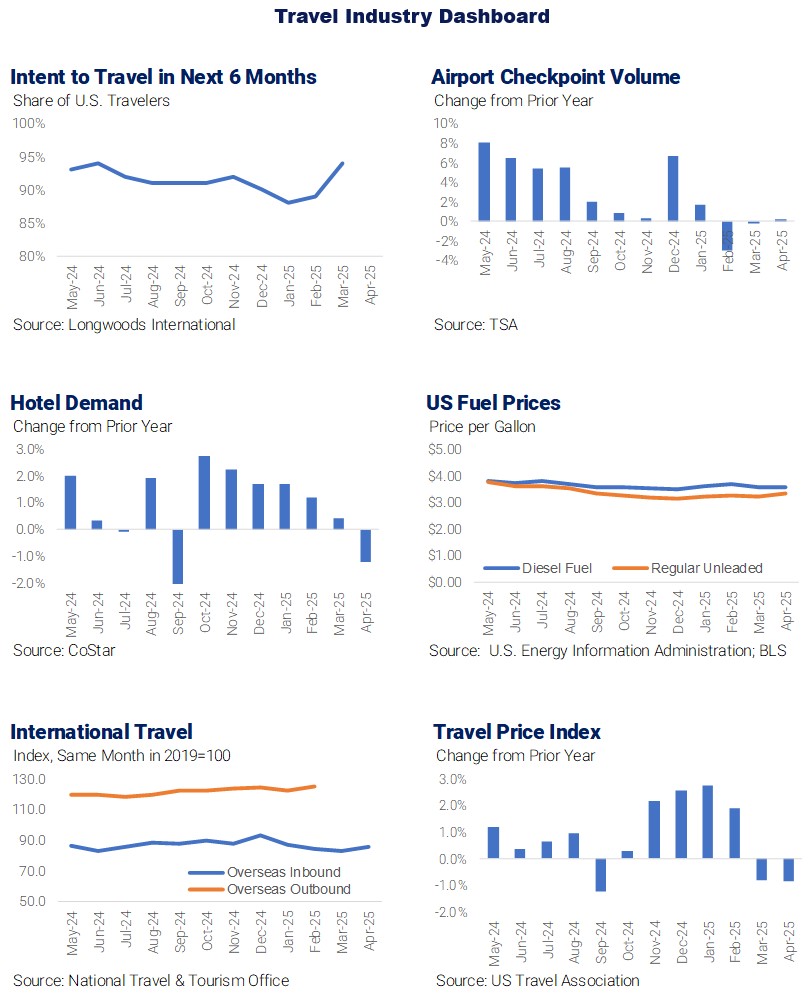

Travel also remains a weak spot – the timing of Easter caused large shifts, but after averaging March and April together, foreign travel to the US was down 1.6% y/y, with that weakness concentrated among visitors from Canada and, to a lesser extent, Europe. The weakness from overseas visitors, combined with DOGE-related weakness in business and government travel, is weighing on hotel occupancy, which is a touch weaker than a year ago. Finally, gasoline demand has been running weaker in recent weeks than in previous years, rounding out signs that spending growth could be moderating. However, there were few signs of consumers cutting back on dining out or Broadway shows in April, suggesting spending on discretionary services continued to do well, despite the collapse in consumer confidence.

Slowdown in Travel During Spring Likely to Extend Through Summer

A clear picture of the travel industry’s performance in the first quarter of 2025 was difficult to ascertain due to several factors that muddied comparisons to last year, including wildfires in California, a normal February versus Leap Year in 2024, and Easter shifting from March last year to April.

The industry’s performance is becoming clearer now that results through April are available. The data paints a picture of a slowdown in travel, with several key indicators flat or slightly down compared to the same period last year.

The number of people passing through TSA security checkpoints in US airports was down 0.3% from January through April, versus the same period last year. Month-to-date volume for May 1 – 26 was down 1% versus the same period last year, even though volume surpassed 3 million on Friday, May 23, the start of the Memorial Day holiday weekend and TSA’s third busiest day ever.

Growth in hotel demand has slowed each month this year. Demand rose 1.7% in January, in part due to evacuees, firefighters, and recovery efforts related to wildfires in California. Ongoing recovery efforts in the southeast from last fall’s Hurricane Helene also contributed to January’s demand growth. Year-over-year growth in hotel demand slowed to 1.2% in February and to 0.4% in March, and demand declined 1.2% in April. Year to date through April, hotel demand was up just 0.4% versus the same period last year.

National Park visits is another indicator showing a slowdown in travel. According to data published by the National Park Service, recreation visits to national parks have trailed prior year levels in three of the first four months of 2025. Total visits are down 3.3% year to date through April.

Much attention was paid to the 11.6% decline in overseas arrivals to the US in March, with some debate over how much of the drop could be attributed to Easter shifting to April this year from March last year. The Easter shift certainly pulled some leisure travel out of March and into April, and overseas arrivals rose 8.0% in April versus the same month last year.

However, April’s increase was not enough to offset March’s decline. Combined arrivals in March and April, to account for the Easter shift, were down 1.6%. Year-to-date through April, overseas arrivals are essentially flat to last year (-0.2%) despite starting the year strongly with a 5.4% increase in January.

The contraction in overseas arrivals during the March and April spring travel season likely represents early ramifications from a wave of negative sentiment toward the US among potential international travelers. International sentiment toward the US has shifted in response to the Trump administration’s polarizing rhetoric and policy actions, combined with heightened border security measures and visible immigration enforcement actions.

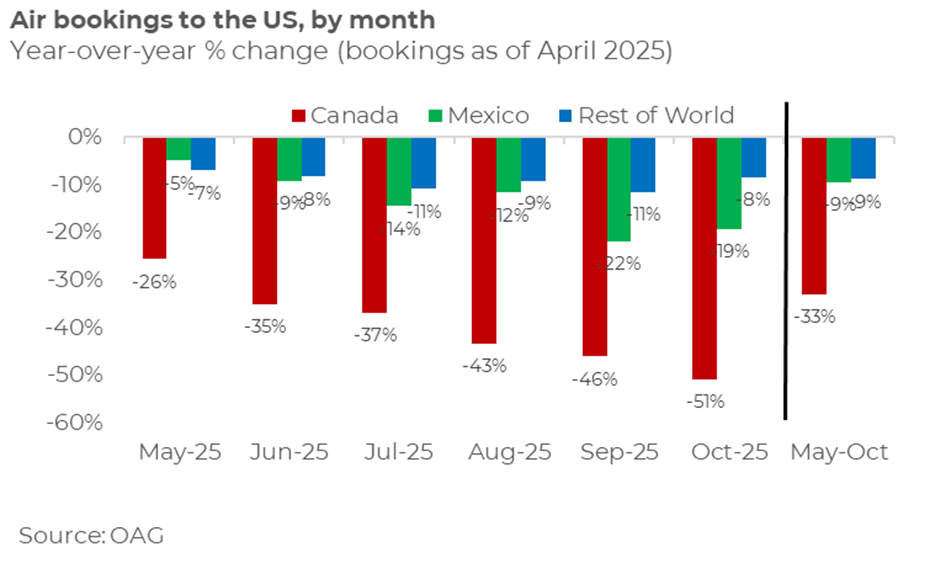

Airline bookings for international travel to the US through the summer are down sharply compared to prior year levels. Canadian bookings are the weakest, by far, with current bookings down by one-third for travel between May and October. Bookings for air travel to the US from Mexico are down 9%- 12% through the summer months, and bookings from the rest of the world are down a similar amount.

The pullback in travel does not appear to be affecting all travelers equally. In particular, there are indications that high-end households continued to travel despite expectations for slower economic growth and higher inflation. Hotel demand among Luxury hotels was up 6.0% through April, compared to the same period last year, versus 0.4% demand growth in the hotel industry overall.

Similarly, international travel by U.S. residents, which tends to skew towards higher-income households, continues to grow. The National Travel & Tourism Office reported that outbound trips by US residents rose 5.2% in the first two months of the year, the most recent data available.

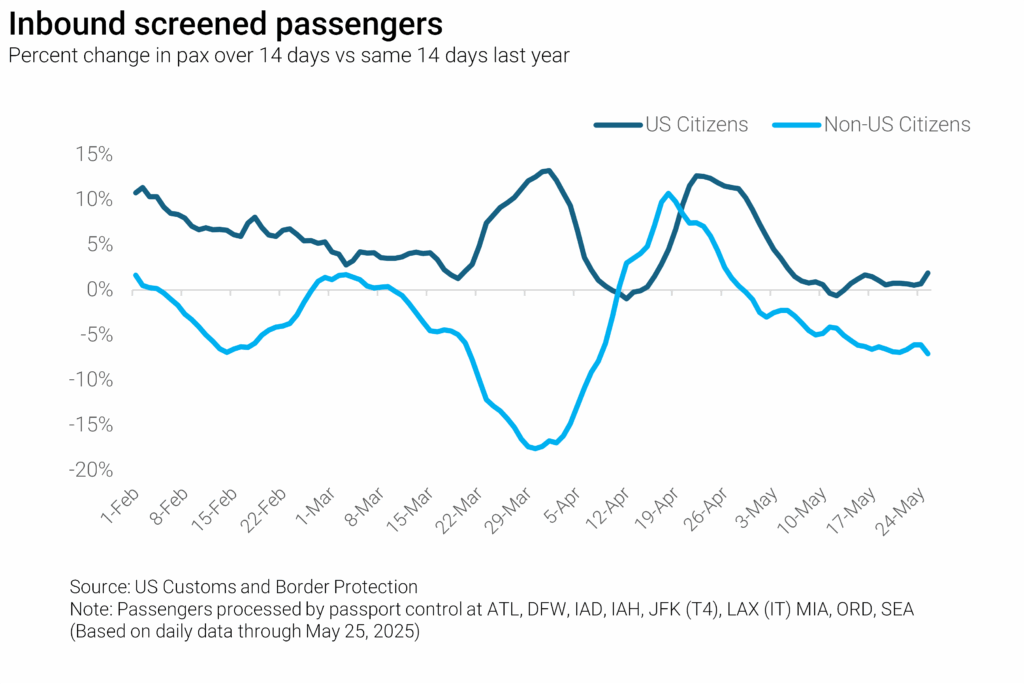

More recent data from US Customs and Border Protection, which tracks daily inbound arrivals, shows that US citizens returning to the US from an international trip exceeded prior year levels throughout March and April, with some fluctuations that can be related to the later date of Easter. However, year-over-year growth has slowed in May and could portend a softer outlook for outbound travel through the summer.

Additionally, according to the latest American Travel Sentiment Study from Longwoods, only 19% of American travelers say it is very likely they will make an international trip in the next twelve months, down from 25% in January. Fewer outbound trips by US residents is a potential bright spot for domestic travel, if those travelers substitute a domestic trip for an international one.

Meanwhile, the CBP data shows non-US citizen arrivals have generally trailed prior year levels since February, aside from a spike in April related to Easter. This pattern of inbound arrivals, combined with significantly lower air bookings for the summer months, suggests international travel to the US is likely to be quite soft for the foreseeable future.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.